Market Data

November 26, 2018

SMU Steel Buyers Sentiment: Worried About 1Q 2019

Written by John Packard

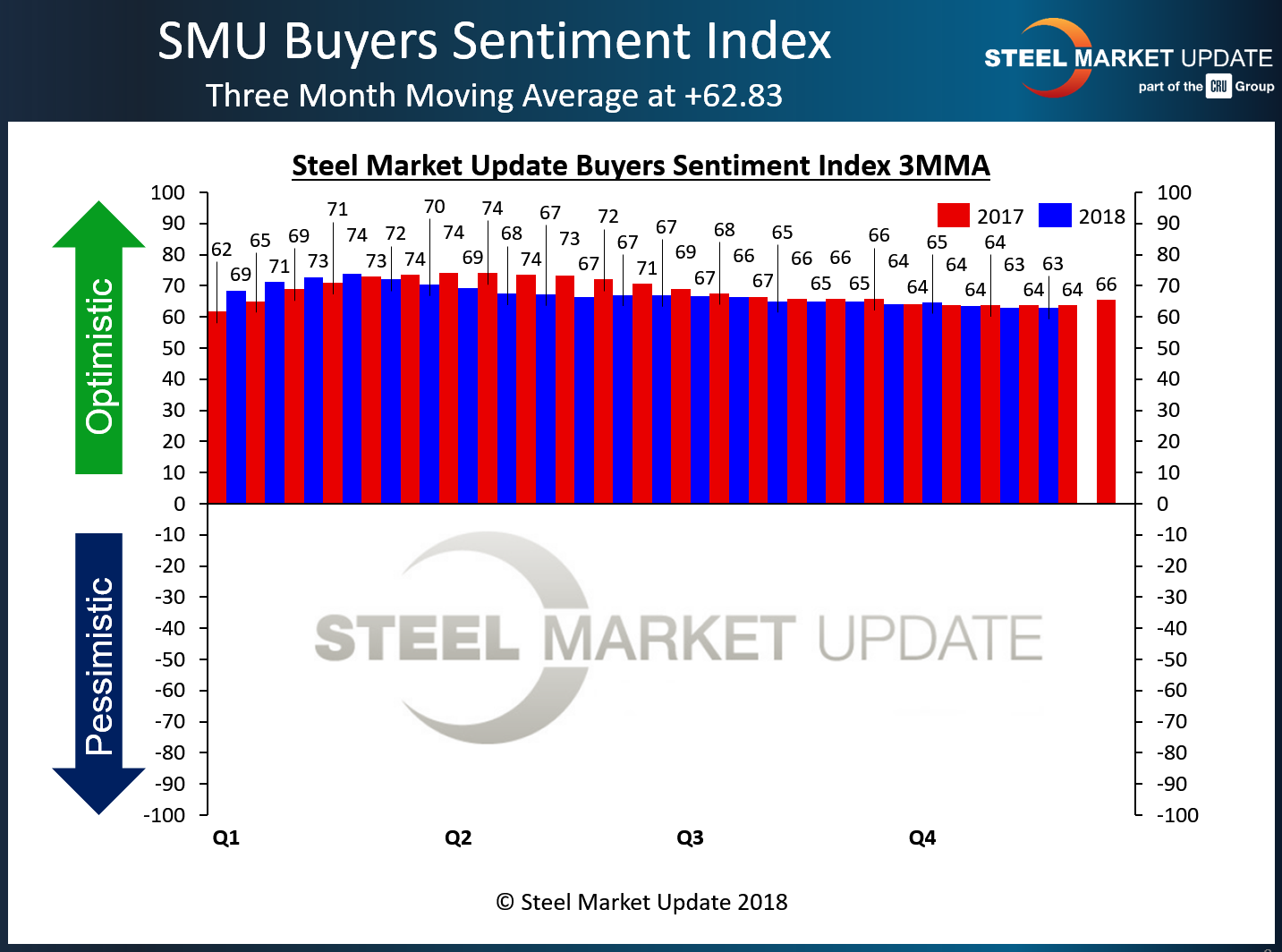

The attitudes of steel buyers and sellers, as measured by this week’s SMU Steel Buyers Sentiment Index questionnaire, show mixed feelings in the marketplace following the midterm elections. Current Sentiment was an impressive +65 measured as a single data point. Future Sentiment dropped -7 points to +58. Both are well within the “optimistic” side of the equation, but the three-month moving average, compared to one year ago, does not lead us to think the market is as strong as some might want us to believe.

The goal of the index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Index), as well as three to six months into the future (Future Index). Results are posted as both a single data point and as a three-month moving average (3MMA), which smooths out the numbers and provides a clearer view of the trend.

Measured as a single data point, Current Sentiment registered +65, up 3 points from early November. Perhaps most telling, Current Sentiment, measured as a three-month moving average, dropped to 62.83, its lowest reading in nearly two years. Even so, we are in line with what our index was showing us one year ago when the index went through its normal late third quarter/early fourth quarter swoon.

Future Sentiment

As a single data point, Future Sentiment registered +58, down 7 points from two weeks earlier. At 59.83, the 3MMA for Future Sentiment was also down 1.5 points from SMU’s last poll prior to the election. As you can see by the graphic below, going back to the time of the Section 232 announcement, Future Sentiment has been consistently below year-ago averages. This leads SMU to believe that first-quarter 2019 may have some challenges ahead.

What Our Respondents Had to Say

• “We’re very concerned about the overall dynamics of the market. Demand is really slowing uncharacteristically for this time of year. Customers continue to state they are only buying what they need, even if it costs more for low volumes.”

• “It is imperative that we buy what we need, and need what we buy. In other words, we’re cautious about putting too much inventory on the floor until the dust settles.”

• “We’re holding our own, but seeing a lot of downward pricing pressure from competitors.”

• “We’re getting past the inflection point of high priced inventory.”

• “It all depends on the tariff picture.”

• “232.”

• “There is so much negative news now. While demand remains strong, once it softens, this whole house of cards could fall.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 39 percent were manufacturers and 47 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.