Market Data

January 14, 2019

SMU Recession Monitor: No Downturn Imminent

Written by Peter Wright

Indicators of economic activity in the U.S. do not predict an imminent recession.

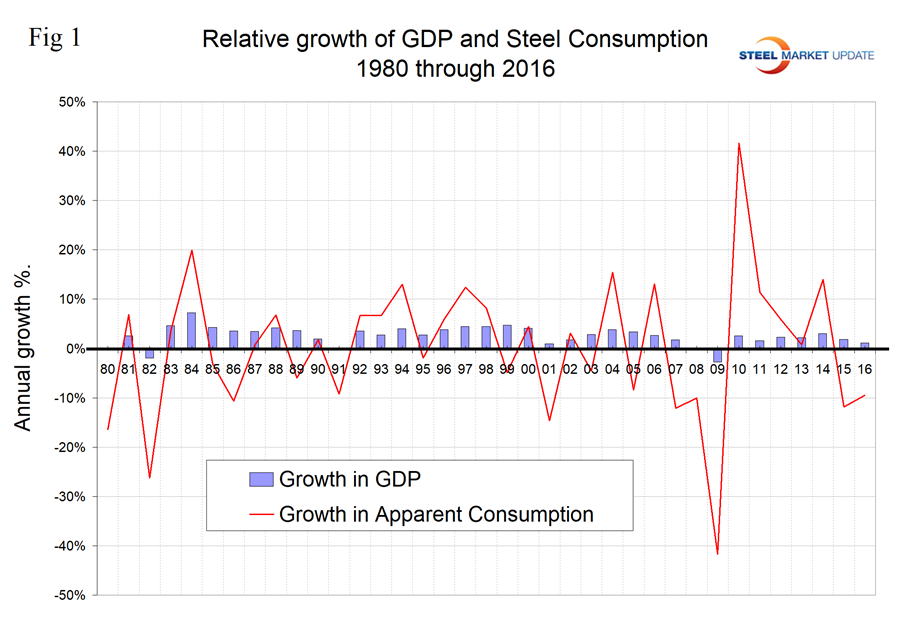

This month we have revamped our recession monitor report to make it more time sensitive. The reason for steel people in particular to know where we are in the business cycle is that steel demand is related to GDP but is vastly more volatile. Figure 1 compares the change in GDP and in apparent steel consumption over a period of 26 years. Steel consumption routinely varies by plus or minus 10 percent or more and this will happen again.

Recessions are defined by the National Bureau of Economic Research (NBER), the organization tasked with identifying when a recession starts and ends. A recession is defined as back-to-back quarters of negative economic growth. The problem with this definition is that it is about six weeks after the second quarter of negative growth before we know we are (or were) in a recession. For example, we could find out in late 2019 that a recession began in the spring. This is not likely, but we are now 115 months into the current expansion, which is the second longest on record.

In this report we have identified eight indicators that have some predictive ability. Viewed individually, they don’t offer much insight into the future, but viewed collectively they give subscribers a better idea of present and future business activity. Our recommendation is that readers examine Figures 4-11 and look for signs of a turnover in recent results. If the majority is heading south, we should be concerned. Since World War II, most recessions have been preceded by an overheated economy as indicated by low unemployment, tighter monetary policy and rising long-term interest rates.

