Market Segment

March 7, 2019

Ryerson Forecasts Strong First Half, Uncertainty in Second

Written by Sandy Williams

After an accelerated decline in carbon and steel prices in the fourth quarter, spot prices bottomed in January and are now moving higher in the first quarter, said Ryerson President and CEO Eddie Lehner.

Demand conditions appear favorable in the first part of 2019 despite weather interruptions in the early part of the year. Ryerson customers are expecting low to mid single-digit growth this year. Construction equipment, commercial ground transportation and HVAC are expected to be on the higher end of that range and energy markets on the low end.

“There’s probably a little more uncertainty in the second half in terms of what we’re going to see around demand and price,” added Lehner.

“I’d say most of our customers are really optimistic certainly about the first half despite the uncertainty around trade policy and for sure are more optimistic than what we were hearing or seeing in the fourth quarter,” added Kevin Richardson, president, South-East region. “And the other thing I would point out, as just another sign of things still being really pretty strong, is that the labor markets are as tight as we’ve seen in probably 10 years.

Lehner said that the new North American trade agreement will likely be positive for the company. “I think if we get a trade agreement executed and if the policy plays out the way it’s been reported, we see that as being a net positive,” said Lehner. “We never thought that the 232 tariffs were going to be a permanent condition within North America, so when those get mediated and they eventually go away we think it’s a net positive for the industry, all things considered.”

Ryerson is forecasting its 5.2 percent market share will improve to 6.0 percent during the next three years and gross margin will climb 1 percent to 20 percent. Lehner expects average selling prices to normalize from the $1,950 per ton seen currently to the historical range of $1,750 to $1,800 per ton.

Ryerson posted its strongest financial performance in more than a decade in 2018, generating net income of $106 million, including $70 million related to the purchase of Central Steel & Wire. Revenue for the year was $4.4 billion, an increase of 31.0 percent from 2017. Average selling price per ton climbed 15.6 percent year-over-year and shipments 13.4 percent.

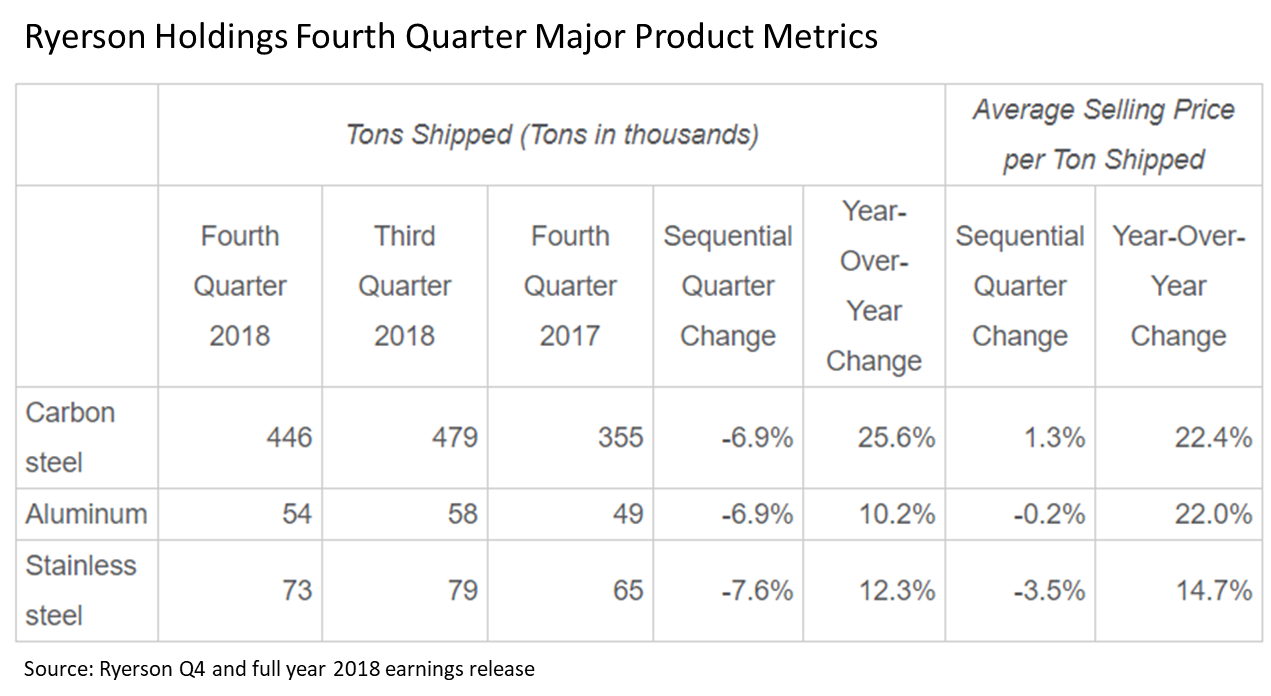

Fourth-quarter revenues jumped by 43.1 percent year-over-year to $1.16 billion due to a 22.8 percent increase in tons shipped and an 18.7 percent increase in the average selling price per ton.

Ryerson CEO Eddie Lehner will be one of our speakers at this year’s SMU Steel Summit Conference in Atlanta on August 26-28. You can find more information about our program, speakers, costs and how to register at www.SteelMarketUpdate.com/events/steel-summit