Plate

January 20, 2019

CRU: Plate Remains Outlier in Bearish U.S. Market

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

Scrap prices in the U.S. fell $30 /lt m/m in January, the first time since 2006 that prices have declined in the month. The fall was also the largest December to January decrease in at least two decades for obsolete grades. The unusual decline occurred because supply outpaced demand due to a weak export market, unseasonably warm weather and relatively high mill inventory levels, reports CRU Principal Analyst Josh Spoores.

Long product prices in the U.S. are coming under downward pressure after a build-up in late-2018 inventory levels lingered into the new year and import prices became more attractive for domestic buyers. Price drops so far—where they have occurred—have been minimal, but import deals, with arrival dates 60-90 days out, were concluded at price levels that point toward further short-term price pressure. Furthermore, domestic long product prices have come under pressure from lower scrap prices.

For sheet products, market sentiment has soured. A weakening view of the market has come alongside multiple indicators including: HR coil prices have continued to fall; the new orders component of a U.S. manufacturing PMI survey fell to near neutral levels; and local equity markets ended 2018 clearly in the red. According to a popular search engine, the search for “recession” reached an index of 100, representing maximum popularity during the third week of December. Sheet lead times remain shorter than normal for this time of year and buyers are quite skeptical of any price increase due to rising domestic production and the recent drop in scrap prices. Reflective of this, our Jan. 16 sheet price assessment shows further declines with HR coil falling by $18 /s.ton w/w, to $722 /s.ton.

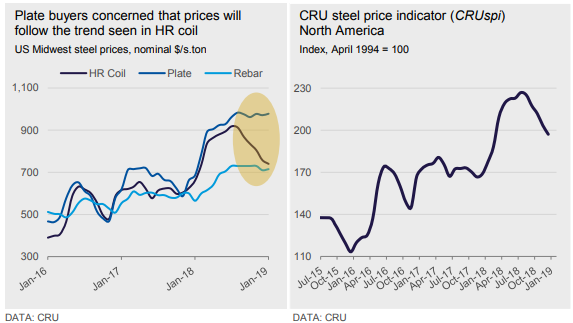

While sheet prices have fallen for the past six consecutive months with an overall decline of $196 s/.ton, plate prices have remained uncannily steady since late July (see chart). This steady price environment started the week after the Department of Commerce announced an investigation regarding mills potentially “illegitimately profiteering” from the S232 tariffs. Over this time period, plate prices averaged $972 /s.ton. Our current price assessment is $978 /s.ton. Currently, service centers have reported steady demand so far in January versus December as stronger post-holiday gains have yet to emerge. Due to the fear that plate prices will inevitably follow the downward trend seen for HR coil prices, plate buyers remain risk averse to taking on any more than immediate needs with mills as some are opting to purchase needs from mill stock lists as well as other service centers.

Outlook: Seasonal Demand Changes Expected

For sheet, our near-term view remains that prices will rise as seasonal demand gains come about while import arrivals and inventories fall. The two questions on this potential increase: at what time will it come and to what price level will HR coil fall in the meantime.

As for plate, supply remains restricted by the S232 and previous AD/CVD duties. With plate prices remaining historically high and now $256 /s.ton higher than HR coil, some substitution is inevitable. Additionally, with the new North American Free Trade Agreement, we anticipate that Canada and Mexico will regain some form of an exclusion to the S232 and additional supply, albeit limited, will come to the U.S.