Product

February 10, 2019

Service Center Spot Prices Still Don't Reflect Confidence in Price Increases

Written by John Packard

Flat rolled steel distributors have been slowly backing away from offering spot prices to their end customers at lower numbers than what was seen a couple of weeks ago. At the same time, these same service centers are reporting difficulties getting those same end user customers to pay higher prices, despite the price increase announcements led by the West Coast mills and then Nucor in the East over the past few weeks. This is part of what we learned from the flat rolled and plate steel market trends analysis done last week (week ending Feb. 8, 2019).

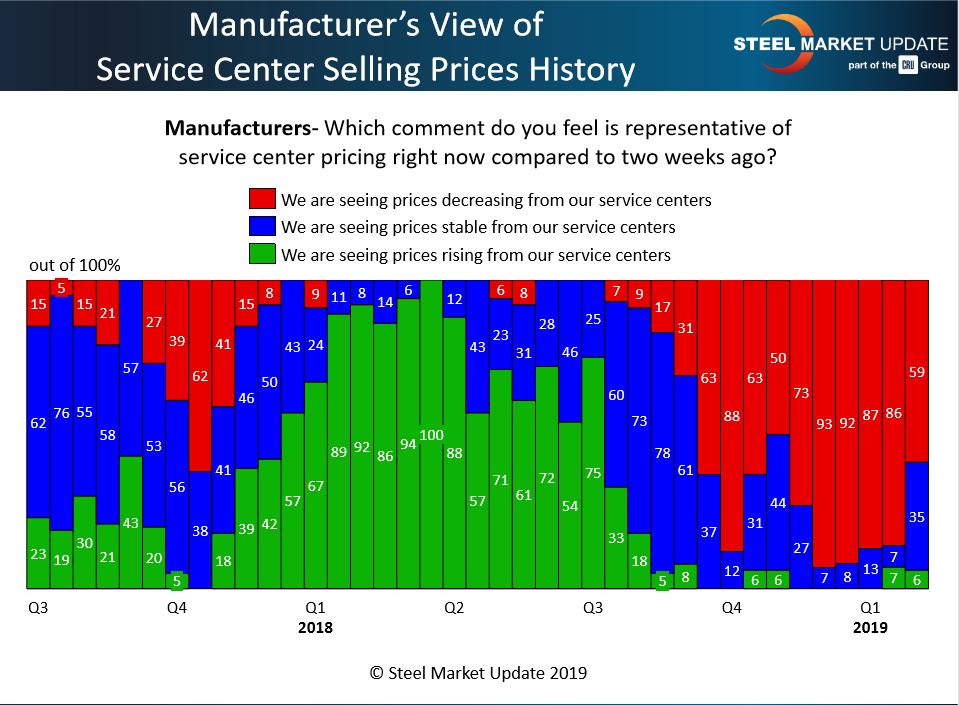

Fewer manufacturing companies reported their service center suppliers as lowering spot prices. During the middle of January, 86 percent of the manufacturing companies responding to our invitation reported distributor spot prices as being lower than what they were seeing at the beginning of January. Now, two weeks later, only 59 percent reported spot prices as still in decline.

We need to be careful here not to infer that the flat rolled price increases announced by the mills located east of the Rocky Mountains are thus “sticking.” As you look at the data contained in the below graphic, note the last time manufacturing companies saw a sharp reversal of spot pricing fortunes was in early fourth-quarter 2018. Or, to put it a little more bluntly, the last time Nucor announced a price increase there was a blip in quoting for a couple of weeks before going right back to distributors dumping spot prices (and inventories) into their customers.

Service centers, who had not yet reached capitulation using the SMU formula which requires 75 percent or more of steel service centers responding to our survey reporting their company as dropping their spot pricing to their customers, are providing some stability to the market. Our most recent analysis has 28 percent of the steel distributors lowering spot prices this past week, down from 59 percent during the middle of January.

What is missing for that support is those service centers who believe higher prices will be supported by the market, and thus are raising spot prices. Only 5 percent of the steel distributors reported reaching out and raising prices to their customers. There will need to be a huge move in this percentage if the price increase is going to actively “stick” and be collected across the market.

In the graphic shown above, this question was asked of the service centers only and the red ovals above the bars represents AK Steel price increase announcements. As of today, Feb. 10, 2019, AK Steel has not followed the other domestic steel mills with an official price increase announcement of their own (based on the lack of an announcement on the AK Steel website: www.aksteel.com).