Government/Policy

October 11, 2018

Retaliatory Tariffs Aimed at Trump Base

Written by Sandy Williams

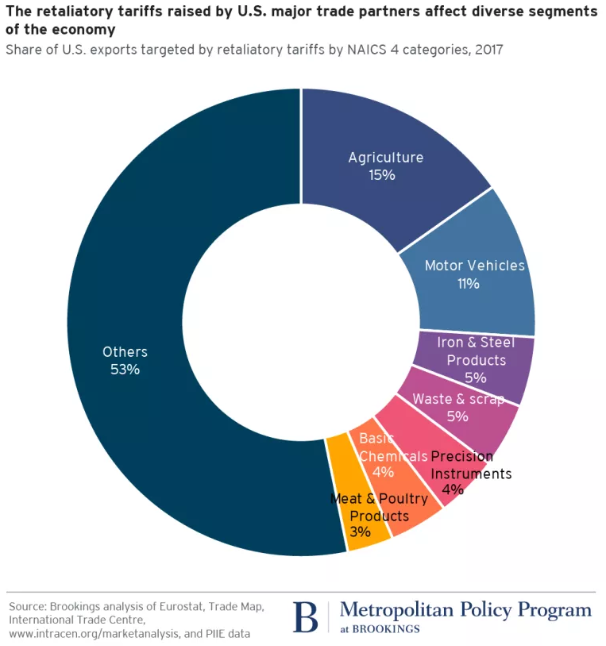

Retaliatory tariffs are taking aim at those sectors that have been the strongest supporters of President Trump. An analysis of data by the Brookings Institution reports that 6.1 percent of U.S. exports, or $121 billion worth of goods, are now subject to tariffs by China, the European Union, Canada and Mexico.

The Trump administration has levied punitive tariffs of about $250 billion on Chinese goods, as well as tariffs on steel and aluminum exports from its North American partners, the EU and others. China has responded with retaliatory tariffs on over $101 billion worth of U.S. goods. Canada has targeted $12.8 billion of U.S. exports, Mexico $3.5 billion and the EU $3.3 billion.

“Trade policy is inextricably linked with politics, and the retaliatory tariffs seem geographically and industrially targeted to mobilize political angst,” said Brookings.

Agricultural regions in the U.S were hit hard by retaliatory tariffs, particularly in regions of high GOP and Trump support. Pork and soybeans in Sen. Charles Grassley’s home state of Iowa were targeted as were cranberries from Rep. Paul Ryan’s constituents in Wisconsin. Whiskey exports were hit with a 25 percent tariff in Sen. Mitch McConnell’s home state Kentucky. After Trump lauded “made in America” Harley Davidson, the EU targeted the iconic motorcycle manufacturer resulting in the company moving some production overseas.

Retaliatory tariffs also impact the metals industries and certain manufacturing sectors. Regions at the top of the list for tariff exposure include Birmingham, Ala., Nashville, Tenn., and Toledo, Ohio.

Brookings found that counties that voted for Trump are exposed to 8.1 percent of the retaliatory tariffs compared to 4.2 percent of exports from industries in counties that voted for Clinton. Rural and small towns, the Trump base, are hit hardest by tariffs.

Brookings also estimates that tariffs will affect about 294,000 direct export jobs and 354,000 jobs that are supported by the export industry. In total, nearly 650,000 jobs will be impacted by the tariffs. Brookings notes that the numbers are not necessarily estimates of anticipated job loss.

“This analysis provides a look at how regions and states are positioned given their distinctive firms and industries, an important starting point that provides greater understanding to subnational leaders of how a significant macroeconomic policy change influences their place,” said the research firm.