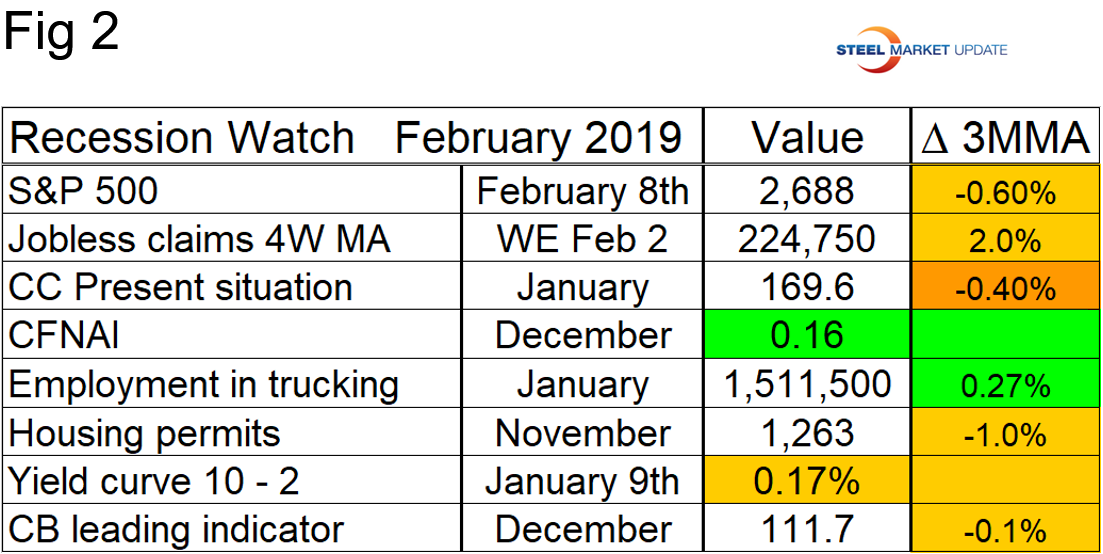

Figure 2 is what we describe as a heat map that summarizes the present state of the eight indicators tracked in this analysis. Color codes show the degree of distress of each item. Red, of which there are none today, would indicate a cause for concern. All except the Chicago Fed National Activity Index and the yield spread are reported as changes to the three-month moving average (3MMA). The CFNAI and yield spread are shown as actual values.

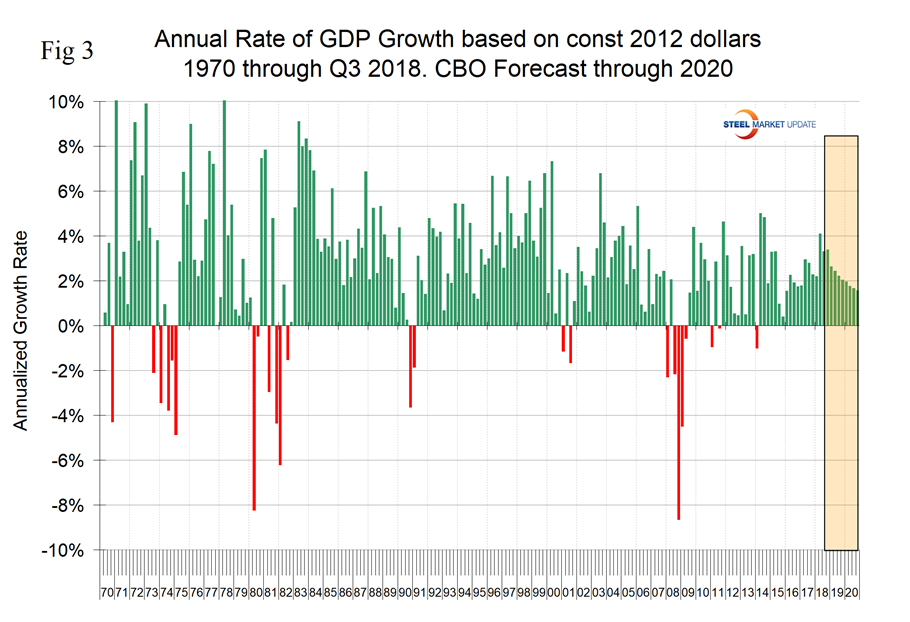

Figure 3 provides a history of U.S. recessions since 1970. Recessions occurred in 1974, 1980, 1981, 1990, 2001 and 2008. In its third estimate of the growth of U.S. GDP for Q3 2018, the BEA reported the growth of GDP to be 3.36 percent. This is a quarter-on-quarter result. On a trailing 12-month basis, GDP grew 3.0 percent in Q3. This was the first quarter to reach 3.0 percent since Q2 2015. Congressional Budget Office economists expect economic growth to decline in upcoming quarters, but not to become negative through 2020.

