Market Data

October 30, 2018

October Consumer Confidence at Highest Since 2000

Written by Peter Wright

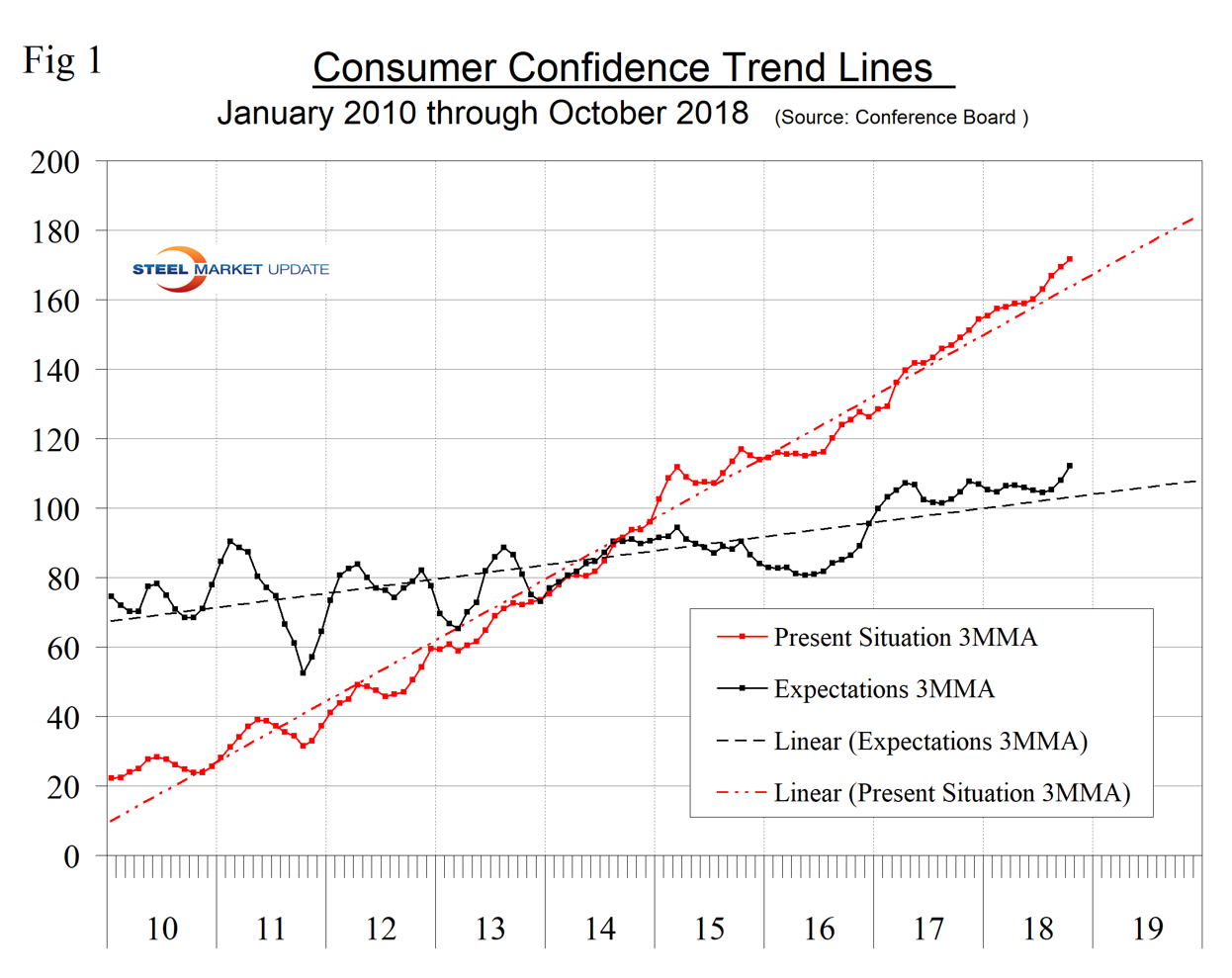

The Conference Board measure of consumer confidence was revised down for September, but October made up most of that correction. Consumer confidence in October was at its highest level since September 2000. The composite value of consumer confidence in October was 137.9, up from the revised September value of 135.3. The three-month moving average (3MMA) increased from 132.6 in September to 136.0 in October, which was 13.6 points higher than in October last year. We prefer to smooth the data with a moving average because of monthly volatility, which in the case of consumer confidence has been quite extreme since the beginning of 2016. The composite index is made up of two sub-indexes. These are the consumer’s view of the present situation and his or her expectations for the future. Both are above their nine-year trend line and both are accelerating (Figure 1).

