Market Data

February 1, 2019

Consumer Confidence Suffers from Government Shutdown

Written by Peter Wright

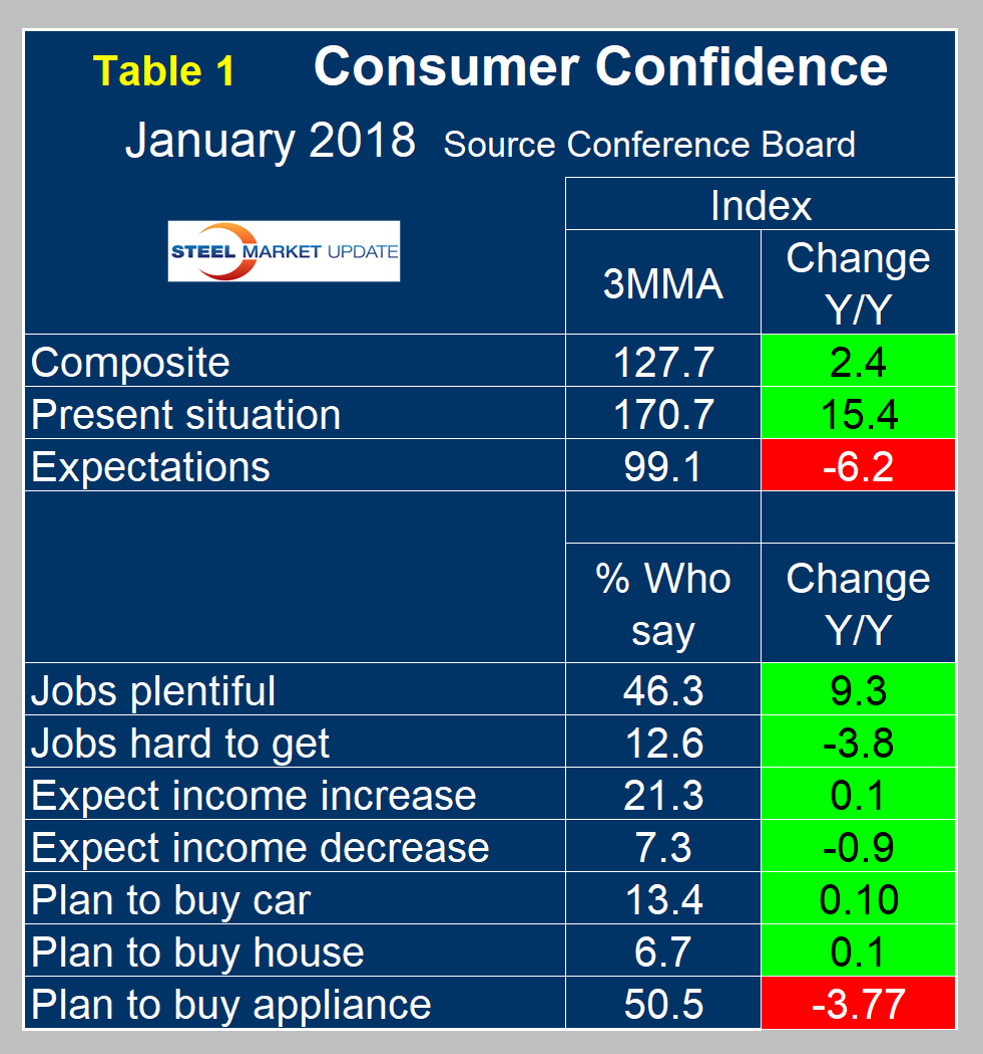

The U.S. government shutdown has had a negative effect on consumer expectations. The Conference Board’s measure of consumer confidence declined each month from November through January. It appears the shutdown had a major effect on consumers’ expectations, but not so much on their perception of the present situation. The composite value of consumer confidence in January was 120.2, down from 137.9 in October. The three-month moving average (3MMA) decreased from 136.5 in November to 127.7 in January, which was 2.4 points higher than in January last year.