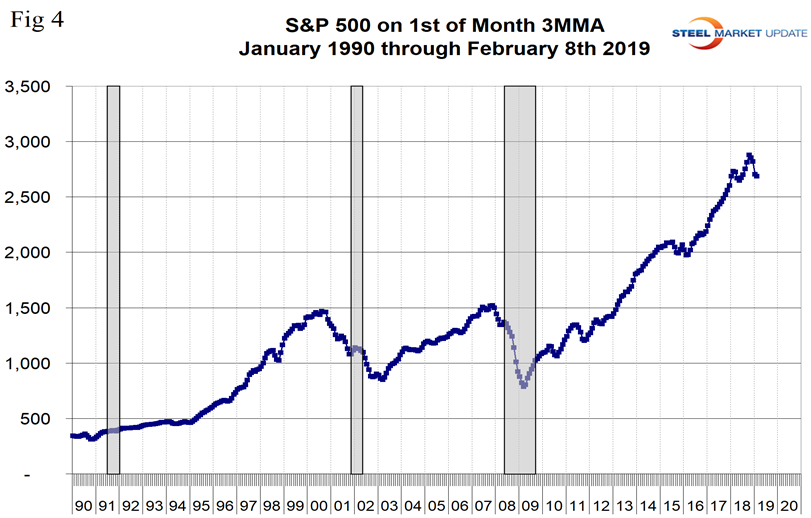

Figure 4 shows the three-month moving average of the S&P 500 at the beginning of each month from January 1990 through February 2019. The stock market did predict the recession of 2001, but failed in 2008. Since then there have been several blips that proved to have been of no significance. The tendency is that stock prices decline as investors anticipate a weakening economy and flagging corporate earnings. Fed tightening is also a factor in today’s world.

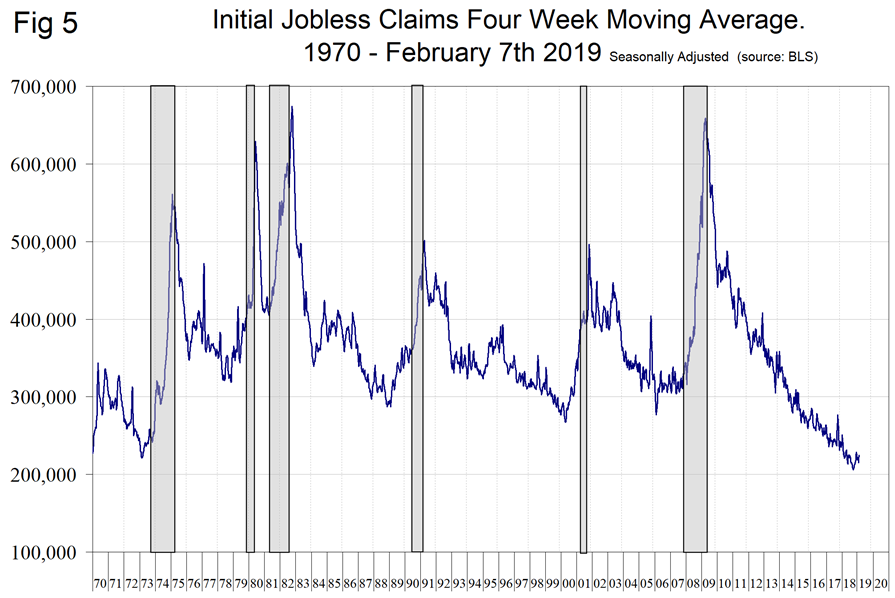

Figure 5 records new weekly claims for unemployment compensation. This indicator failed to predict the 1981 and 2008 recessions. It had a lead of over a year on the other four. Initial claims for unemployment insurance, reported weekly, are a sensitive measure of layoffs. Initial claims were at a 50-year low at the end of 2018, but there has been a recent blip resulting from the government shutdown.