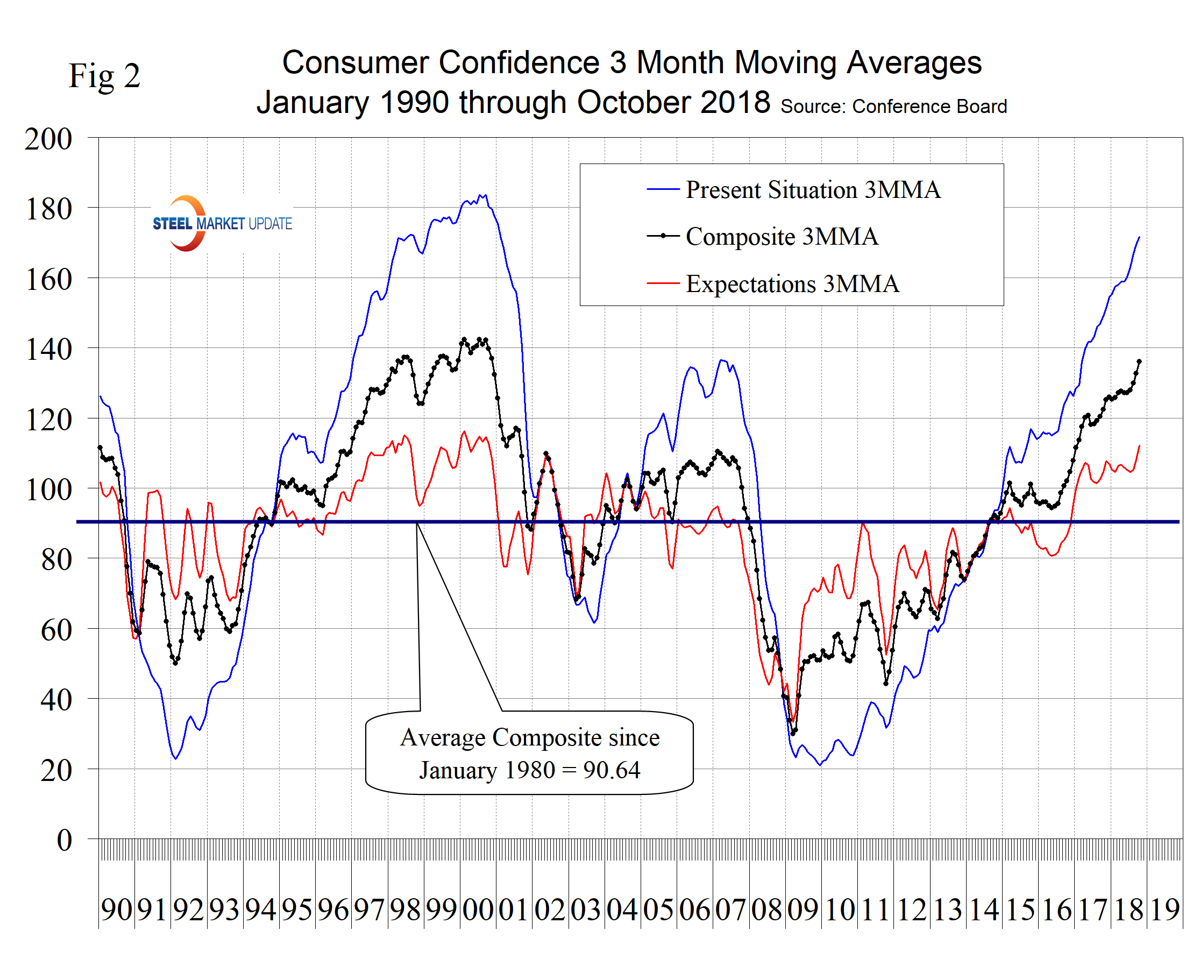

The historical pattern of the 3MMA of the composite, the view of the present situation and expectations since January 1990 are shown in Figure 2.

