Market Segment

October 11, 2018

Nucor Raises Sheet Prices by $40 Per Ton

Written by Tim Triplett

On Wednesday of this week, Nucor’s Sheet Mill Group announced a $40 per ton ($2.00/cwt) price hike on flat rolled steel products produced by the mill. The price hike affects only spot tons and not contract orders, which tend to be tied to a flat rolled steel price index.

In an Oct. 10 letter to customers, Nucor said that base prices on hot rolled, cold rolled and galvanized steel products would all increase by $40 per ton, effective immediately.

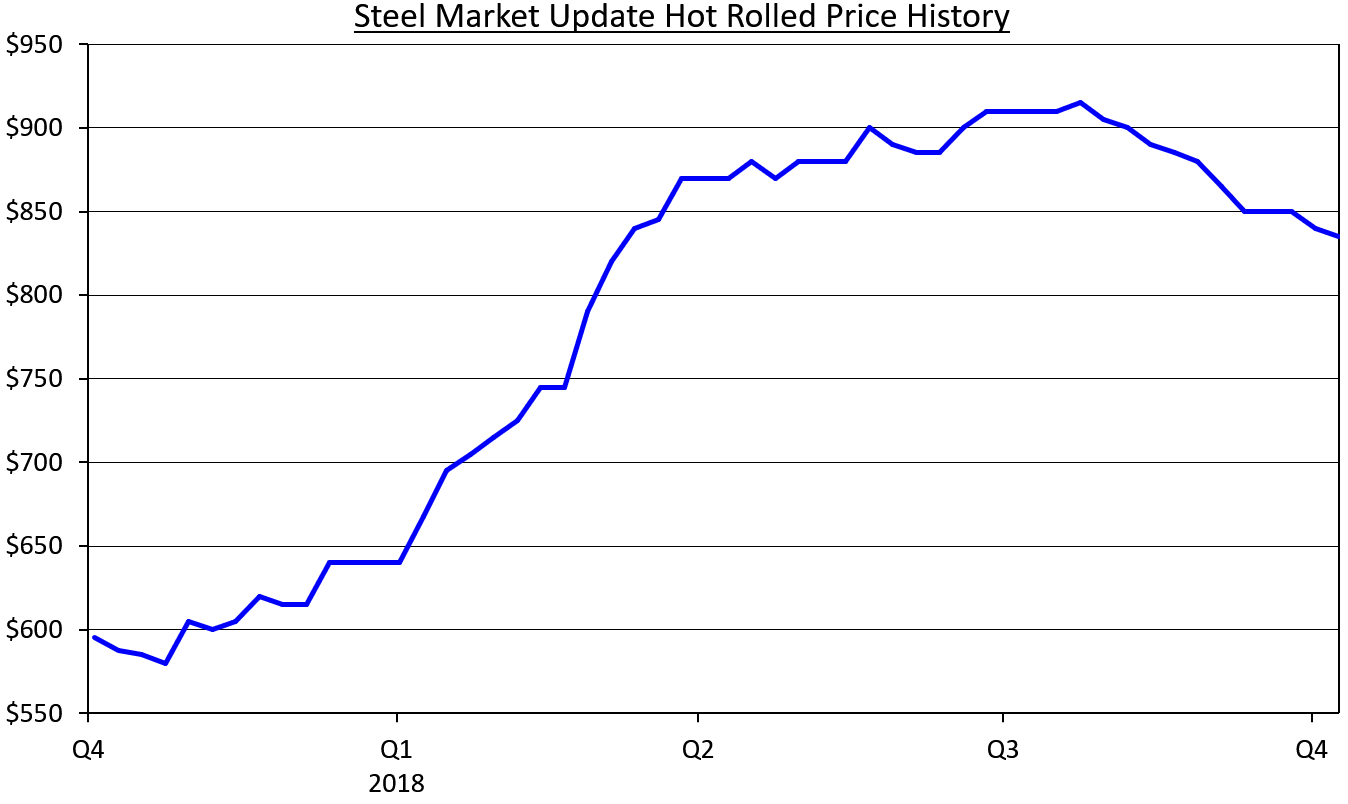

The steel mills have been largely silent on price changes for the past few months. Even though the last price increase announcement publically made was in late January, the domestic mills continued to push prices past the $705 per ton SMU’s index showed when Nucor last announced an increase (Jan 26, 2018).

Over the past couple of months, flat rolled steel prices have been on a downward slide since peaking around $915 per ton in late July. The current HR price is $835 per ton, according to Steel Market Update data.

Other mills may choose to sit and wait to see how the market reacts to the announcement. However, there are some mills that have begun to raise spot offers, reflecting a change in the pricing stance of that mill – even if they have not yet made an announcement.

Steel Market Update has moved its Price Momentum Indicator from Lower to Neutral, which is our policy when a price announcement has been made. We will continue to watch the markets carefully to see if prices begin to move higher (or not) and we will adjust our indicator once we have a better feel for the trend.