Analysis

October 17, 2018

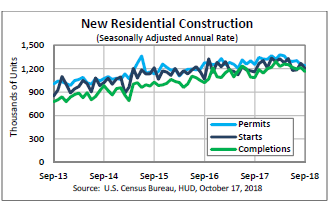

Housing Starts Drop More than Expected in September

Written by Sandy Williams

Housing starts dropped 5.3 percent in September to a seasonally adjusted annual rate of 1,201,000, falling more than expected by economists. Multi-family housing led the decline, falling 12.9 percent, compared to 0.9 percent for single-family homes. Compared to a year ago, starts were 6.4 percent higher, said the Census Bureau and HUD.

“Slight gains off the summer soft patch for single-family mirror a minor uptick of the NAHB/Wells Fargo Housing Market Index, now registering a score of 68,” said chief economist Robert Dietz at the National Association of Home Builders. “While builders are benefitting from recent declines in lumber prices (at least relative to spring and summer’s elevated levels), they continue to report concerns about labor access issues.”

The Northeast saw a 29 percent gain last month followed by an increase of 6.6 percent in the West. Starts fell 14.0 percent and 13.7 percent for the Midwest and South, respectively. The plunge in starts for the South was blamed on Hurricane Florence that swept over the region in mid-September.

Permit authorizations held relatively steady, dipping just 0.6 percent from August to a rate of 1,249,000. Single-family authorizations were up 2.9 percent month-over-month while housing of five or more units slid 9.3 percent.

Permit authorization fell in the Northeast and Midwest as the winter months approach. Authorizations in the West were the strongest at 11.1 percent and were mostly flat in the South at 0.6 percent.