Analysis

January 6, 2019

Auto Sales Top 17 Million for Fourth Year

Written by Sandy Williams

U.S. auto sales topped the 17 million mark for the fourth year in a row. Total sales for the year are estimated at 17.2 million to 17.3 million vehicles.

“New-vehicle sales were surprisingly strong in 2018 despite late cycle headwinds from higher interest rates and more nearly-new competition in the used market,” said Jonathan Smoke, chief economist, Cox Automotive. ”The key positive factor was stimulated demand from tax reform, which strengthened retail demand as the year progressed and also enabled strong gains in fleet sales.”

Cox Automotive analyst Michelle Krebs added that consumers were also wary of tariffs by the Trump administration that would add to vehicle costs, prompting sooner-than-planned purchases.

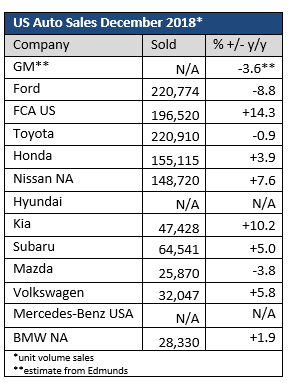

December sales were mixed for automakers with Ford posting an 8.8 percent drop to 220,774 vehicles, while FCA U.S. sales gained 14.3 percent year-over-year to 196,520 vehicles. General Motors announced fourth-quarter deliveries totaling 785,229 units, a decline of 2.7 percent from fourth-quarter 2017. Electric car producer Tesla announced that fourth-quarter deliveries were up 8 percent from the third quarter to 90,700 vehicles.

The forecast for 2019 predicts fewer sales overall, but a continued appetite by consumers for SUVs and pickups. Higher interest rates are perceived as the biggest challenge for the coming year. Cox Automotive expects sales to slip to 16.8 million units in 2019.