Prices

December 13, 2018

CRU: Zinc Demand to Benefit from Growth in Renewables

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary

The global transition towards sustainable energy sources is set to accelerate over the coming decades as some of the world’s largest consumers of energy look to reduce carbon emissions, with the USA and EU targeting net zero emissions by 2050 and China by 2060. In this Insight, we bring together our research on the current main end-uses for zinc in the renewable energy sector and assess the potential impact on zinc demand:

• Offshore wind: currently one of the smallest renewable energy sources globally, but rapidly growing and requiring zinc-intensive galvanization.

• Solar: less zinc-intensive than offshore wind, but a well-developed technology that can be installed on a massive scale and often requires galvanized mountings.

• Utility-scale batteries: essential to ensure flexibility of variable renewable energy sources and a potential growth area for zinc oxide.

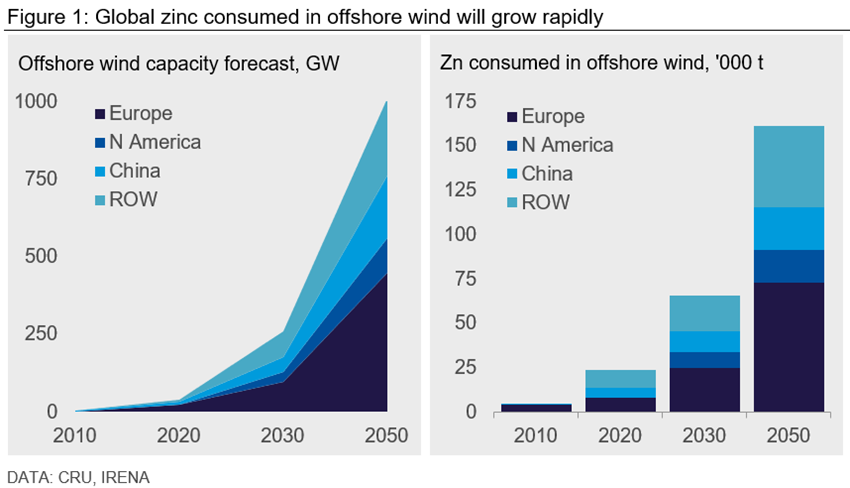

Offshore Wind Installations Will Grow Rapidly Over the Next 10 Years

Offshore wind installations are far more zinc-intensive than their onshore equivalents as they are exposed to both the corrosive power of sea water and extreme weather conditions. The largely steel structure typically receives a 300-1,000 µm coating of thermally sprayed zinc alloy (85% Zn, 15% Al) followed by layers of epoxy paint (75-90% Zn), with the thickest coating found in the transition piece, which is exposed to both waves and atmospheric conditions.

Europe Will Continue to Lead the Way in Offshore Wind Capacity

Offshore wind capacity has grown rapidly in recent years, reaching ~40 GW globally in 2020. According to the IRENA REmap scenario, global offshore wind capacity could reach 1,000 GW by 2050, which we estimate will require on average an additional 90,000 t/y zinc in new annual capacity in 2021-2050.

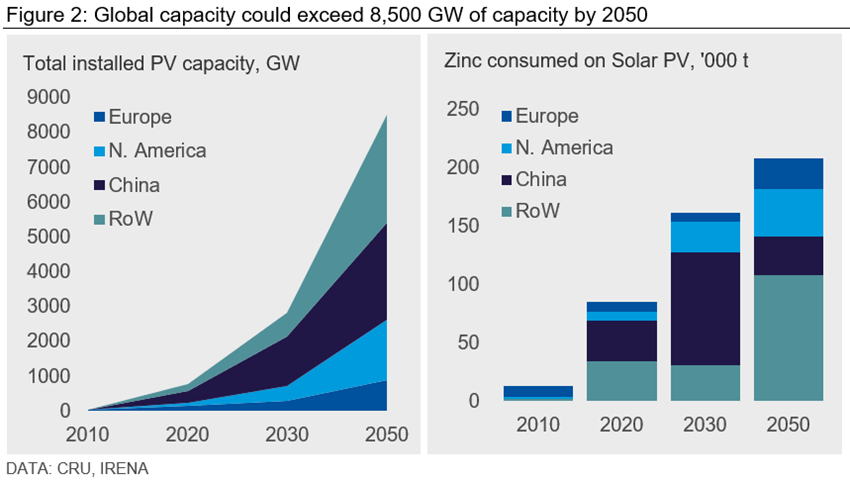

Solar Could be a Bright Spot for Zinc Demand

Solar energy capacity has been rapidly built out across the world over the past two decades, thanks to improved technologies, economies of scale and government incentives. Between 2010 and 2020, global solar photovoltaic (PV) capacity increased at 35% CAGR and growth is set to accelerate over the next 10 years as the major energy-consuming regions work towards carbon neutrality.

Zinc is Key to the Longevity of Solar Mountings

In solar PV installations, the panels themselves contain almost no zinc, but galvanization is key to the longevity and strength of the mounting structure. Utility-scale PV installations tend to be ground-mounted arrays, the largest of which can have a capacity of more than 2 GW and cover an area of 50 km2. Rooftop installations on residential or commercial buildings are typically much smaller (1 KW to 250 KW capacity) and made from aluminum or stainless steel. As a result, only some of the small steel fastenings may be galvanized.

