Market Data

March 2, 2019

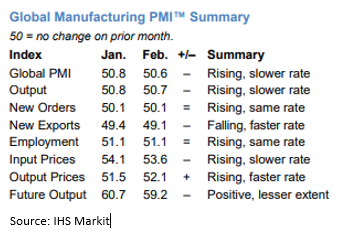

Global Manufacturing Edges Lower in February

Written by Sandy Williams

Global manufacturing growth hit a 32-month low in February. The J.P. Morgan Global Manufacturing PMI dipped to 50.6 from 50.8 the previous month. Operating conditions expanded in the consumer and investment goods sector but deteriorated in the intermediate goods sector, said J.P. Morgan and IHS Markit. International trade was blunted as new export orders fell for the sixth consecutive month.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at J.P. Morgan, said: “The rates of expansion in global manufacturing output and orders held broadly steady in February. Slower growth in the U.S. and contractions in Japan and the euro area were offset by a stabilization in China. The outlook remains lackluster, as stagnant new order growth, declining international trade volumes and weak business confidence rein in the prospects of output growth staging a meaningful revival in the coming months.”

The IHS Markit Eurozone Manufacturing PMI slipped into contraction in February, posting at 49.3 from 50.5 in January. Production, new orders and backlogs continued to decline in February although employment growth remained at a solid pace. Powerhouse Germany led the decline with a PMI reading of 47.6 and a 74-month low.

The falling rate of new orders was particularly worrying, said IHS Markit Chief Economist Chris Williamson. “Orders are falling at a faster rate than output to a degree not seen for seven years, meaning production is likely to be pared back further in coming months unless demand revives.” Excess capacity resulted in less hiring and investment, and more cost control.

“In addition to widespread trade war worries, often linked to U.S. tariffs, and concerns regarding the outlook for the global economy, companies report that heightened political uncertainty, including Brexit, is hitting demand and driving increased risk aversion,” added Williamson.

The Caixin China General Manufacturing PMI remained in contraction in February, but rose to 49.9 from a low of 48.3 in January. A slight increase in domestic demand was noted although new export orders slipped lower. Backlogs increased for the 36th month adding to capacity pressure. Input costs fell for the third month and selling prices increased for the first time in four months. Cost cutting led to declines in inventory and employment levels. Manufacturers expressed less confidence in the future outlook.

Manufacturing conditions in Russia declined marginally in February. The PMI registered 50.1, down from 50.9 and just above the neutral mark of 50. A recent increase in the Valued Added Tax (VAT) pushed input costs higher resulting in higher output charges for clients. New export orders declined for the second month as foreign demand faltered. Backlogs decreased sharply along with a contraction in buying activity and inventories. Manufacturers remained optimistic that conditions would improve during the next 12 months.

Manufacturing conditions in Canada were subdued in February as demand, production and employment levels weakened. The IHS Markit Canada Manufacturing PMI slid to 52.6 from 53.0 the previous month. Input price growth eased except on metals. Firms noted that backlogs were higher due to adverse weather affecting supply chains. Input buying slowed as a response to softer demand and stockpiled inventories.

“Production growth was relatively subdued, reflecting a sustained soft patch for incoming new work so far this year,” said Christian Buhagiar, CEO at the Supply Chain Management Association. “Survey respondents noted that trade frictions and heightened global economic uncertainty had led to delayed decision making among clients on new orders.”

Mexico was among the few nations that experienced strong growth during February. The PMI rose to 52.6 from 50.9 as new orders soared to a 15-month high. Domestic demand remained solid and new export orders flowed in from abroad, in particular, the U.S. and El Salvador. Production improved modestly and boosted input buying. Employment levels increased at the fastest pace since September 2018 and capacity expansion helped clear backlogs. Input costs rose at a slower rate in February. Firms noted favorable exchange rates, and successful negotiations with vendors helped curtail inflation. Output charges rose marginally as higher costs were passed through to clients.

“Given the breadth of the expansion, it looks increasingly likely that this upturn can be sustained, at least during the near-term. Business sentiment also improved considerably from January’s series low,” commented Pollyanna De Lima, principal economist at IHS Markit.

The IHS Markit U.S. Manufacturing PMI was at an 18-month low in February, posting a reading of 53.0 from 54.9 in January. Manufacturing activity remained solid but growth rates for output and new orders softened to 17- and 20-month lows, respectively. The modest increase in output was attributed to clearing of backlogs and sustained expansion in new business. Purchasing prices grew sharply on higher raw material costs and tariffs, causing a rise in factory gate prices. Raw material inventory purchases eased as input stocks were used in production.

Commented Williamson: “The survey exhibits a strong advance correlation with comparable official data and suggests that factory production and orders growth rates are close to stalling mid-way through the first quarter, albeit in part representing some payback after a strong January. Export markets remained the principal drag on order books.”

“Worries regarding the impact of tariffs and trade wars, alongside wider political uncertainty, undermined business confidence, with expectations of future growth running at one of the most subdued levels seen for over two years and suggesting downside risks prevail for coming months.”