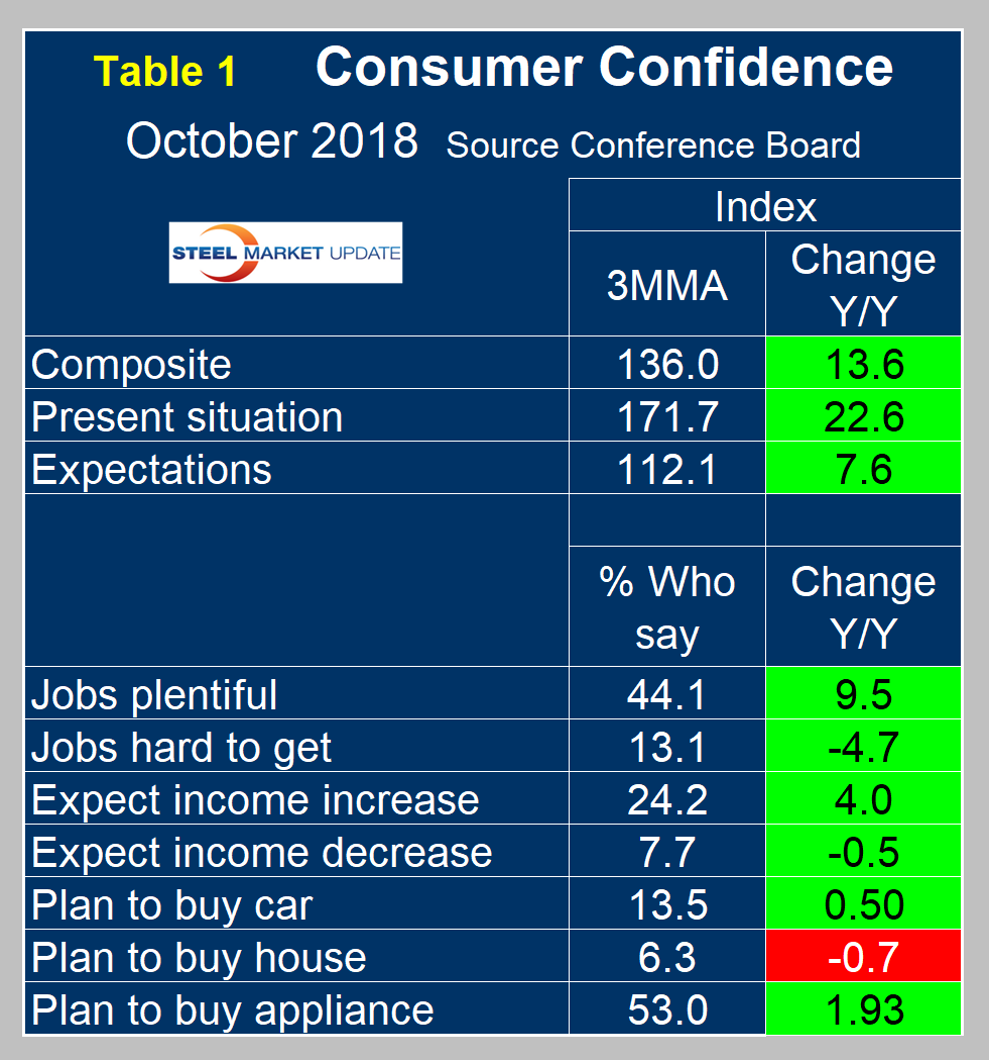

All three measures are higher than they were at the pre-recession peak of 2007. Expectations were relatively constant for over a year until August, but in September and October broke out of that range to the upside. The consumer’s view of the present situation has been surging since December 2010. Comparing October 2018 with October 2017, the 3MMA of the present situation was up by 22.6 and expectations were up by 7.6 points (Table 1).

