Overseas

November 1, 2018

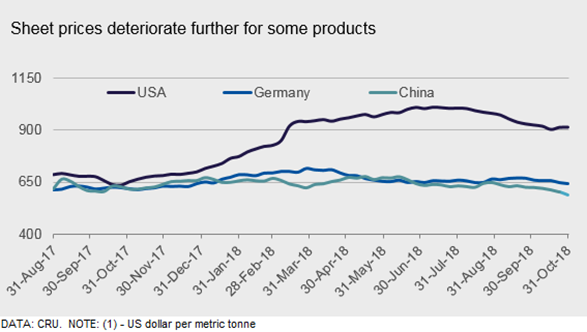

A Brief Look at Steel Prices in Europe, China, Asia

Written by Tim Triplett

CRU Steel Analyst Ryan McKinley offers the following brief analyses of steel prices in Europe, China and Asia and the factors that have influenced them this week.

Europe

Sheet prices in Germany have remained unchanged this week. Last week’s Euroblech trade fair has not brought any immediate change to the spot market, though this may also reflect some holidays being taken around the industry. Feedback from the fair was generally negative towards near-term prices, with the feeling that customers were lacking in numbers and in interest towards fresh purchases. We expect to see this become reflected in prices shortly, and especially since prices continue to fall in Southern Europe. Italian HR coil prices are now approaching €500/t ($547 U.S.) and have lost over €30/t ($34 U.S.) during October.

China

Chinese domestic sheet prices continue to edge down this week, given a collapse in both transaction and market sentiment. While demand prospects are not promising given the latest data in sheet-consuming sectors, participants are worried about continuous declines and are thus eager to give discounts to increase sales. Nonetheless, stock kept increasing for six weeks in a row, suggesting deterioration in underlying demand. Furthermore, recent news on the VAT rebate increase on galvanizing sheet from 13 percent to 16 percent effective Nov. 1 has started to impact export prices. Some steel mills said that an estimated $20/t fall in cost may result in an export price decline of similar extent, so overseas buyers are postponing orders, which is a headache for Chinese exporters. But domestic galvanized sheet prices may see some support if future export volumes increase, though with limited extent given the current loosening market balance.

Asia

Asian prices for sheet products continued to fall in the past week. Indian traders further lowered their offer prices for hot rolled coil. For December shipment, offer prices for SAE1006 from Tata Steel and Essar Steel were at $558/t and $550/t CFR, Vietnam, respectively, from a level of $570/t CFR a week earlier. A trader based in Vietnam suggested that offer prices from Russian mills were even lower, with prices at $541/t CFR Vietnam for big coils. In the meantime, offer prices from China were further down. Offers for SS400 are at $545-555/t FOB at the moment. However, buyers have been sitting on the sidelines as they expect prices to drop further. Several traders indicated that Chinese export prices are likely to weaken due to rising tax rebates on alloyed HR coil from November. CRU assessed HR coil prices at $560/t, CFR Far East Asia, down $5/t w/w. CR coil prices were assessed at $620/t CFR Far East Asia, unchanged w/w, while HDG prices were assessed at $663/t CFR, also unchanged w/w.