Market Segment

October 16, 2018

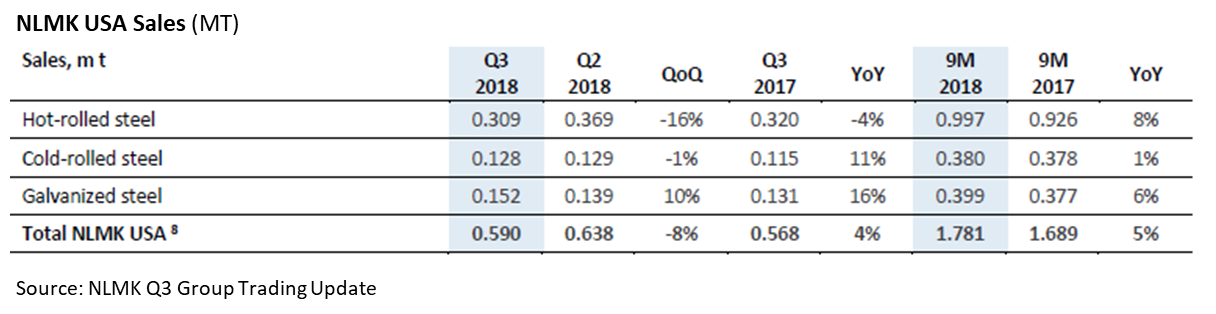

NLMK Group Sales Flat, USA Division Down 8%

Written by Sandy Williams

NLMK USA sales slipped 8.0 percent in the third quarter to 590,000 metric tons as customers waited to see if steel prices would decline after reaching a high in July.

Sales were up 4 percent from third-quarter 2017, driven by a stronger U.S. economy and steel demand. Sales in the first nine months of the year totaled 1.78 million metric tons, an increase of 5 percent year-over-year.

Steel product prices fell 1 percent in the U.S. quarter-over-quarter as a balance between supply and demand was restored, said NLMK.

Steel output at NLMK Indiana totaled 172,000 metric tons in the third quarter compared to 181,000 tons in the second quarter, a 5 percent decrease but a 17 percent increase compared to Q3 2017. For the first nine months of 2018, the Indiana facility produced 517,000 tons of steel, an 8.0 percent increase from the same period in 2017.

NLMK USA includes NLMK Indiana, NLMK Pennsylvania and Sharon Coating.

NLMK Group Results

NLMK Group results were flat for the third quarter with steel output and sales growing only 1 percent to 4.4 million metric tons, each. Sales for the quarter were driven by an increase in long steel sales. Year-over-year sales results grew 4 percent, driven by semi-finished product and long steel sales. Group capacity utilization was near 99 percent for the quarter.