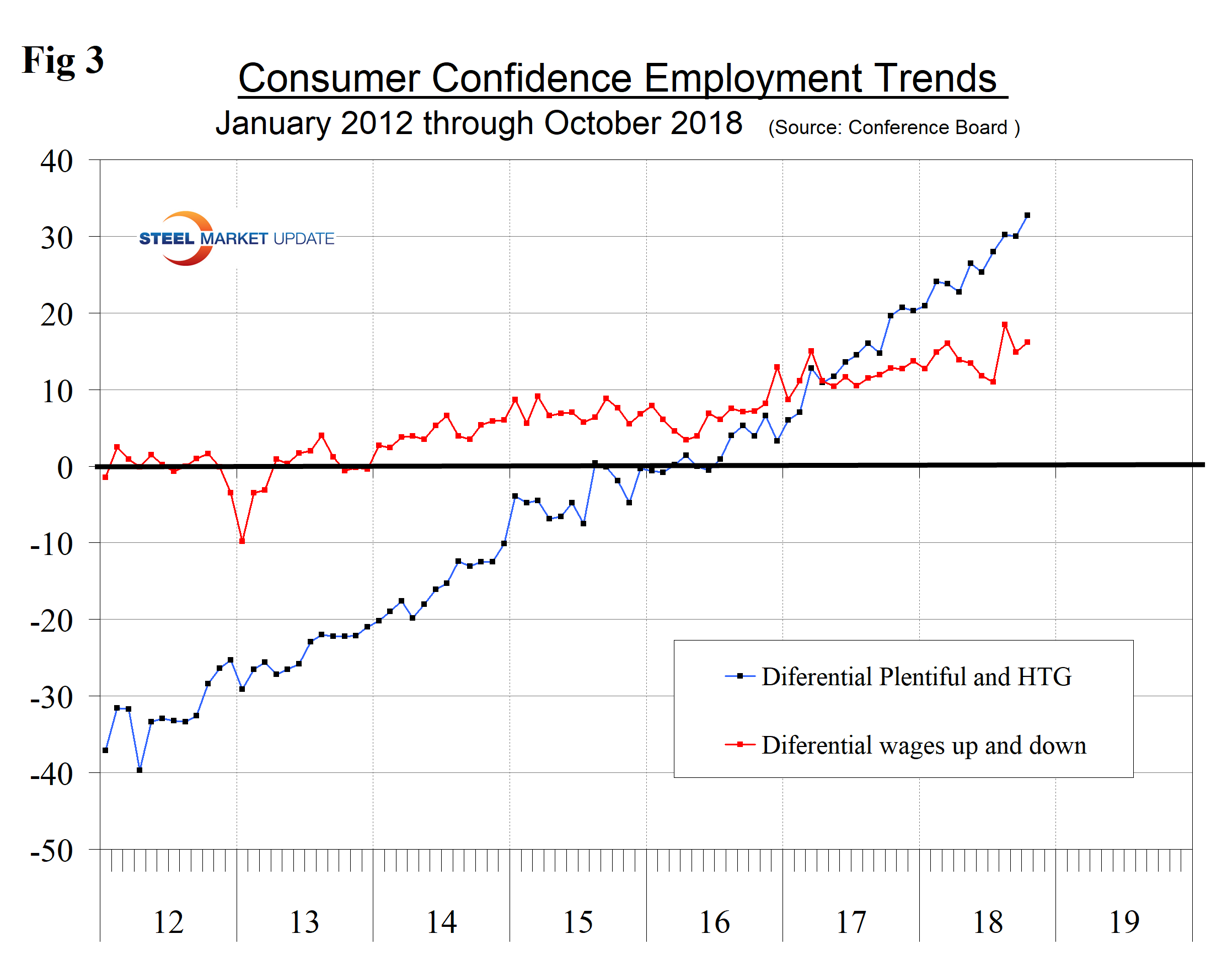

The consumer confidence report includes encouraging data on job availability and wage expectations. It reports on the proportion of people who find that jobs are hard to get and those who believe jobs are plentiful, and it measures those who expect a wage increase or a decrease. Since January 2012, both of the employment components have steadily improved. The difference between the percentage of those finding jobs plentiful and those finding jobs hard to get has improved from a low of negative 40 percent at the beginning of 2012 to positive 32.75 percent in October 2018. The change in those expecting a wage increase has been less striking, but has improved from zero in early 2012 to 16.2 percent in October 2018 (Figure 3).

