Market Segment

October 23, 2018

New Proposal from ArcelorMittal to USW

Written by Sandy Williams

The United Steelworkers and ArcelorMittal USA still have not signed a collective bargaining agreement despite the USW coming to terms with U.S. Steel and Cleveland Cliffs. Union members at ArcelorMittal USA have been working under an extended contract since Sept. 1.

The following statement was issued by John Brett, president and CEO, ArcelorMittal USA:

On Friday, Oct. 19, ArcelorMittal USA presented a proposal to the United Steelworkers which includes significant wage increases, a signing bonus, zero increase to healthcare premiums and substantial capital investment. Based on publicly available information, we believe our offer is consistent with the pattern established by other industry participants and the USW.

Our latest proposal includes:

- A four-year contract with annual base wage increases of 4%, 3.5%, 3.5% and 3% each year, respectively

- Lump sum payment of $4,000 following ratification

- NO change to profit sharing

- NO healthcare premiums for active employees and NO premium increases for retirees

- NO increase to deductibles, co-pay or out-of-pocket maximum for active employees or retirees

- More than $1,800 per year in additional contributions to the Steelworkers Pension Trust

- A commitment to the long-term competitiveness of our operations by investing a minimum of $2.3 billion over the life of the contract

For a typical labor grade three employee working 22% overtime (2017 average), this proposal means the employee would earn an additional $14,000 in wages per year by the fourth year of the contract.

We remain focused on securing a contract that protects our customers, operations, people and communities for the long term, not just during current market conditions. We will continue our commitment to negotiating in good faith with the union until we reach an agreement.

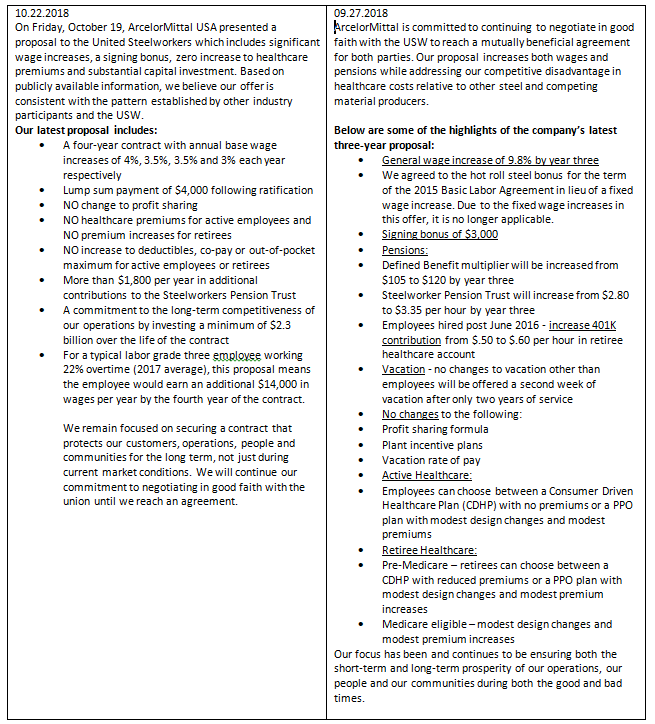

Some of the changes from the last proposal to this one include a total increase in wages over the four-year agreement of 14 percent vs. 9.8 percent in a three-year agreement. Upon ratification, employees would receive a lump sum payment of $4,000 instead of $3,000. The company dropped its demand to raise healthcare premiums for active and retired employees and would make no changes to the profit sharing plan. A side by summary is below:

USW Response

The USW responded on Tuesday with disdain toward the company’s posting, calling it an attempt by ArcelorMittal USA to “appear reasonable and fair.”

“As always, ‘the devil is in the details,’ and of course Brett doesn’t want to talk about them. He also claims the offer meets the industry pattern, but what he really means is that AMUSA’s offer ‘cherry picks’ the industry pattern,” said the USW in its Update #11.

The USW says that the ArcelorMittal summary is “incomplete and misleading” and makes “no mention of the company’s persistent concessionary demands.”

Said the USW in its update, “We have made clear and significant progress toward our goal of negotiating fair contracts with ArcelorMittal – not because of anything management has done – but thanks only to the solidarity of union members at all of the company’s facilities and the hard work and determination of our USW negotiating committee.”