Market Data

November 8, 2018

SMU Steel Buyers Sentiment Index Improves

Written by John Packard

The SMU Steel Buyers Sentiment Index saw both the current and future indices as slightly more optimistic than what Steel Market Update reported during the middle of October. Current Sentiment was measured at +62, up +3 points from our last analysis. Future Sentiment at +65 improved by +12 points from what we reported two weeks ago. Sentiment is defined as how buyers and sellers of steel feel about their company’s ability to be successful in the current market, as well as looking three to six months into the future.

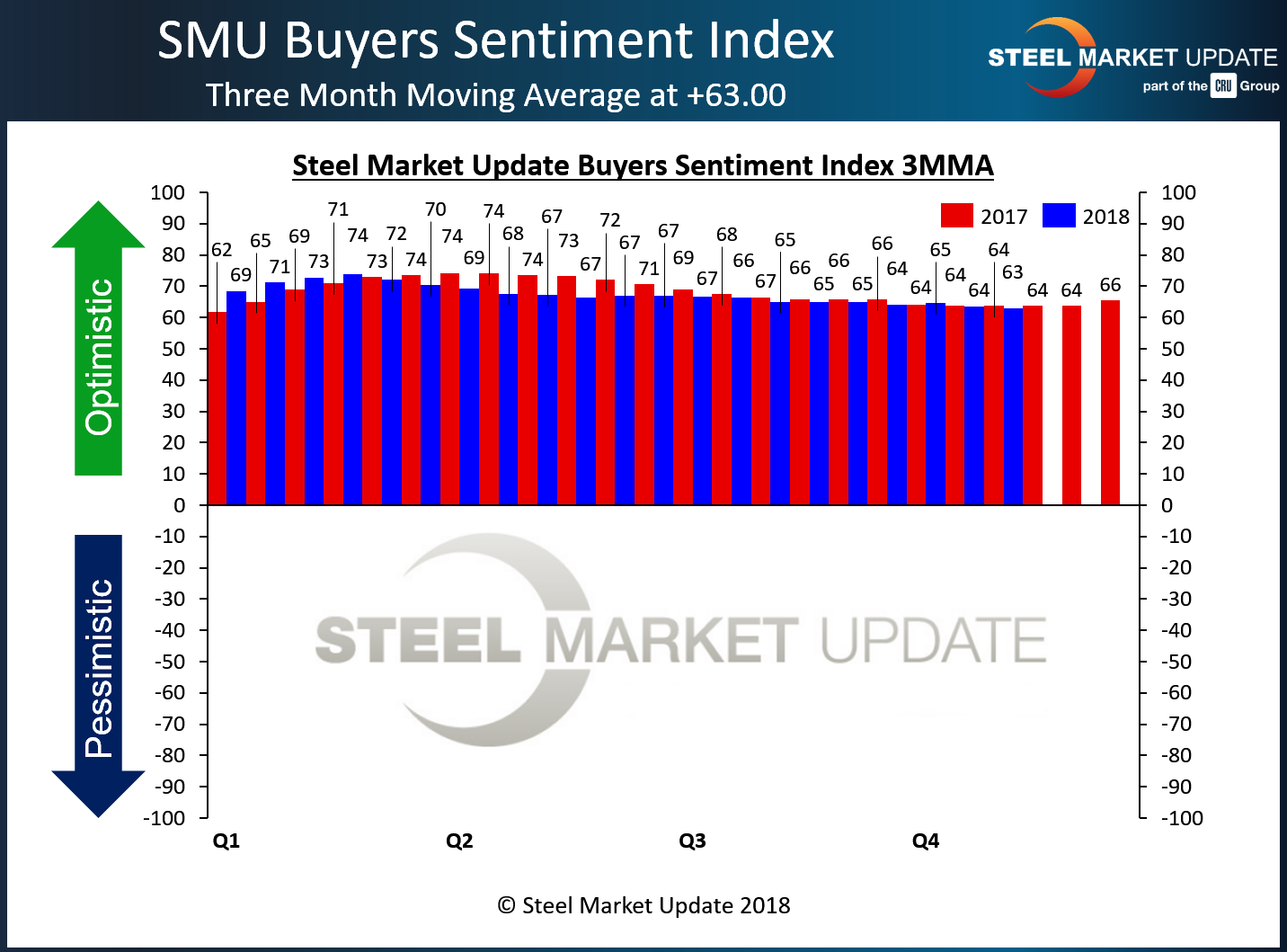

The real story is Current Sentiment. When viewed based on a rolling three-month moving average (3MMA), it continued to be less optimistic than at any point in time over the past 12 months. Current Sentiment 3MMA is +63.00, which continues to be optimistic, but has slid almost 10 points from February’s high point for the year (+73.83). As you can see by the graphic below, Current Sentiment is essentially the same as it was one year ago at this time.

