Market Data

November 30, 2018

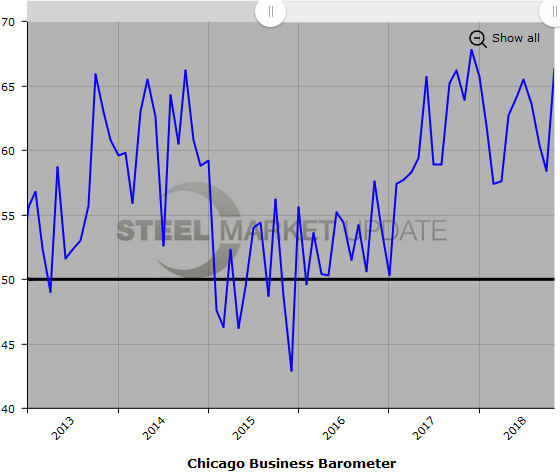

Chicago Business Barometer at 11-Month High in November

Written by Sandy Williams

The Chicago Business Barometer jumped 8.0 points in November to an 11-month high of 66.4. Business was booming as new orders rose to their highest level since May 2014 and output increased for the second straight month.

“The MNI Chicago Business Barometer clipped a run of three consecutive declines in emphatic style in November, boosted primarily by resurgent orders – stronger than typically seen at this time of year and enough to push the Barometer to its best level since December,” said Jamie Satchi, economist at MNI Indicators.

“However, many firms reported seeing the effects of higher China tariffs on their invoices for the first time and voiced concern that business could be stifled going forward,” he added.

Supply issues continued during the month, driving the supplier deliveries index to its highest levels since April 2004. Firms cited delays in receiving material from offshore suppliers. The inventory indicator slipped to a three-month low in November after two months of stocking up in preparation for the holidays and to protect against higher prices from further trade disruptions. Higher demand resulted in an a four-month high for the orders backlog index.

Employment levels increased in November, but firms continued to report difficulty finding qualified labor. When asked if labor issues would impact their business in 2019, 42.6 percent of firms said no, but 36.2 percent said issues were likely to occur. The remainder of respondents were unsure.

The price indices remained elevated last month with prices paid in the historically high range. “Some firms reported an increase in costs across a range of goods, while others said they were in the process of renegotiating contracts,” said MNI Indicators.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.