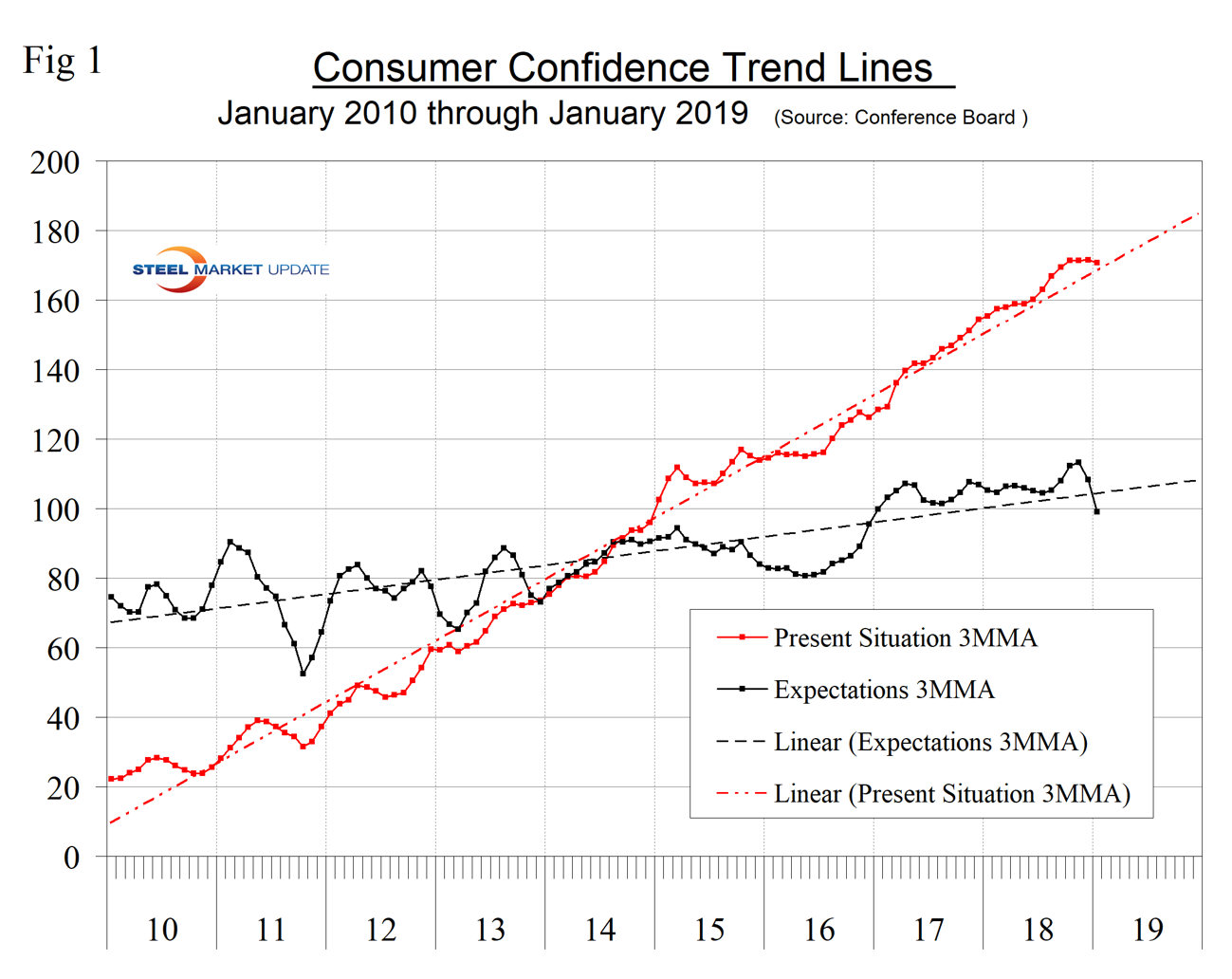

We prefer to smooth the data with a moving average to reduce monthly volatility. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. The present component is just barely above its nine-year trend line, but expectations have fallen below trend (Figure 1).

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, wrote on Jan. 29: “Consumer Confidence declined in January, following a decrease in December. The Present Situation Index was virtually unchanged, suggesting economic conditions remain favorable. Expectations, however, declined sharply as financial market volatility and the government shutdown appear to have impacted consumers. Shock events such as government shutdowns (i.e. 2013) tend to have sharp, but temporary, impacts on consumer confidence. Thus, it appears that this month’s decline is more the result of a temporary shock than a precursor to a significant slowdown in the coming months.”

