Market Data

December 17, 2018

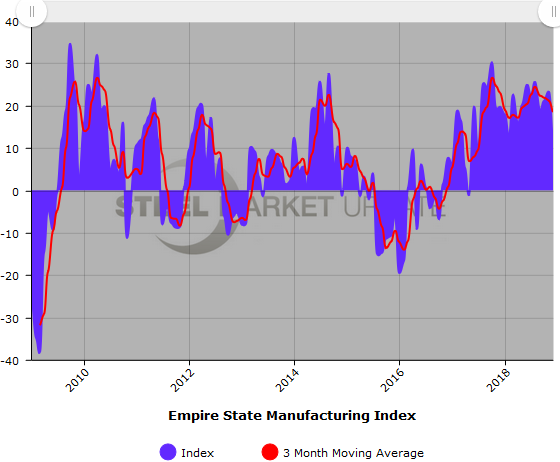

New York Manufacturing Growth Slows in December

Written by Sandy Williams

Business activity grew at a slower pace than in recent months in New York State, according to firms responding to the December 2018 Empire State Manufacturing Survey.

Manufacturing firms surveyed by the Federal Reserve Bank of New York reported that business activity continued to expand in December, though growth was noticeably slower than in recent months. The general business conditions index fell twelve points to 10.9. The share of respondents reporting that conditions had improved over the month dropped to 30 percent, an 11 percentage point decline from November, while 19 percent of respondents reported that conditions had worsened. The new orders index slipped six points to 14.5, and the shipments index fell seven points to 21.0. Unfilled orders were somewhat lower, inventories climbed modestly, and delivery times were slightly longer.

The index for number of employees jumped twelve points to 26.1, indicating very strong growth in employment levels, while the average workweek index was little changed at 8.0. The prices paid index remained elevated but dipped five points to 39.7, indicating a slight deceleration in input price increases. The prices received index was little changed at 12.8.

Firms were slightly less optimistic about the six-month outlook than they were last month. The index for future business conditions fell three points to 30.6. The indexes for future new orders and shipments were also slightly lower, while the indexes for future employment and hours worked were slightly higher. The indexes for future prices paid and future prices received edged lower. The capital expenditures index moved up for a second consecutive month, reaching its highest level in several months, and the technology spending index increased to 26.1.