Analysis

February 26, 2019

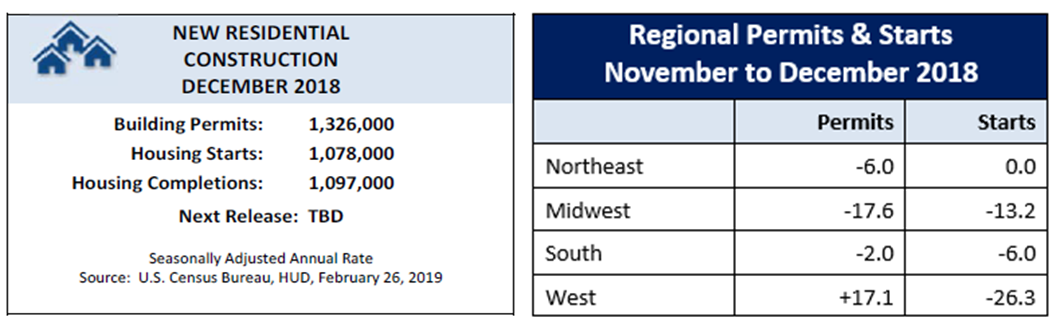

Housing Starts Plummet in December

Written by Sandy Williams

Housing starts plummeted 11.2 percent in December to a more than two-year low, signaling continued slowing in the housing market. Single-family starts fell 6.7 percent from November, while multifamily starts plunged 22 percent.

“Looking back, the December drop in housing production correlated with the peak increase in mortgage rates and corresponding decline in builder sentiment,” said National Association of Home Builders Chairman Greg Ugalde. “During that time, builders adopted a cautious wait-and-see approach as demonstrated in the rise of single-family and multifamily units that were permitted but not under construction.”

Housing permits–an indicator of future housing production–inched 0.3 percent higher in December to a seasonally adjusted annual rate of 1.33 million. The increase was due mostly to a jump in permit authorizations in the West. The volatile multifamily category led the increase with a 4.9 percent climb. Single-family permit authorizations fell 2.2 percent.

“Looking ahead, we expect single-family production will be relatively flat in 2019 and multifamily starts will level off as well,” said NAHB Chief Economist Robert Dietz. “The biggest challenge facing builders this year will be ongoing housing affordability concerns as they continue to grapple with a shortage of construction workers, a lack of buildable lots and excessive regulatory burdens.”