Market Segment

November 4, 2018

U.S. Steel Meets Expectations in Q3

Written by Sandy Williams

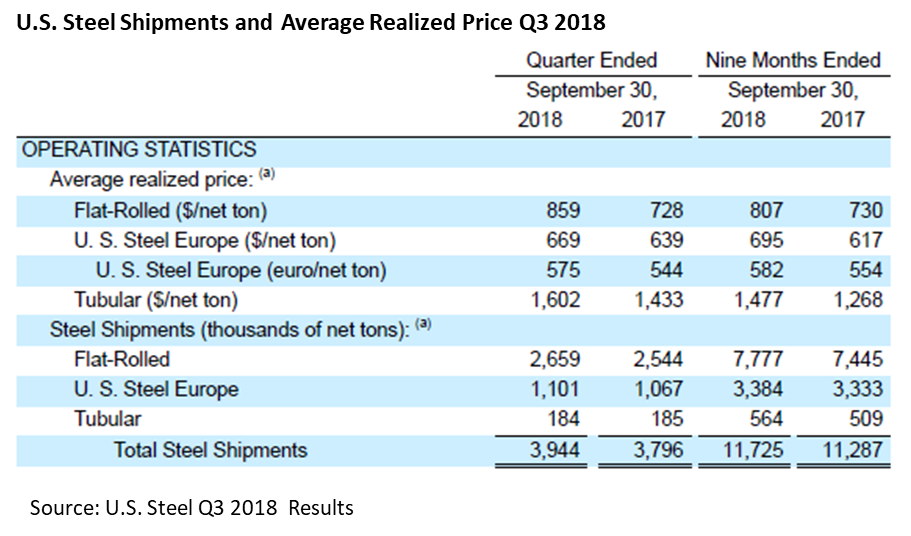

U.S. Steel earnings were in line with expectations for the third quarter. U.S. Steel reported net earnings of $291 million compared to $214 million in the second quarter and earnings of $147 million in Q3 2017. Net sales rose 14.8 percent year-over-year to $3.7 billion. Adjusted EBITDA of $526 million improved by $169 million compared to the third quarter of 2017.

Total steel shipments in Q3 2018 were 5.5 percent lower at 20.5 million tons as compared with 21.8 million tons for Q2 2018 primarily due to normal seasonal patterns, as well as operational disruptions in Europe, required inventory replenishment in ACIS, and temporary market weakness in the U.S.

Flat rolled segment earnings totaled $305 million, up from $224 million in Q2 and $161 million a year ago. The average flat rolled price was $859 per ton and flat rolled capacity utilization was 68 percent. A slowdown in order intake was noted during the quarter, driven by falling spot and index prices.

The slowdown in order rates lasted longer than anticipated, which had about a 200,000-ton impact on volumes, said CFO Kevin Bradley.

The company is pleased with its decision to restart the furnaces at Granite City. The two blast furnaces at Granite City will serve as a back-up during scheduled downtime at Gary, Great Lakes and Mon Valley in 2019. As a standalone mill, its primary markets will be construction, service centers and the water pipe makers. “We’re running pretting hard,” said Dan Lesnak, General Manager, Investor Relations. “If the market is telling us we need those furnaces on, we’ll keep them on as long as we need them. I think we have a pretty good track record over the last decade of matching our production to what the customers need.”

President and CEO David Burritt emphasized that the restart of Granite City was not about adding capacity to the market, but about making sure the assets U.S. Steel already has are run productively. “As far as adding a bunch of capacity, that’s not going to happen,” he said. “We can grow profitably without increasing capacity.”

When asked if the electric arc furnace at Fairfield could be used to produce slabs for sale in the domestic market, Burritt said the furnace would have the capability to do so. He reiterated that restart of the facility is “not a question of if but when.”

Lesnak noted that the company has a smaller, although improving, tubular footprint than it has had in the past and that Fairfield could be used to provide feed for the company’s pipe mills. The extra capacity of the 1.6 million-ton EAF at Fairfield could be used to make slabs for conversion at U.S. Steel operations or for sale.

The company’s tubular division is improving, and customer demand will determine if U.S. Steel’s idled tubular facilities will be restarted. The facilities were in good shape when they were shut down and will not require a major capital investment to restart, said Lesnak. “Tubular mills are more finishing mills—they don’t have nearly the complexity of a blast furnace steelmaking operation.”

U.S. Steel has reached a tentative labor agreement with the United Steelworkers that is expected to be ratified by mid-November. Following the ratification, the company will have more to say about its EAF at Fairfield.

Guidance Outlook

“We continue to see consistent and strong end-user consumption in our North American flat-rolled market,” said Burritt. “We did see a pause in order rates and a decline in index pricing beginning in Q3; impacts of this dynamic are being realized in Q4.”

Results in the flat rolled segment are expected to improve in Q4 due to increased shipments and lower maintenance and outage costs, but will be partially offset by lower average realized prices.

Adjusted EBITDA in the fourth quarter is expected to be approximately $575 million, and $1.8 billion for the full year. The company announced a share repurchase authorization of $300 million over the next two years.

Capex is expected to be $1 billion in 2019, the peak year for the revitalization under way at U.S. Steel. A series of smaller projects are planned that will improve reliability and efficiency.

U.S. Steel expects higher prices for coal contracts in the coming year, but will mitigate increases by shifting its blends of coal.