Market Data

January 23, 2019

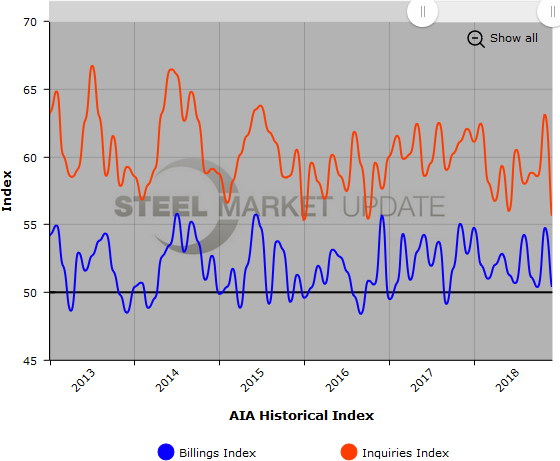

Architecture Billings Index Softens in December

Written by Sandy Williams

The Architecture Billings Index dipped in December, falling to 50.4 from 54.7 in November, according to the latest report by the American Institute of Architects. Billings continued to be positive for the 15th consecutive month, scoring above the neutral reading of 50.

Backlogs lengthened to an average of 6.4 months in December, a historical record for the index. Billings for institutional projects in planning led in December with an index score of 53.1, followed by commercial/industrial at 51.2 and residential at 49.8.

The projects inquiries index was 55.6 and the design contracts index 52.1.

Firms in the Northeast and Midwest showed the strongest growth, while business conditions softened in the South and West. Regional averages were: West 49.2, South 49.4, Midwest 56.3 and Northeast 51.6.

“Given the concerns over the ongoing tariff situation, it is not surprising to see a bit of a slowdown in progress on current projects,” said AIA Chief Economist Kermit Baker. “Growing anxiety over unstable business conditions and the partial shutdown of the government may lead to further softening in the coming months.”

Only 5 percent of firms reported seeing an impact from stock market volatility in December. Smaller firms with annual billings of less than $250,000 were more likely to have experienced an impact on projects, as were firms in the Northeast.

“Of the firms that indicated they have seen a direct impact on their projects from the stock market volatility, the largest share (61 percent) indicated that the impact had come in the form of projects that have slowed, been put on hold or cancelled,” said the American Institute of Architects. “Fifty-six percent reported they have seen less interest in pursuing projects, and 50 percent reported the scaling back of project scope to manage costs. Just 6 percent reported that projects were being accelerated to complete them before conditions potentially weaken further.”

Survey comments:

- “Steady, but government shutdowns and economic uncertainty are beginning to be an issue.” —21-person firm in the South, residential specialization

- “The public sector is strong in RFPs regionally; corporate work is very cautious.” —100-person firm in the Midwest, institutional specialization

- “Steady except for a decline in residential work.” —8-person firm in the Northeast, mixed specialization

- “State is flush with money and rolling out projects. Local school districts passed bonds and are planning a lot of work for the next few years.” —160-person firm in the West, institutional specialization

The AIA’s Architecture Billings Index is considered a leading economic indicator of construction activity, and reflects the approximate nine- to twelve-month lead time between architecture billings and construction spending. The survey panel asks participants whether their billings increased, decreased or stayed the same in the month that just ended. The regional and sector categories are calculated as a three-month moving average, whereas the national index, design contracts and inquiries are monthly numbers. The monthly ABI index scores are centered on the neutral mark of 50, with scores above 50 indicating growth in billings and scores below 50 indicating a decline.

Below is a graph showing the history of the AIA Billings and Inquiries Indices. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.