Market Data

October 15, 2018

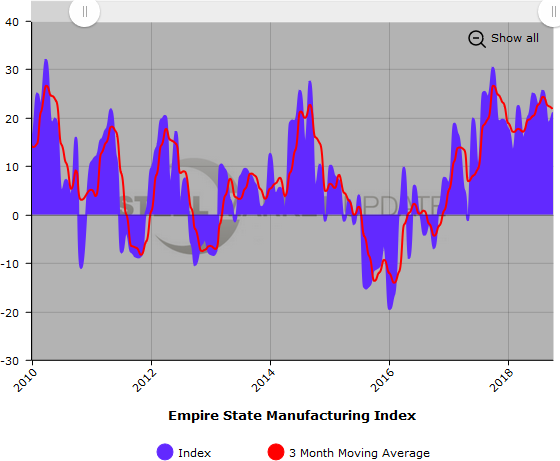

Empire State Manufacturing Shows Strength in October

Written by Sandy Williams

Manufacturing activity in New York State continues to be strong, according to the October 2018 Empire State Manufacturing Survey published by the Federal Reserve Bank of New York.

The general business conditions index rose two points to 21.1 due to a jump in new orders and shipments. The new orders index leapt six points, while the shipment index soared 12 points. Fewer unfilled orders were reported and inventories were steady in October. Delivery times continued to lengthen, said survey participants.

The employee index, while still indicating growth, fell 4.3 points to 9.0 in October and workweek length remained steady.

Prices continued to be elevated, but slowed their upward momentum. The prices paid index fell four points to 42.0, and the prices received index dipped two points to a reading of 14.3.

New York manufacturers reported moderate optimism for business conditions in the next six months. Little change is expected in shipments and new orders. Inventories are expected to decrease.

Manufacturers predict input prices will fall somewhat along with prices received.

The Empire State Manufacturing Index is the first of the regional federal reserve surveys to be released each month. When looked at together, the regional indexes provide insight on the manufacturing business cycle.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.