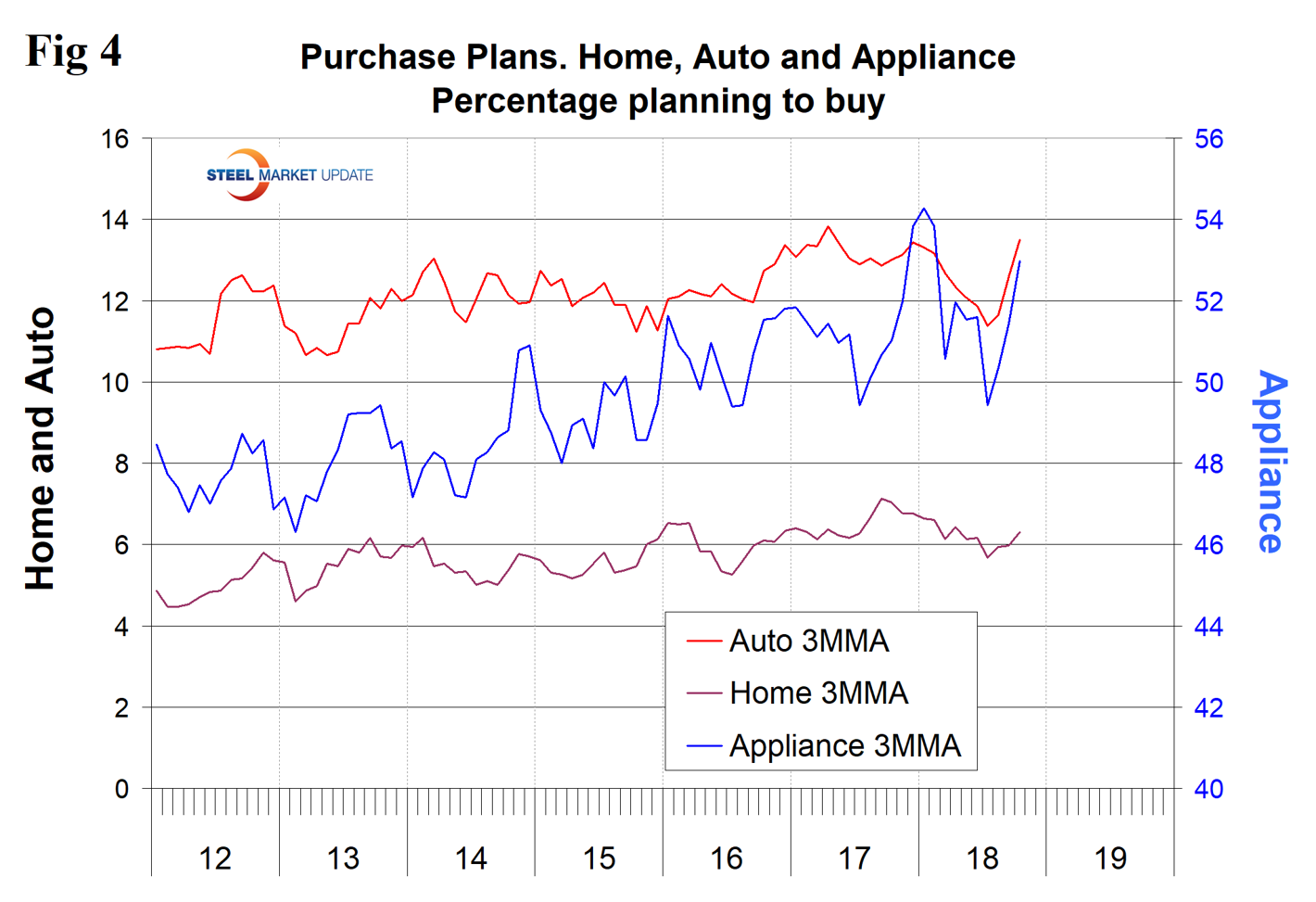

Plans to buy a car had been drifting down for nine months through July this year, but picked back up in the last three months of data. Plans to buy an appliance have been erratic, but there has been an upward trend since our data stream begins in 2012. Plans to buy a home drifted down from last September through July, but also picked back up in the last three months (Figure 4).

SMU Comment: Steel demand is dependent on the growth of GDP, which in turn is strongly influenced by consumer confidence and disposable income. The current consumer confidence report continues to be good in both these respects.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.