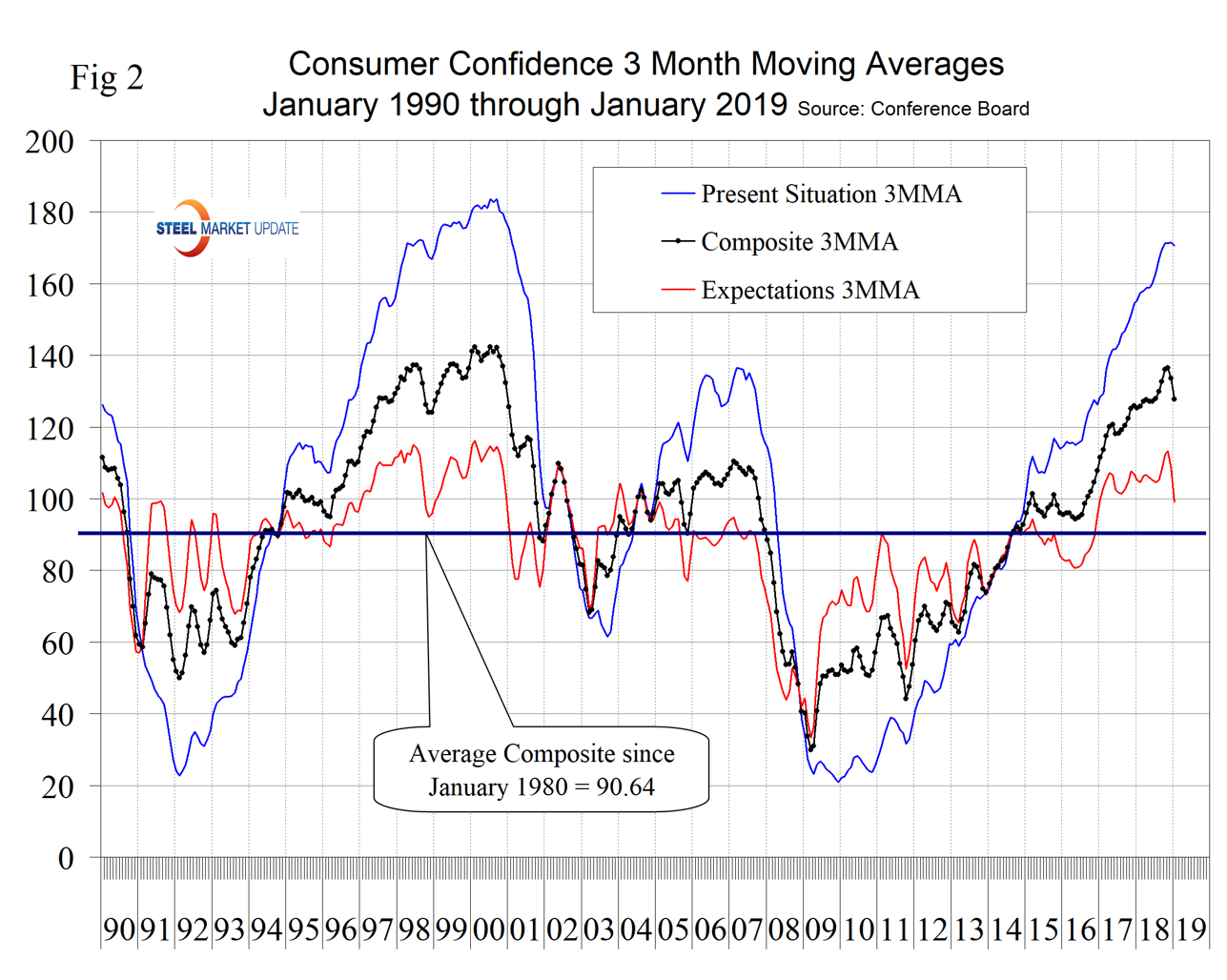

The decline in the monthly composite was almost entirely due to a decline in consumer expectations from 97.7 to 87.3. The consumer’s view of the present situation declined from 169.9 to 169.6. The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

The expectations component is now lower than it was a year ago. The consumer’s view of the present situation has been surging since December 2010. Comparing January 2019 with January 2018, the 3MMA of the present situation was up by 15.4 points and expectations were down by 6.2 points (Table 1).

