Logistics

January 19, 2019

Truckload Capacity Eases After Holidays

Written by Sandy Williams

Truckload capacity eased following the holidays, reducing average rates for dry van, reefers and flatbed trucks. DAT Trendlines reports the national load-to-truck ratio fell from 33.7 to 25.1 loads per truck in the week Jan. 6 through Jan. 12.

Flatbed rates came down four cents to a national average rate of $2.42 per mile during the Jan. 6-12 period mostly due to lower fuel surcharges. Diesel fuel prices dipped 1.3 percent to $3.01 per gallon.

Flatbed rates held relatively steady at an average of $2.42 per mile November through December, but were 10 cents higher than average rate for December 2017.

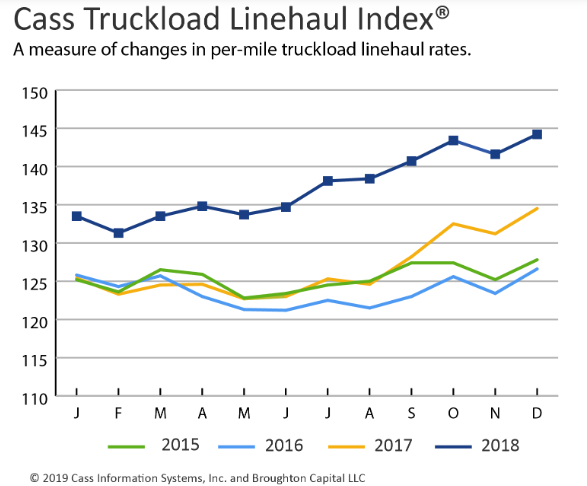

The Cass Truckload Linehaul, a measure of changes in per-mile truckload linehaul rates, rose 7.2 percent year-over-year in December. The Index rose sharply last year making 2018 “the highest year of realized pricing for truckloads since deregulation in 1980, setting a new all-time high of 144.2,” reported Cass Information Systems.

“We expect continued nominal price increases in the coming months, but slightly lower percentage increases as comparisons grow increasingly tough,” stated Donald Broughton, analyst and commentator for the Cass indexes. “Our realized pricing forecast for 2019 is now 2 percent to 5 percent.”

Broughton said in the December Cass Freight Index Report that the transportation sector indicates the economy is continuing to expand just “perhaps not at the scorching pace attained earlier this year, but still at an above-average pace.”