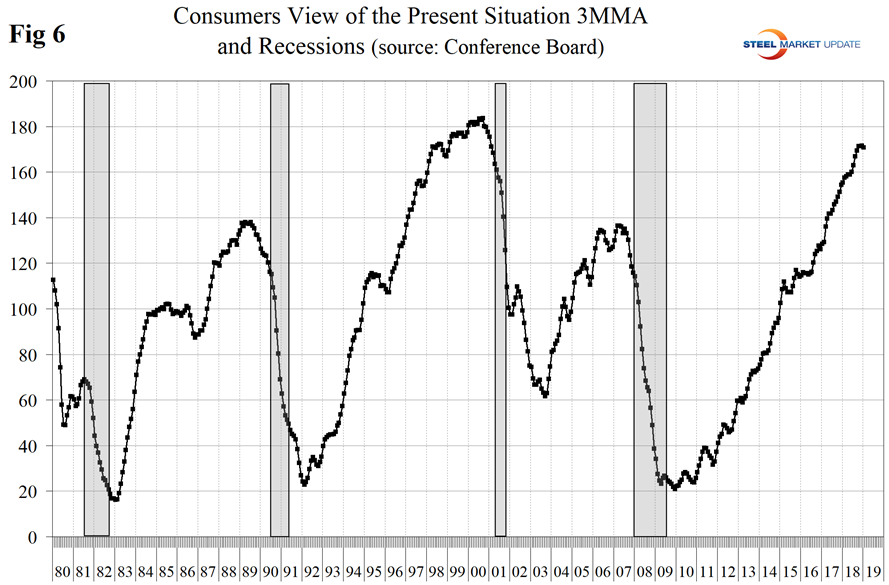

Consumer Confidence: When consumers, businesses and investors lose confidence, it sets up a downward self-reinforcing spiral of reduced spending and investment, causing even higher unemployment and further depressing confidence. Consumer confidence is reported as sentiment indexes of the present situation and expectations and a composite of the two. It appears that the consumer’s view of the present situation is the best predictor of future recessions and this is shown in Figure 6. We believe that the latest CC data was adversely affected by the government shutdown.

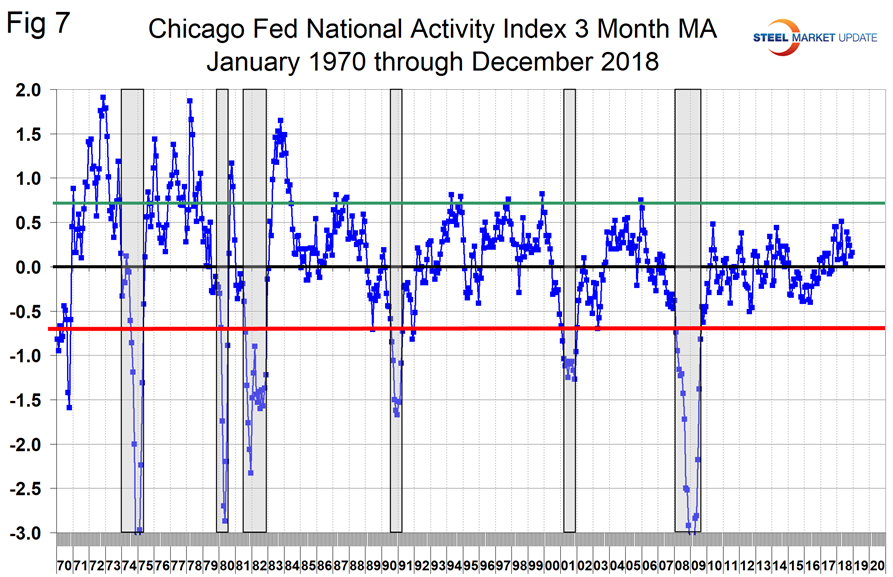

Chicago Fed National Activity Index: This index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories. A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth. When the CFNAI-MA3, (three-month moving average) value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above –0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended. Since our data stream began in January 1970, the CFNAI has predicted every recession, but in between there have been stumbles and false alarms. Figure 2 does not show a year over year comparison for the CFNAI because it is not a progressive indicator (Figure 7).

