Product

October 7, 2018

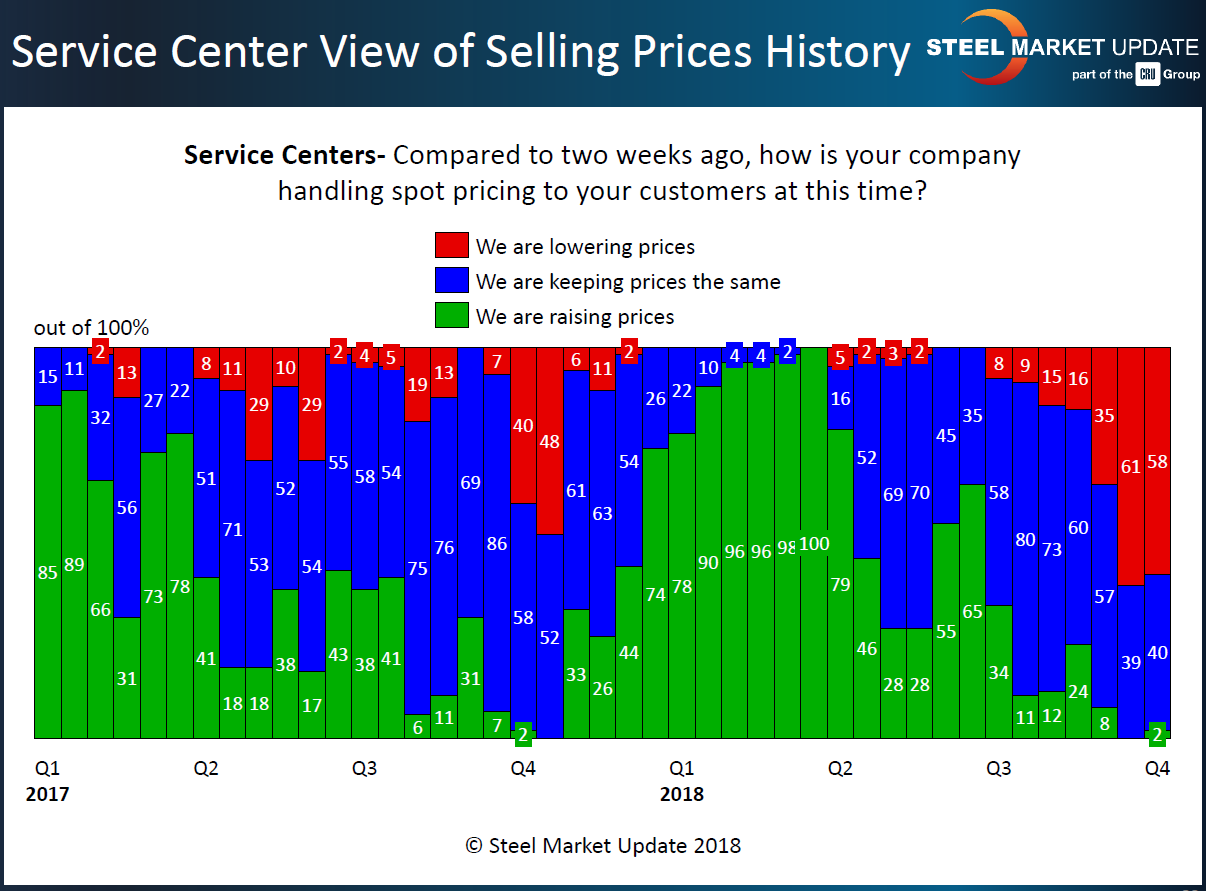

Service Center Spot Pricing Sees Split Between Manufacturers & Distributors

Written by John Packard

We had a bit of a split regarding service center spot prices in the analysis we did of the flat rolled steel markets last week. Manufacturing companies overwhelmingly reported their steel service center suppliers as dropping flat rolled steel spot prices compared to what they were seeing just a couple of weeks ago. On the other hand, the steel distributors themselves reported spot price action as essentially unchanged from our previous analysis which, was done during the middle of September.

Why is this important? Steel Market Update has been tracking the movement of service center spot prices for many years. Over time, we were able to provide a correlation between the movement of distributor spot pricing and support for price increases out of the domestic steel mills. We found as service centers became more active in selling off inventories at lower prices than what was being done in previous weeks, there comes a point at which distributors are supportive of a change in price direction. This is normally accomplished through the introduction of price increase announcements out of the domestic steel mills.

In the past, we have suggested the point of “capitulation” by the service centers is 75 percent. What that means is 75 percent of the service centers responding to our flat rolled steel market trends questionnaire are reporting their company as lowering spot prices to their customers. We measure this against the manufacturing companies to see if they too are reporting the service centers as lowering spot prices compared to what they were seeing the last time we conducted our analysis (which is done twice per month).

Our analysis found 88 percent of the manufacturing companies reporting lower spot prices on flat rolled out of their service center providers. This is a significant jump from the 63 percent who reported spot prices as falling during the middle of September.

The service centers, however, were not in agreement with their manufacturing customers as only 58 percent reported spot prices as dropping compared to mid-September. At that time, we found 61 percent reporting lower spot pricing. Up until last week the manufacturing companies and service centers were reporting very similar results and have been for the past five months. Steel Market Update cannot explain the deviation between the two market segments, but we will be looking at this over the course of this week to see what we can find out.

{loadposition reserved_message}

As it stands right now, if the service center data is to be believed, we are still a little way away from capitulation. We will be watching the mid-October questionnaire closely to see if the manufacturers and distributors get back in step with one another.