Analysis

January 21, 2019

Declining Existing-Home Sales May Signal Trouble

Written by Sandy Williams

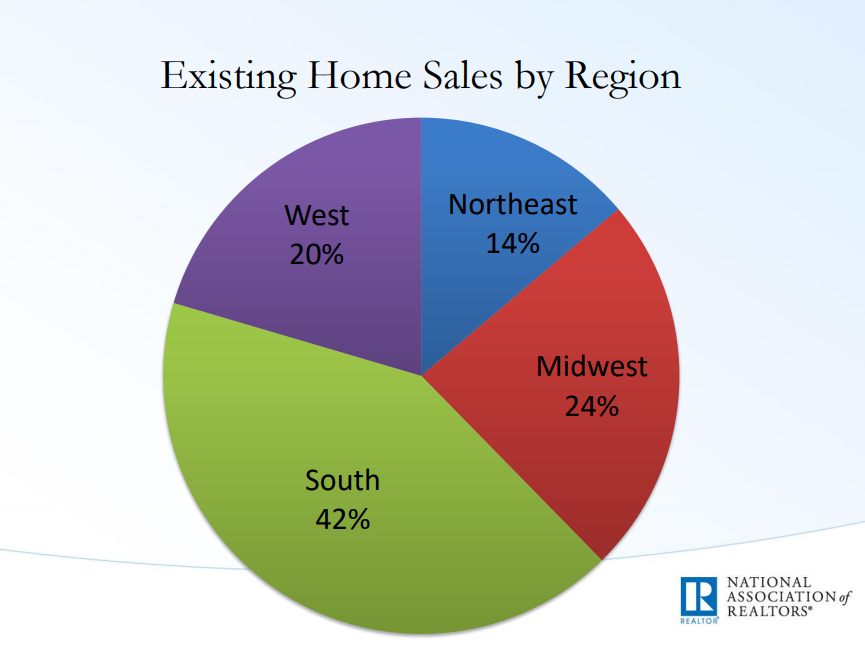

Existing-home sales ended the year with a steep decline, tumbling 6.4 percent in December from November to a seasonally adjusted annual rate of 4.99 million. The decline in sales was widespread across all four U.S. regions, according to the National Association of Realtors. On a year-over-year basis, existing home sales fell 10.3 percent.

December sales ended a weak year for the existing-home market. Sales were the weakest since 2015 due to higher mortgage rates and concerns about a volatile stock market, said economists.

“The housing market is obviously very sensitive to mortgage rates,” commented NAR chief economist Lawrence Yun. “Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today.”

A 30-year, conventional, fixed-rate mortgage decreased to 4.64 percent in December from 4.87 percent in November, according to Freddie Mac.

Yun suggested home sales may see a revival going into spring due to the decrease in rates. Other economists suggest that anxiety over the stock market and political news will continue to dampen buyer enthusiasm in the coming months.

“Certainly, we’re in a mental recession. It’s a constant stream of negative headlines for a couple of months. We’re humans and it wears on you,” said Sam Khater, chief economist at Freddie Mac.

Price growth slowed last month, climbing 2.9 percent in December to a median price of $253,600. Inventory decreased to 1.55 million units from 1.74 million in November. At the current sales pace, inventory is at a 3.7-month supply, down from 3.9 months in November.

“Several consecutive months of rising inventory is a positive development for consumers and could lead to slower home price appreciation,” says Yun. “But there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points.”

Sales of single-family homes and condo/co-ops both declined during December, dropping 5.5 percent and 12.9 percent from November, respectively. Median price for an existing single-family rose 2.9 percent year-over-year to $255,200 and the median condo price rose 2.3 percent to $240,600.