Market Data

January 13, 2019

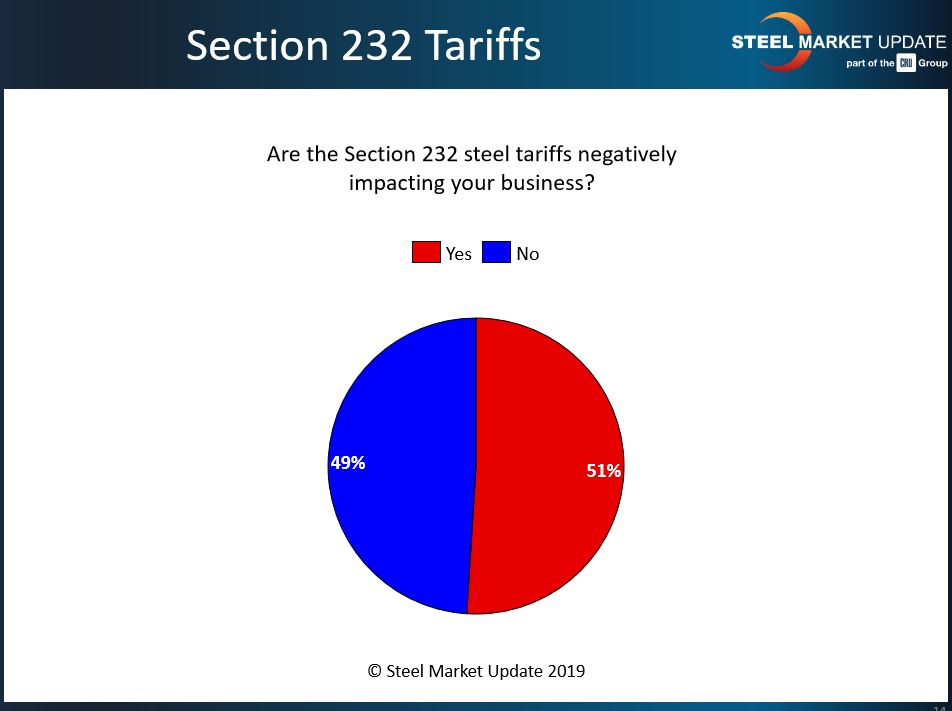

SMU Market Trends: Split on Impact of 232

Written by Tim Triplett

Steel Market Update asked: Are the Section 232 tariffs negatively impacting your business? The market is evenly split on the subject. About half of those responding to SMU’s questionnaire this week—primarily service center and OEM executives—say they have been hurt by the tariffs, while the other half say the tariffs have had no direct effect.

Most of the comments SMU received came from companies that view the tariffs negatively:

• “We’re beginning to see some hits to demand due to the 232s.”

• “Some of our customers are outsourcing overseas now.”

• “The tariff is just turning it into a spot market environment, where everyone is afraid to go long, mills are cutting deals with end users completely different than service centers, and brokers are just churning inventory for cash.”

• “The extra price volatility is causing a great deal of pain since service centers sell on actual cost when prices are going up and on replacement cost on the way down.”

• “Adding 25 percent makes some sources less competitive, and quotas restrict supply artificially.”

• “Not sure we’ve been able to pass along all the material increases.”

• “We are eating the tariffs.”

• “Now that demand has softened, the domestic mills cannot strong arm us like they tried earlier in 2018.”