Market Data

November 8, 2018

Steel Mill Lead Times: Plate, Galvalume Shorten a Bit

Written by Tim Triplett

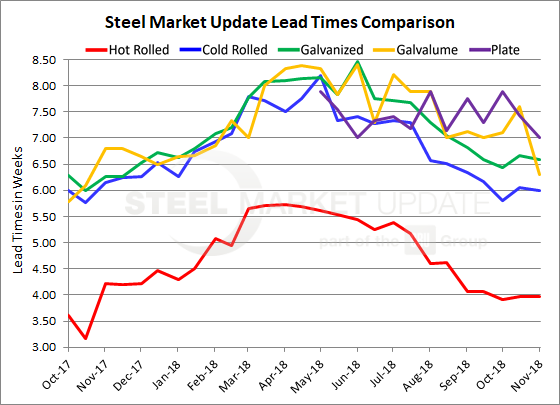

Lead times for Galvalume and plate products shortened up a bit in the past two weeks, but otherwise lead times for flat rolled products have seen little change in October or November, despite the price hike announcements by the major mills.

Lead times for steel delivery are a measure of demand at the mill level—the longer the lead time, the busier the mill. The busier the mill, the less likely they are to negotiate on price. Responses to SMU’s latest flat rolled and plate market trends questionnaire show that lead times for hot rolled now average about four weeks, cold rolled about six weeks, galvanized and Galvalume about six and a half weeks and plate about seven weeks.

Demand continues to outpace supply in the plate segment of the market, as mills still have customers on allocation. Lead times on plate orders have exceeded eight weeks in some cases. However, the current average lead time is 7.00 weeks, down from 7.89 weeks a month ago, which suggests that the plate market may be moving toward a better balance.

At 6.30 weeks, Galvalume lead times have shortened noticeably from the 7.60 weeks registered in the last SMU market canvass. AZ lead times topped out this year at 8.40 weeks in June.

Hot rolled lead times now average 3.97 weeks, essentially unchanged from October. This year’s longest lead time for hot rolled delivery was 5.73 weeks in April.

Cold rolled orders currently have a lead time of 6.00 weeks, slightly shorter than the 6.06 weeks in mid-October. CR lead times peaked this year at 8.19 weeks in May.

The current lead time for galvanized steel is 6.58 weeks, down a tick from 6.66 weeks two weeks ago. Lead times on galvanized orders extended as far as 8.46 weeks earlier this summer.

Lead times that are stable or even shorter in some cases are a sign that the mills are having difficulty collecting their price increase. As one buyer commented: “We’re seeing normal published lead times, but the majority of orders are ready early.”

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.