Market Data

January 24, 2019

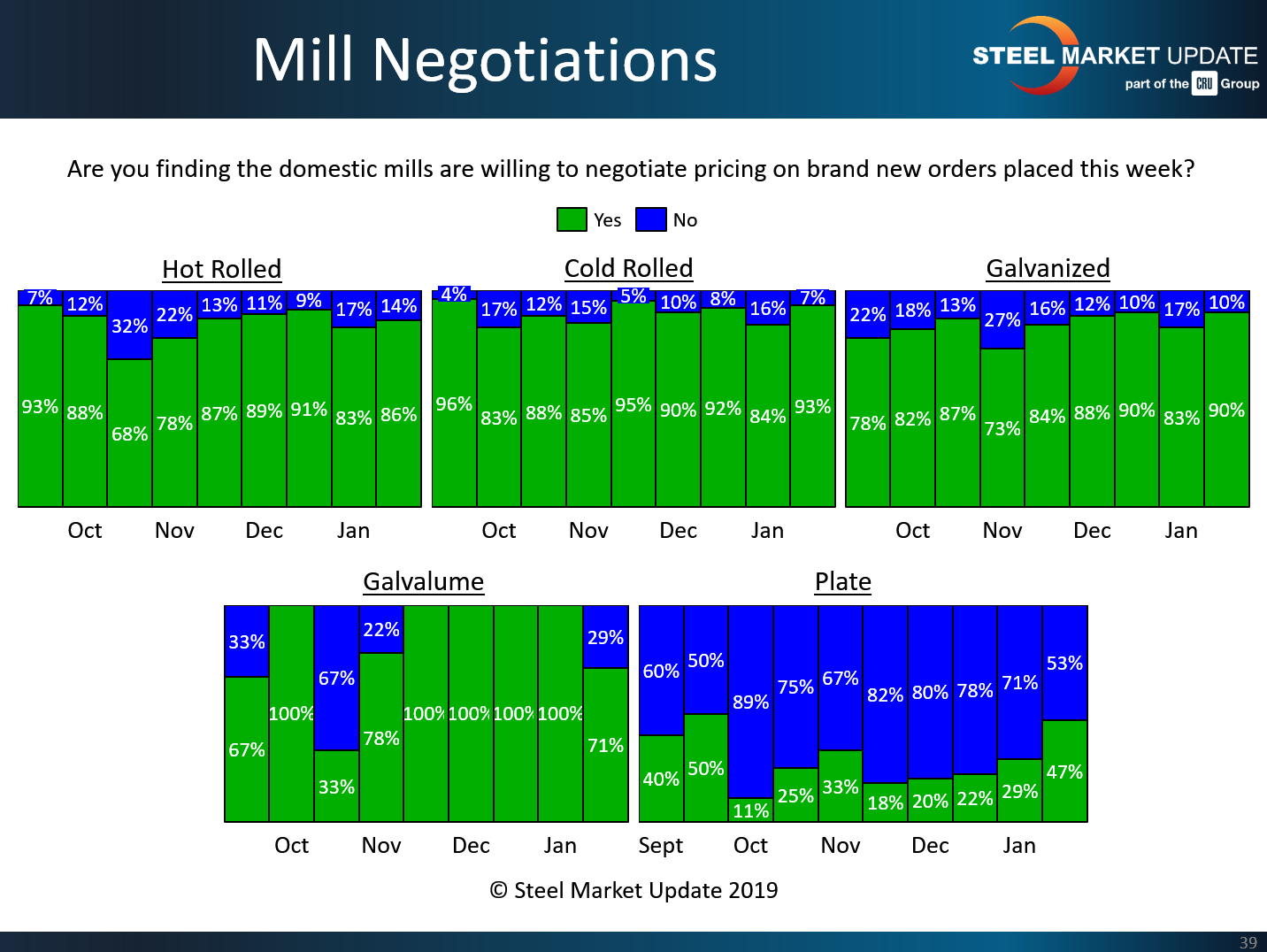

Steel Mill Negotiations: Even Plate Mills Talking Price

Written by Tim Triplett

Halfway through the first month of the year, buyers report that most mills are willing to talk price to secure the order. Even price negotiations with plate mills are beginning to loosen up.

Nearly half (47 percent) of plate buyers responding to Steel Market Update’s market trends questionnaire this week said suppliers are now open to price negotiations on plate orders, up from 29 percent at the beginning of the year. That’s a significant change as the mills were in the power position for most of last year with lead times extended and customers on allocation. As with other products, lead times for plate have begun to shorten as demand wanes while the market pauses to see if steel prices have bottomed.

In the hot rolled category, 86 percent of buyers responding to SMU’s questionnaire said they have found mills willing to talk price, up from 83 percent on Jan. 1. Only about 14 percent say the mills are now holding the line on HR.

In the cold rolled segment, 93 percent said they have found mills open to price negotiation, up from 84 percent two weeks ago. Only about 7 percent reported current mill prices on cold rolled as firm.

The same trend is true in coated products. In the galvanized sector, 90 percent said the mills were open to price discussions, up from 83 percent at the beginning of the month. About 10 percent of GI buyers report that prices are nonnegotiable. For Galvalume, 71 percent of respondents reported AZ prices as open to negotiation.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.