We estimate that globally around 70% of installed PV capacity per annum is ground-mounted and, although the size and intensity of steel use varies greatly, we are basing our estimates on an average of 53 t of galvanized steel per MW of capacity installed.

Huge Solar Capacity Growth Forecast Globally, with China Leading the Way

Solar PV installed capacity is expected to increase more than tenfold over the next 30 years, from under 800 GW in 2020 to more than 8,500 GW by 2050, according to IRENA, at a CAGR of 8.3%. We expect solar-related zinc demand to grow from an estimated 85,000 t/y in 2020 to 160,000 t/y by 2030. Beyond 2030, the pace of growth is forecast to slow as mountings become smaller and rooftop installations gain market share. Despite this, solar-related zinc demand is forecast to reach 210,000 t/y by 2050.

Stationary Batteries Help to Regulate Renewable Energy

Energy storage is essential to balance supply and demand from fast-growing variable sources and the global market will expand rapidly over the next 10-20 years, driven by an increasing acceptance that grid efficiency is vital in reducing emissions and increasing use of renewables. Utility-scale batteries are increasingly being connected to power-generation assets such as wind farms and solar arrays to regulate power flows and can vary in size from several MWh to hundreds of MWh. Batteries compare well to conventional storage systems such as pumped hydro storage as they have the benefit of scalability and can be installed close to the location where the flexibility is needed. Large-scale batteries can also be used to restart systems when required, replacing the reliance on diesel generators.

Zinc Batteries are Beginning to Make Inroads

CRU estimates that 15 GWh of stationary battery storage was deployed globally in 2020, around 90% of which was Li-ion. Li-ion is expected to remain the mainstay of the sector in the medium term, as it continues to benefit from technological development and economies of scale from increased battery manufacturing for the EV sector. Vanadium redox flow batteries are increasing in popularity due to their scalability and longer duration but will struggle to maintain competitiveness with rival technologies. Zinc’s electro-chemical properties have long been considered suitable for use in large-scale rechargeable batteries, but few companies have succeeded in making them commercially viable until recently. The surge in demand for stationary storage batteries over the next 10-20 years should give zinc battery technologies a chance to penetrate the market.

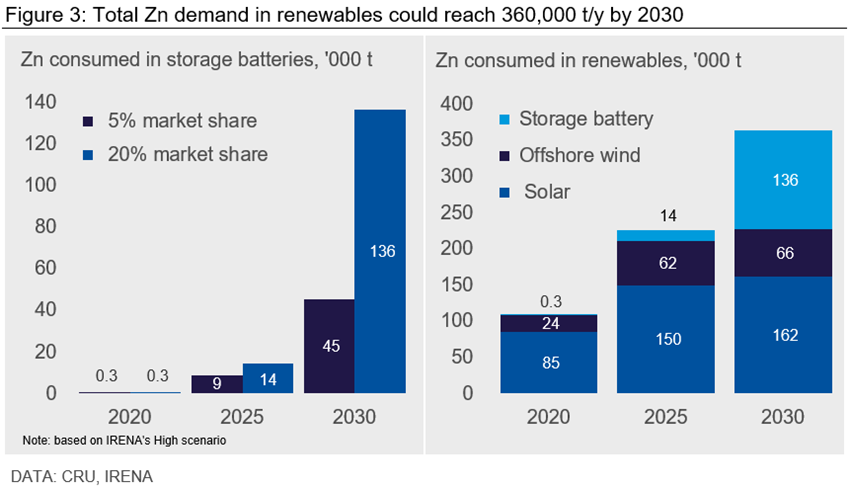

ZnO Demand in Storage Batteries Could Increase Rapidly

We estimate that every 1 MWh of capacity in a zinc-containing battery accounts for ~2.0 t of zinc demand. IRENA forecasts that the global storage battery market could reach 422 GWh by 2030. If zinc storage batteries were to achieve a 5% share of the market, they would account for around 45,000 t/y of zinc demand by 2030, while a 20% market share could increase that to as much as 180,000 t/y.

The Global Energy Storage Database shows that the USA currently accounts for the majority of zinc utility-scale battery installations. Total U.S. battery storage capacity is expected to grow rapidly from the current 3.5 GWh, and zinc is poised to grow its share of this market.

Our forecasts for zinc demand in the offshore wind, solar and battery storage sectors look set to remain modest individually over the medium-term. But looked at in the round, renewable energy capacity additions could account for ~360,000 t/y zinc demand by 2030, up from an estimated 110,000 t/y in 2020 and continue to grow well beyond that.

Risks to the Forecast

As with any long-term forecast, there are significant risks. Upside risks include:

• Accelerated investment and greater adoption of renewable energy than anticipated across all sectors, leading to higher-than-expected zinc demand.

• Zinc storage batteries become a serious challenger to the dominant Li-ion technologies and increase market share more rapidly than expected.

• Further research into the use of ZnO as a coating on solar cells to improve efficiency, leading to a boost in zinc demand from the solar sector if the technology becomes widespread in the future.

Downside risks include:

• Technological developments leading to further improvement in the capacity-to-size ratio of offshore wind turbines, leading to a fall in zinc intensity per MW of installed capacity.

• Technological developments lead to lighter PV panels requiring smaller mountings and less galvanization or increased use of aluminum.

• Technological improvements in corrosion protection leading to optimization of coating weights and/or galvanizing alloys and epoxy coatings containing less zinc in offshore wind and solar.

• Competing solutions, particularly in the storage battery sector, leading to lower-than-expected adoption of zinc-containing technologies.