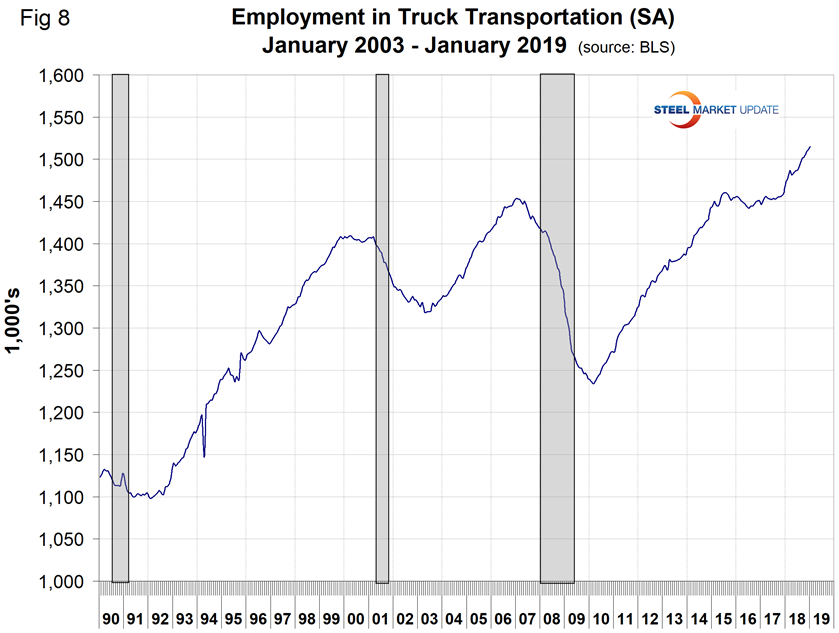

Employment in Trucking: Figure 8 shows total truck driver employment as reported monthly by the BEA. As a measure of economic activity, this indicator has predicted the last three recessions and at present is showing no sign of a slowdown.

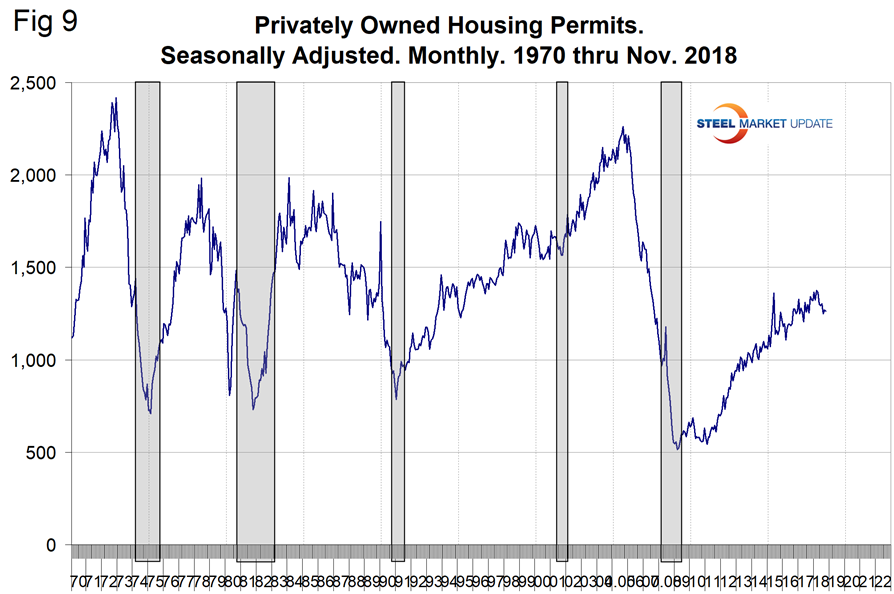

A decline in housing permits and starts has led every recession since 1970. This seems to be a very prescient market. At present, there is evidence of slowing but no sustained decline. In our last report, we changed our analysis from starts to permits to try to be ahead of the game. On a year-over-year basis, growth still looks good, but in the shorter term a slowdown is beginning to appear. Due to the government shutdown, this data is a month overdue (Figure 9).

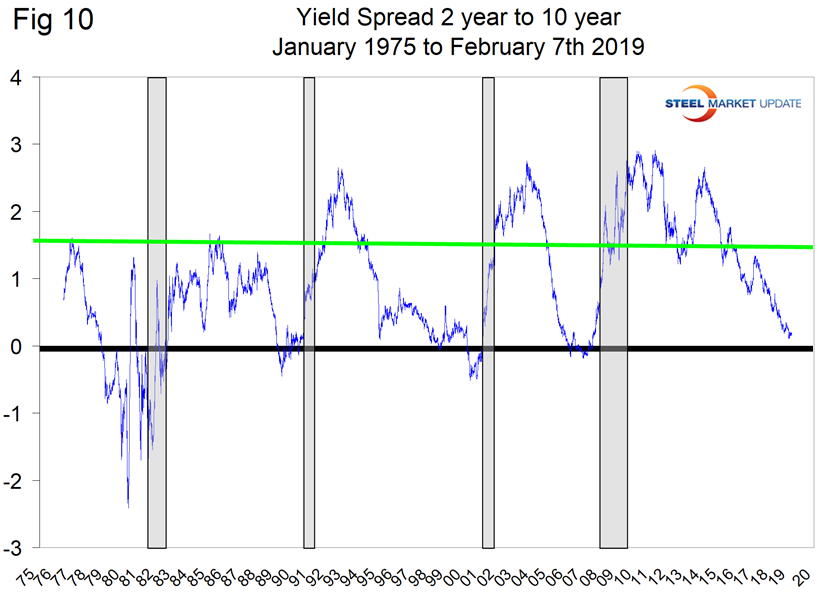

Historically, the most accurate recession predictor has been the bond market, because this massive capital market determines government and business borrowing rates. This is why the famous yield curve has been able to predict every recession since the mid1960s with a 6- to 24-month lead time (and just one false positive). Or put another way, if the 2/10 yield curve inverts, there’s a 90 percent historical probability that a recession is coming in the next two years.

