Market Data

October 21, 2018

Troubling Signs for Price Increase Support?

Written by John Packard

Twice per month, Steel Market Update conducts a detailed analysis of the flat rolled and plate steel markets through an online questionnaire. We invite 640 individuals to provide their opinions about the flat rolled and plate markets, what are the driving factors behind pricing, lead times, and mill negotiations, as well as how they feel about their company’s ability to be successful in both the existing (Current) and 3-6 months in the future (Future) markets (Sentiment Index). We cover other issues as we break out the questions by market segment: manufacturing, steel distribution and wholesalers, steel mills, trading companies, as well as support companies. This information is shared with those who participate in the process, along with our Premium Members.

Last week, 45 percent of the participants were manufacturing companies, 42 percent distributors, 6 percent trading companies, 4 percent suppliers to the industry and 3 percent steel mills.

As was mentioned in an article on our SMU Steel Sentiment Index, we are a little concerned with the information that we are gathering regarding how steel buyers and sellers feel about their company’s ability to be successful in the current and future markets. Last week, as a single data point, our Current Sentiment Index was a +59, which is well below the +67 reported two weeks earlier. Our assumption is that the flat rolled price announcements by Nucor and a few other domestic steel mills had a negative impact on Sentiment. The +59 is tied with our early March 2018 results. We will have to wait and see if this is a “one off” as it was back in March when the mid-March results posted a +66. We saw similar results in our Futures Sentiment single data point, which came in at +53, the second lowest reading since the early March 2018 results. As with Current Sentiment, the mid-March Future Sentiment Index reading was up +9 points to +57 after recording the lowest reading of the year at +48.

It should be noted that both the Current and Future Sentiment Indexes are well within the “optimistic” portion of our Index and miles away from March 2009 when we measured our Current Sentiment Index at -85! (Article Continues Below)

