Analysis

November 1, 2018

Auto Demand Exceeds Expectations in October

Written by Sandy Williams

Robust demand offset increased vehicle pricing and higher interest rates last month, keeping U.S. auto sales strong in October, although weaker than a year ago.

October sales were expected to be impacted by replacement buying due to hurricane damage in the South. There was also one extra selling day in the month.

“Many signs in the economy would suggest that vehicle demand should be moderating – higher interest rates, import tariffs, weak housing market, stock market volatility, elevated gas prices – yet vehicle buying remains strong,” said Charlie Chesbrough, senior economist for Cox Automotive.

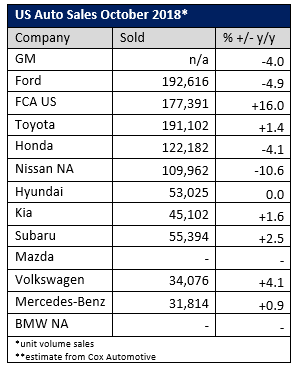

FCA turned in the best results for October, with a year-over-year sales gain of 16 percent. Ford sales fell 4.9 percent and General Motors, which no longer reports monthly, is estimated to be down 4.0 percent.

Annualized auto sales are down about 2 percent from a high of 17.55 million in 2016 and are likely to fall further by the end of 2018. The consensus among analysts is that sales will remain above 17 million, however, for the fourth consecutive year.

Affecting affordability are annual loan percentage rates that have climbed to an average of 6.2 percent for new financed vehicles.

“We haven’t seen interest rates hit the 6 percent mark in nearly 10 years, and zero percent finance loans have been cut down by nearly a third of where they were in 2016,” said Jeremy Acevedo, Edmunds’ manager of industry analysis. “It’s getting harder and harder for shoppers to afford a new car, and if the economy starts to slip, we’re at a point now where we really could start to see some significant impacts in the auto market.”