Market Data

October 31, 2018

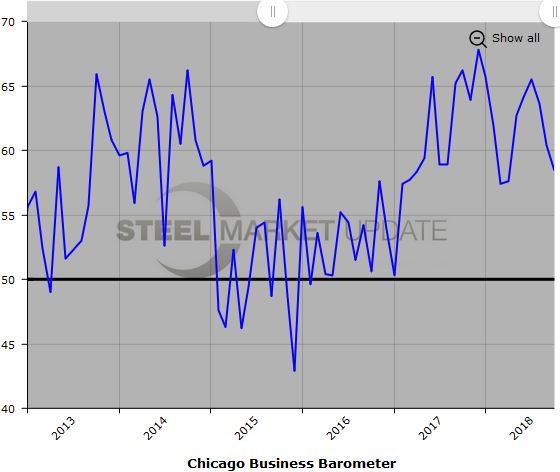

Chicago Business Barometer Dips in October

Written by Sandy Williams

Manufacturing activity continued at a healthy clip in October, although slipping on the MNI Chicago Business Barometer. The index dropped 2.0 points to 58.4 in October and plunged 10.7 points year-over-year to its lowest reading since December 2014. The decrease may signal a return to more normal levels after a year of particularly strong performance, said MNI Indicators.

“The MNI Chicago Business Barometer continued to revert back towards trend-levels in October, cooling off after a hot and unsustainable run last year,” said Jamie Satchi, economist at MNI Indicators.

“Production continues to be restrained by issues between firms and their suppliers, reflected by Supplier Deliveries at a 14-year high, while the latest raft of tariffs on Chinese goods appears to be exacerbating uncertainty across firms,” he added.

New orders decreased for the sixth month in a row to January 2017 levels, but output edged up marginally.

Backlogs receded in October, while supplier delivery times lengthened to their highest level in more than 14 years. Inventory levels were mostly unchanged, however, some firms reported additional stockpiling ahead of potential price increases.

Prices paid were in the historically high range. “Some firms reported seeing higher unit prices on invoices for the first time on the back of further import tariffs levied on China, while others said they expected shortages to push prices higher over the coming months,” said MNI Indicators.

Hiring activity increased in October, but firms continued to report difficulty finding qualified labor.

MNI found that 31.9 percent of firms believe allocation issues will affect fourth-quarter operations, while 36.2 percent expect no impact.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.