Plate

October 23, 2018

Nucor Raises Plate Price by $40 Per Ton

Written by Tim Triplett

The Nucor Plate Group announced today, Oct. 23, that it is raising transaction prices on carbon and alloy plate and heat-treated plate by $40 per ton ($2.00/cwt). The increase takes effect immediately on all new orders promised on or after Jan. 1, 2019. All published extras will be applied. Nucor’s last price hike on plate was a $50 increase announced Feb. 14.

The change in the plate price follows on the increase announced Oct. 10 by Nucor’s Sheet Mill Group raising the price of hot rolled, cold rolled and galvanized products by $40 per ton.

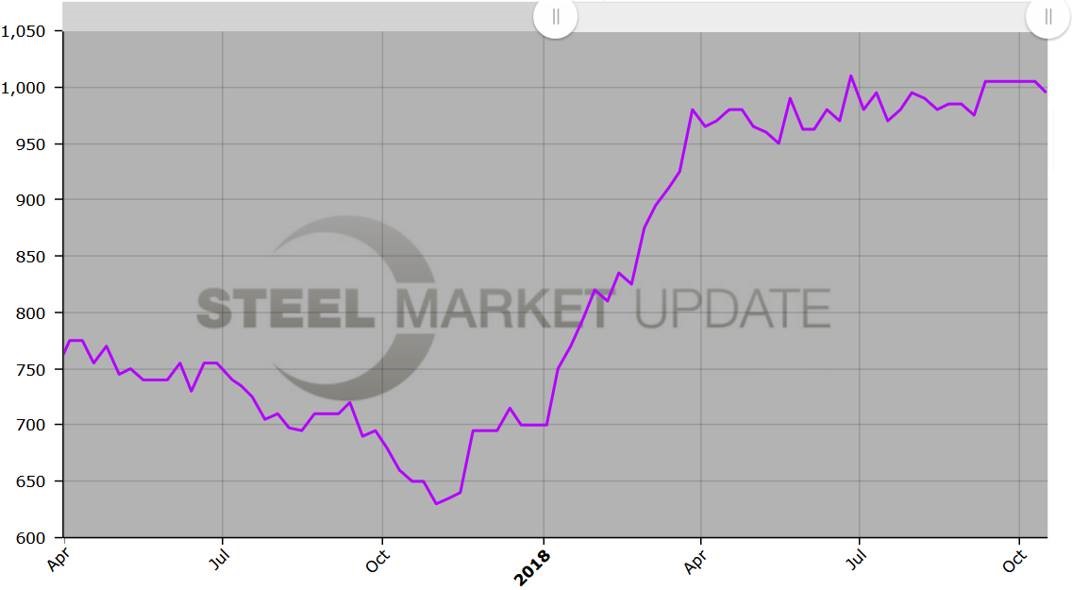

Domestic plate mills have been on controlled order entry for months with lead times extended to 6-10 weeks as demand has outpaced supply. Plate prices have been relatively stable (see chart below), compared to flat rolled prices, which have been on the decline since this summer. However, Steel Market Update data showed plate prices slipping by about $10 last week to an average around $995 per ton.