Analysis

March 7, 2019

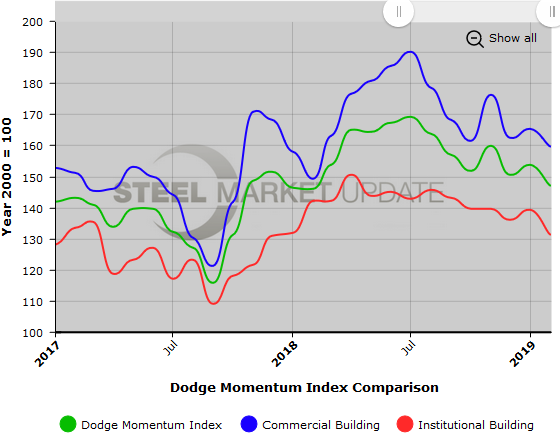

Dodge Momentum Index Declines in February

Written by Sandy Williams

The Dodge Momentum Index, a measure of the initial report for nonresidential construction projects in planning, fell 4.4 percent to 146.9 in February after rebounding in January.

“Since November, the Momentum Index has re-established a sawtooth pattern that’s often been present in recent years,” said Dodge Data & Analytics. “It’s also become clear that the average level of activity has downshifted slightly since the summer of 2018. From April through August last year, the average level of the Momentum Index was 158.6, while from September through the latest month the average is 150.3 – a decline of 5.2 percent. This shift continues to suggest that the growth in construction activity will moderate over the coming year.”

The report shows that planning in both the institutional sector and commercial sector slowed last month, falling 5.9 percent and 3.4 percent, respectively.

Nine projects with a value of $100 million or more entered the planning phase in February.

The Dodge Momentum Index is published by Dodge Data & Analytics and is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.