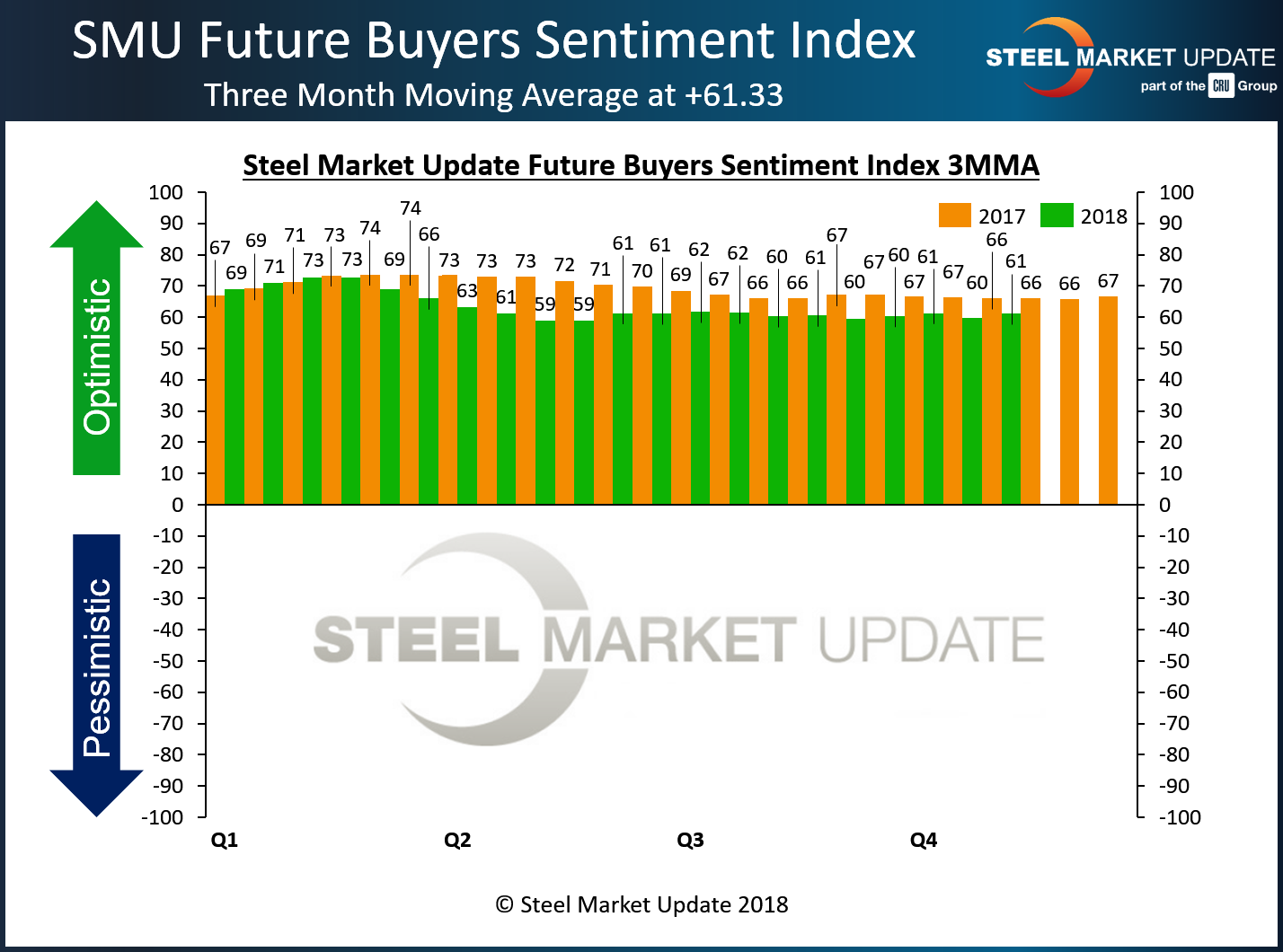

There is a silver lining to this story as Future Sentiment, when viewed as a three-month moving average, was slightly more optimistic than what was reported in mid-October. At +61.33, the 3MMA has been traveling in a narrow range over the past seven months from +61.33 to a low of +59.50. Prior to mid-April, Future Sentiment was as high as +72.83 back in early February 2018. The silver lining may not be silver but another not so shiny metal, as you can see by the graphic below, Future Sentiment has not returned to the levels seen one year ago.

Most of the data collected this week was prior to the election returns being announced showing the Democrats as having taken back control of the House of Representatives.

What Our Respondents Had to Say

“High steel prices are hard to pass on to our customers.”

“Seasonal factors will result in reduce volumes over the next several months.”

“Demand’s steady and if trade action is steady and there’s nothing new (doubt that will last), then we should do okay. But future risk of changes/restrictions on trade are more likely to happen then not.”

“Demand has risen relative to September/early October. Prices are stable.”

“Unfair steel pricing.”

“Customer inventory adjustments are on the back side of the curve. Buying patterns should return to a state of normalcy.”

“Competitive forces create significant margin compression on contractual business.”

“Fear a trade war.”

“Trade wars and politics are wild cards.”

“Higher priced substrate is flushing through and costs are now more reflective of the current market.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 39 percent were manufacturers and 47 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.