Market Data

January 14, 2019

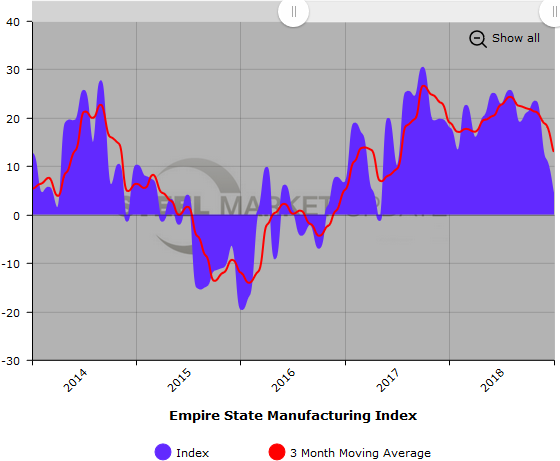

Business Optimism Weakens in New York

Written by Sandy Williams

Manufacturing firms in New York State are less optimistic regarding future business conditions than they were in December. In the January 2019 Empire State Manufacturing Survey, the future business outlook index fell 13 points to 17.8. The indices for future new orders and new shipments plunged 15.3 points and 11.4 points, respectively.

Overall business activity grew only slightly in January. The headline general business index dropped eight points to 3.9, its lowest level since mid-2017. Since November, the index has lost 18 points.

The index for new orders showed a significant slowing in growth, dropping 10 points in January. The shipment index stayed strong, dipping just 2.4 points from December. Delivery times were somewhat shorter, while inventories continued to decline.

The pricing indices showed input costs retreating slightly, while prices received remained consistent with December, increasing just 0.3 points.

The index for employment levels fell 10 points, but still indicated a modest increase at a reading of 7.4. The average work week held steady in January.

The trade fight with China and the partial government shutdown were cited by analysts as underlying reasons for the lower results in January.

“Overall, the message is that manufacturing activity is still rising, but only just, and we expect a substantial further weakening over the next few months,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. Shepherdson expects the Empire State Index to fall to early 2016 levels at negative 10 over the next few months, said Market Watch. “The current weakening is different; the trade war with China, coupled with the underlying slowing in China’s growth, likely are responsible for most of the damage,” added Shepherdson.

The Empire State Manufacturing Survey is conducted monthly by the Federal Reserve Bank of New York and is based on about 100 responses from a pool of about 200 manufacturing executives in New York.