On Jan. 10, equities analyst John Mauldin wrote: “Everybody is suddenly talking about the inverted yield curve. They’re right to do so, but alarm bells may be premature. Inversion is a historically reliable but early recession indicator. Even a fully inverted yield curve – which is not yet – isn’t saying recession is imminent. What we see now is really more of a flattened yield curve. It has a smaller but still positive spread between short-term and long-term interest rates. That’s not normal, but it’s also not a recession guarantee. However, when we combine this with other threats, it adds to the concerns. I would not conclude from the yield curve that recession is imminent. It says what I already knew: A recession will strike at some point, but we probably have a little time.”

The Treasury spread is developed by subtracting a shorter-term from a longer-term Treasury yield. Ten-year interest rates minus two-year interest rates, for example, as shown in Figure 10. A spread that is increasing is a sign of higher growth and inflation as bank lending becomes more profitable (borrow short and lend long) and loan growth is expected to accelerate. A declining or contracting yield spread foreshadows lower growth and inflation due to contractions in bank loan growth due to reduced profitability. The current forecast predicts that lower growth and inflation will materialize in 2019. That thesis has been unfolding as the yield curve is contracting. Prior to the last few weeks, the Fed was signaling that it would raise rates several more times in 2019. This policy is now being re-examined.

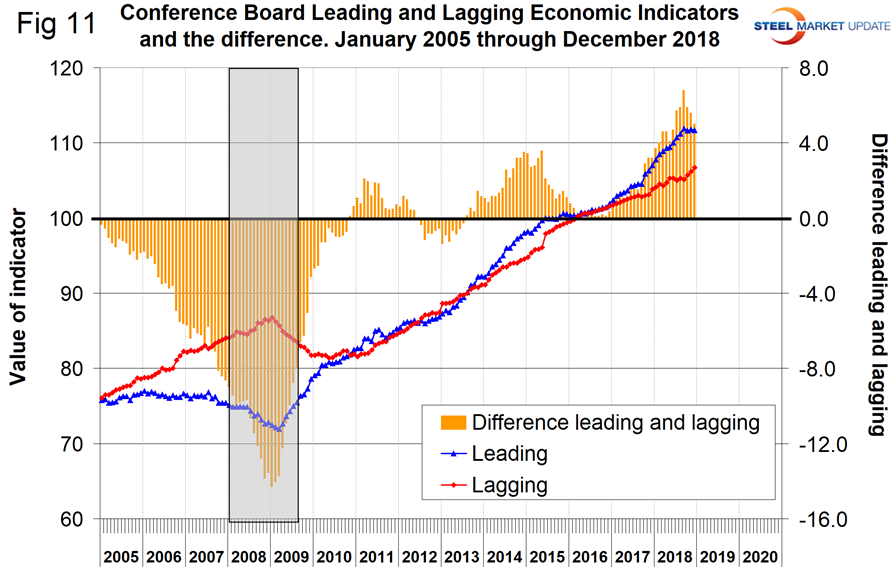

Figure 11 is the chart we like the best, though we have no history before 2008. This is The Conference Board leading and lagging economic index. We have subtracted one from the other in the rationale that if the lead is better than the lag, the situation is improving, or vice versa. The lead minus lag inverted three years in advance of the 2008 recession; certainly by 18 months before the big event it was clear something was happening. The spread began to narrow in October last year with a continuing trend in November and December, but is still healthy.

SMU Comment: Of the eight indicators summarized in Figure 2, two are green, five are showing a small deterioration and one, consumer confidence took a hit in January. The latter was probably due to the government shutdown. Clearly markets are becoming more nervous, but taken as a whole our eight indicators don’t signal a recession in at least the next six months. The U.S. economy is generally healthy, but the yield spread and housing market bear watching.