Product

January 22, 2019

Popular Economist to Make Return Appearance at SMU Steel Summit

Written by Tim Triplett

Economist Alan Beaulieu, president of ITR Economics, will make another appearance as a keynote presenter for Steel Market Update’s premier event, the 2019 Steel Summit Conference, set for Aug. 26-28 at the Georgia International Convention Center in Atlanta. He will offer an insightful overview of U.S. economic trends and their implications for the steel industry. Following are his current observations on steel supply, demand and prices:

Steel prices, as measured by the Steel Scrap Producer Price Index, are expected to edge lower as demand wanes in the coming year. Producers are expected to trim prices as they seek to keep production—and profits—rolling.

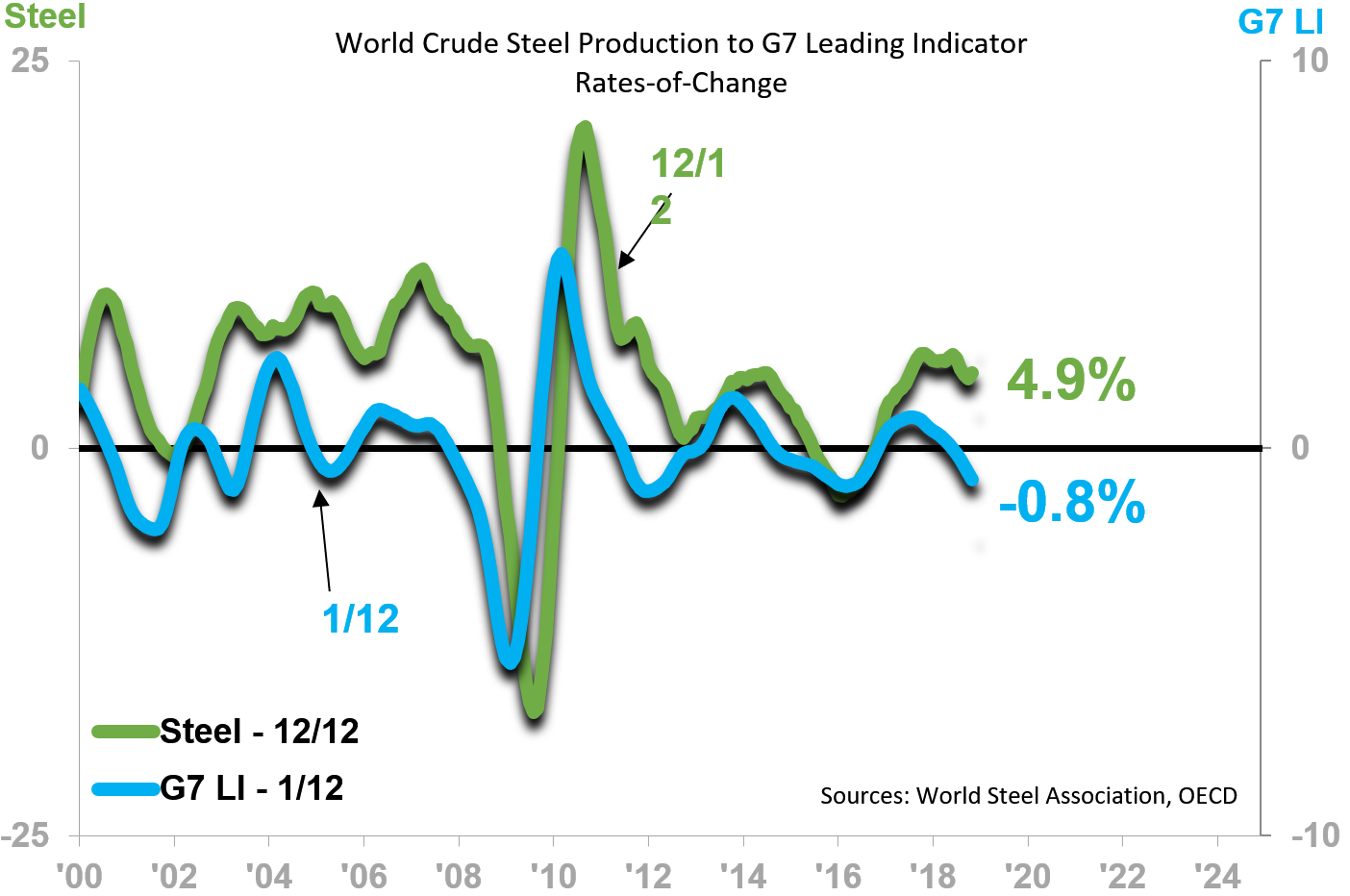

The relationship between global steel production and the G7 Leading Indicator 1/12 is shown on the following chart:

The decline in the G7 Leading Indicator (blue line) is signaling that the decline in the World Industrial Production 12/12 will extend well into 2019. The U.S., China and other steel-producing nations will see their industrial production growth trends similarly muted, and in some cases actual declines will occur in the 12MMA trends. Worldwide industrial demand for steel will ease, and prices are expected to ease along with the demand.

Nonresidential construction, another large market for steel, is expected to improve in many countries, including the U.S., in 2019. Nonresidential construction lags industrial production, and thus often appears counter-cyclical. The nascent rate-of-change ascents in the various segments of nonresidential construction are expected to extend until late 2019, and that means an increased demand for steel in this segment of the economy. This demand will keep steel prices from cratering, but it is not expected to be strong enough to keep prices from generally moving lower this year. Readers should be wary of inventory buildups at today’s higher prices.

Registration is open for the 2019 event, SMU’s 9th Steel Summit Conference. We welcome anyone interested in the greater steel and manufacturing industries.

To learn more about Steel Summit 2019 and to register, visit www.SteelMarketUpdate.com/Events/Steel-Summit