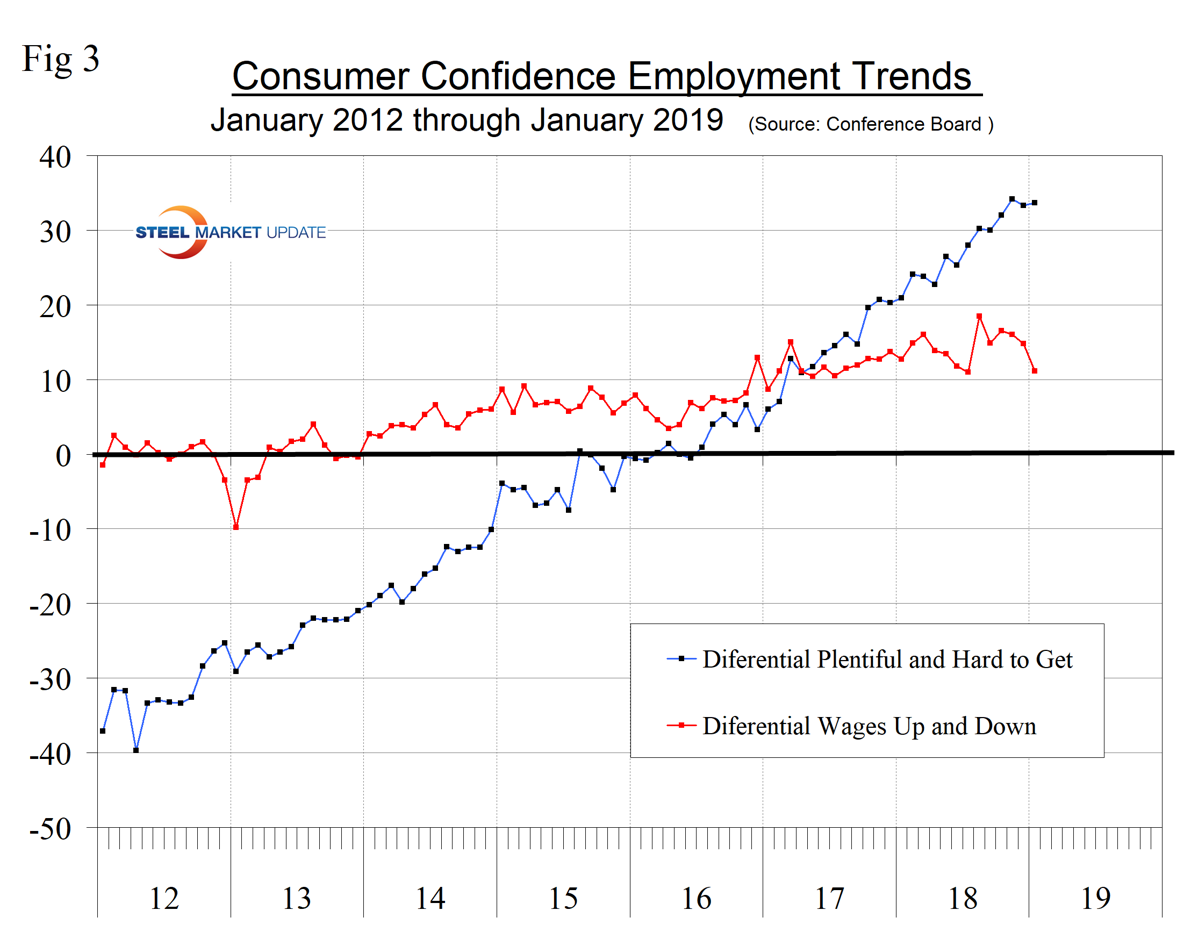

The consumer confidence report includes encouraging data on job availability and wage expectations. It reports on the proportion of people who find that jobs are hard to get and those who believe jobs are plentiful, and it measures those who expect a wage increase or a decrease. Since January 2012, the consumer’s view of job availability has surged. The difference between the percentage of those finding jobs plentiful and those finding jobs hard to get has improved from a low of negative 40 percent at the beginning of 2012 to positive 33.7 percent in January 2019. Expectations of a wage increase have been less optimistic with the up/down differential declining from positive 18.5 percent in August to positive 11.1 percent in January.