{loadposition reserved_message}

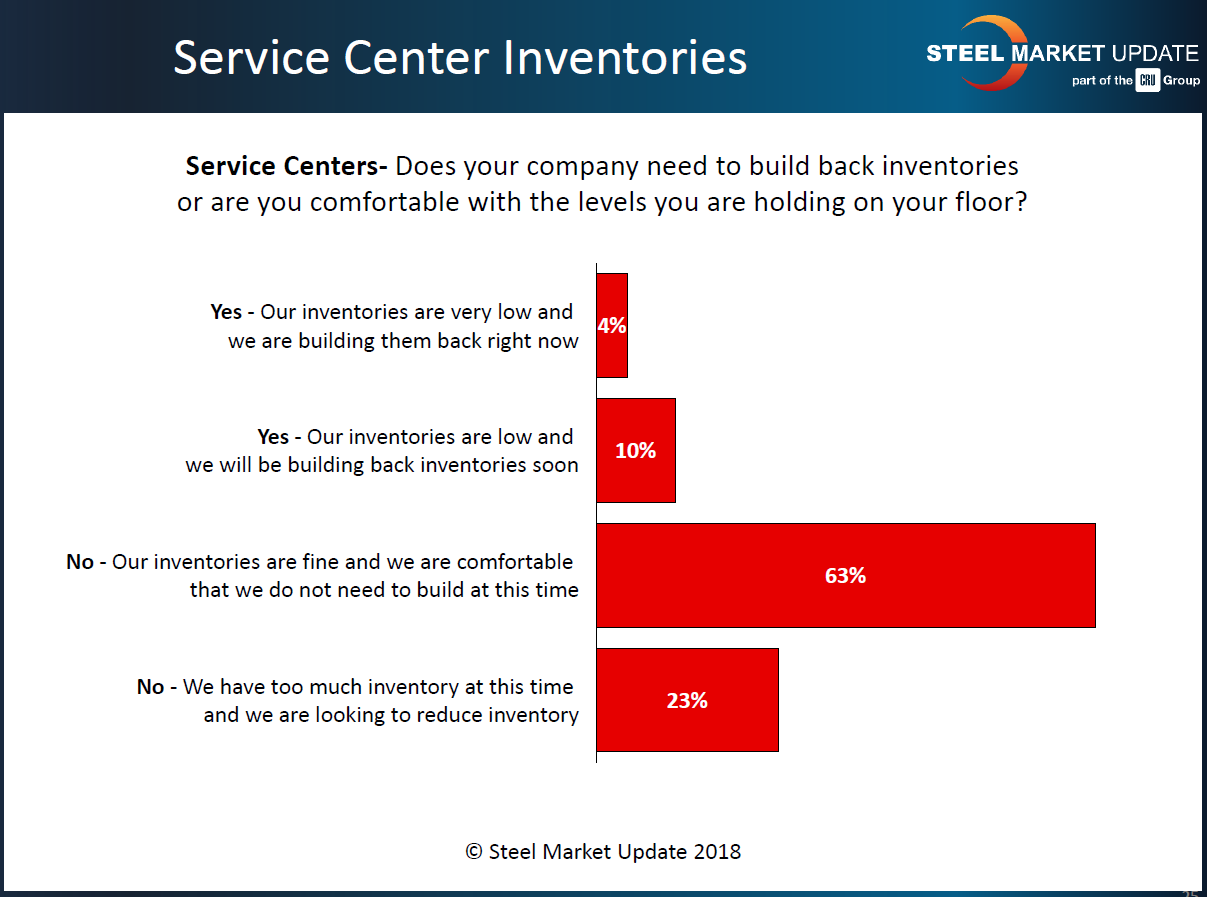

Service Center Inventories

One of the areas SMU watches closely is service center inventories. More specifically, are the distributors needing to build flat rolled steel inventories, are they looking to lower inventories or are their inventories balanced. Last week, the distributors reported: 14 percent had low inventories or would soon need to build back inventories, 23 percent had too much inventory, and the majority, 63 percent, believe their inventories are balanced. In SMU’s opinion, these results are not favorable to supporting a price increase announcement.

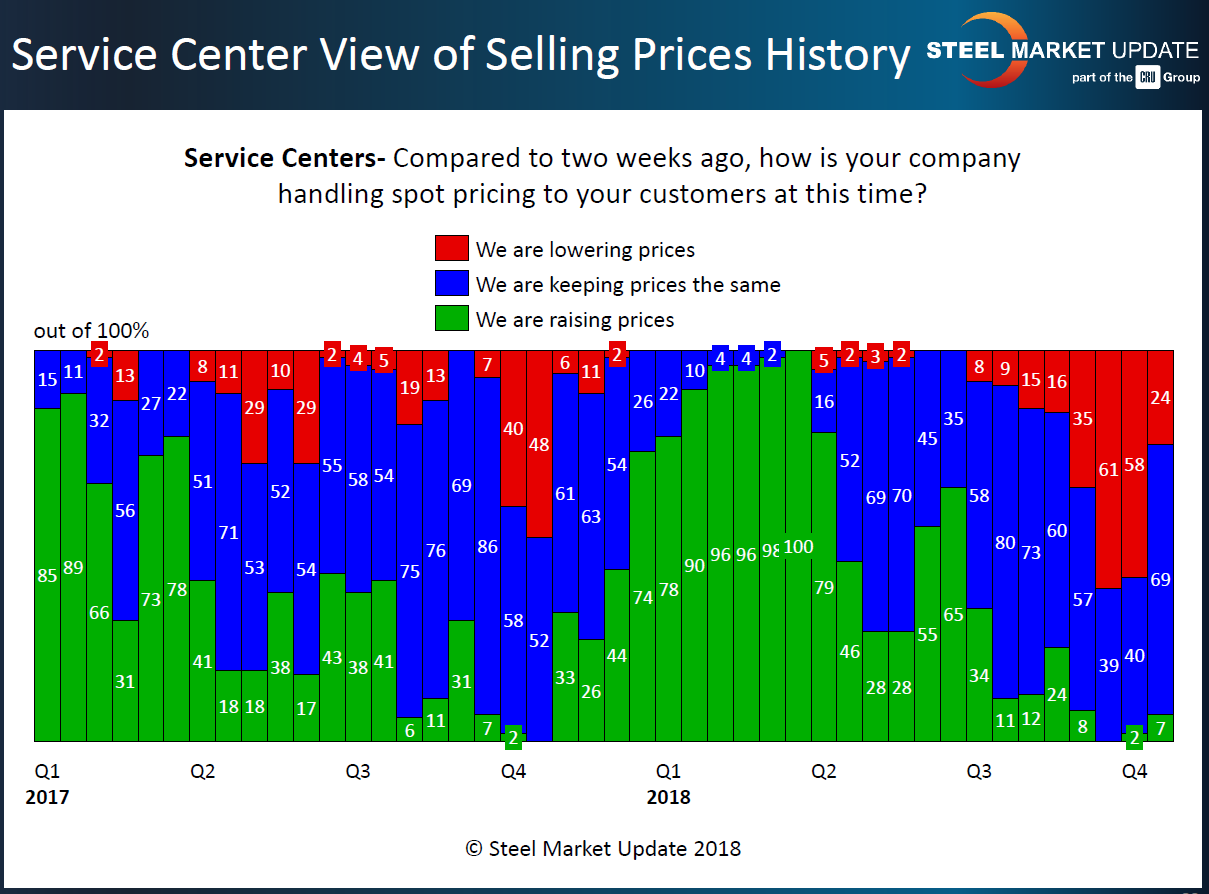

A second leg of the service center inventories stool is how they are handling spot pricing to their manufacturing customers. A few weeks back, SMU thought the service centers were heading to a point of “capitulation,” that point where distributors can no longer tolerate lowering prices to dump inventory, thus squeezing (or eliminating) margins and devaluating inventory values.

We normally consider the point of capitulation to be somewhere close to 75 percent of the service centers reporting their company as lowering spot prices. At the beginning of October, we saw 58 percent reporting that way. Last week, the percentage of distributors reporting their company as lowering prices dropped to 24 percent. However, at the same time, those reporting their company as raising prices (which would be normal in a “supported” mill price increase environment) went from 2 percent to 7 percent. Again, not a good sign for support of the Nucor-led price announcements on flat rolled.