Market Data

January 10, 2019

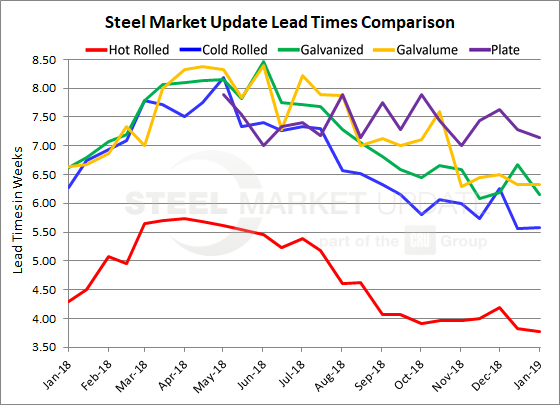

Steel Mill Lead Times: Short to Start the Year

Written by Tim Triplett

Mill lead times turned the corner on the new year little changed from mid-December. At less than four weeks for hot rolled and around six weeks for cold rolled and coated products, lead times for spot orders of most products are as short as they have been in over a year. While still in high demand, even plate lead times dipped slightly last week.

Lead times for steel delivery are a measure of demand at the mill level—the shorter the lead time, the less busy the mill. The less busy the mill, the more likely they are to negotiate on price.

Lead times for spot orders of plate steel now average 7.14 weeks, down from 7.63 weeks a month ago. Mills still have plate customers on allocation.

Hot rolled lead times now average 3.78 weeks, down from 4.19 weeks in early December. Current lead times for hot rolled are below the 4.29 weeks at this time last year and nearly two weeks shorter than the 2018 peak of 5.73 weeks recorded in April.

Cold rolled orders currently have a lead time of 5.58 weeks, down from 6.26 weeks a month ago. Cold rolled lead times have been under six weeks on only a few occasions in the past two years.

Even galvanized steel, which has seen the strongest demand this year, showed a small shortening in lead times for spot orders last week, dipping from 6.67 to 6.15 weeks. Galvalume lead times were unchanged in the latest poll at 6.33 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.