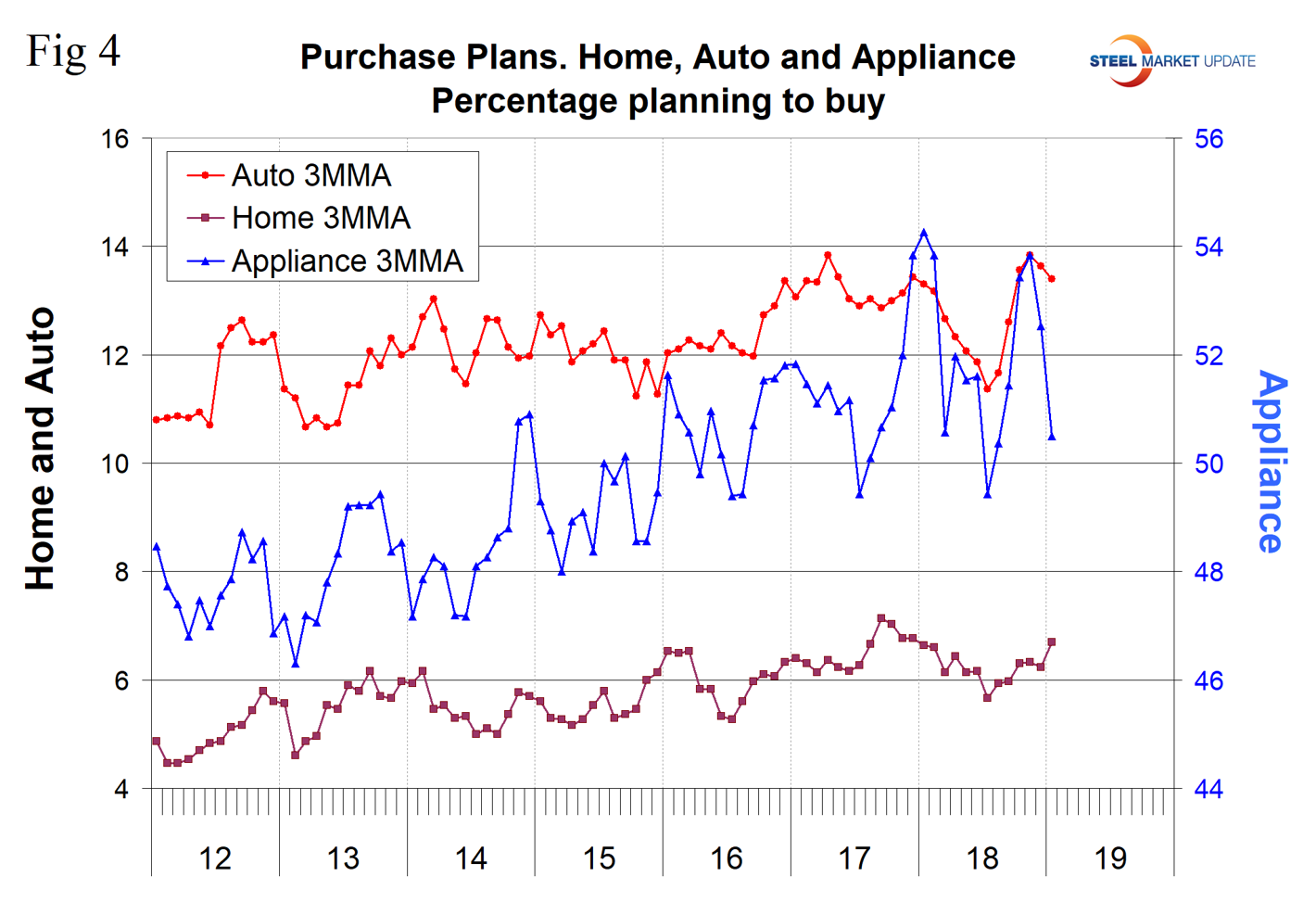

Consumers’ plans to buy a car had been drifting down for nine months through July last year, but picked back up through November and declined slightly in December and January. Plans to buy an appliance have been erratic, but there has been an upward trend since our data stream begins in 2012. Plans to buy a home drifted down from September 2017 through July 2018, but have picked back up in the last six months (Figure 4).

SMU Comment: The expectations result is probably an outlier resulting from the political situation. Therefore, we need a couple more months of data before it is a cause for concern. Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence and disposable income.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.