Market Data

September 30, 2018

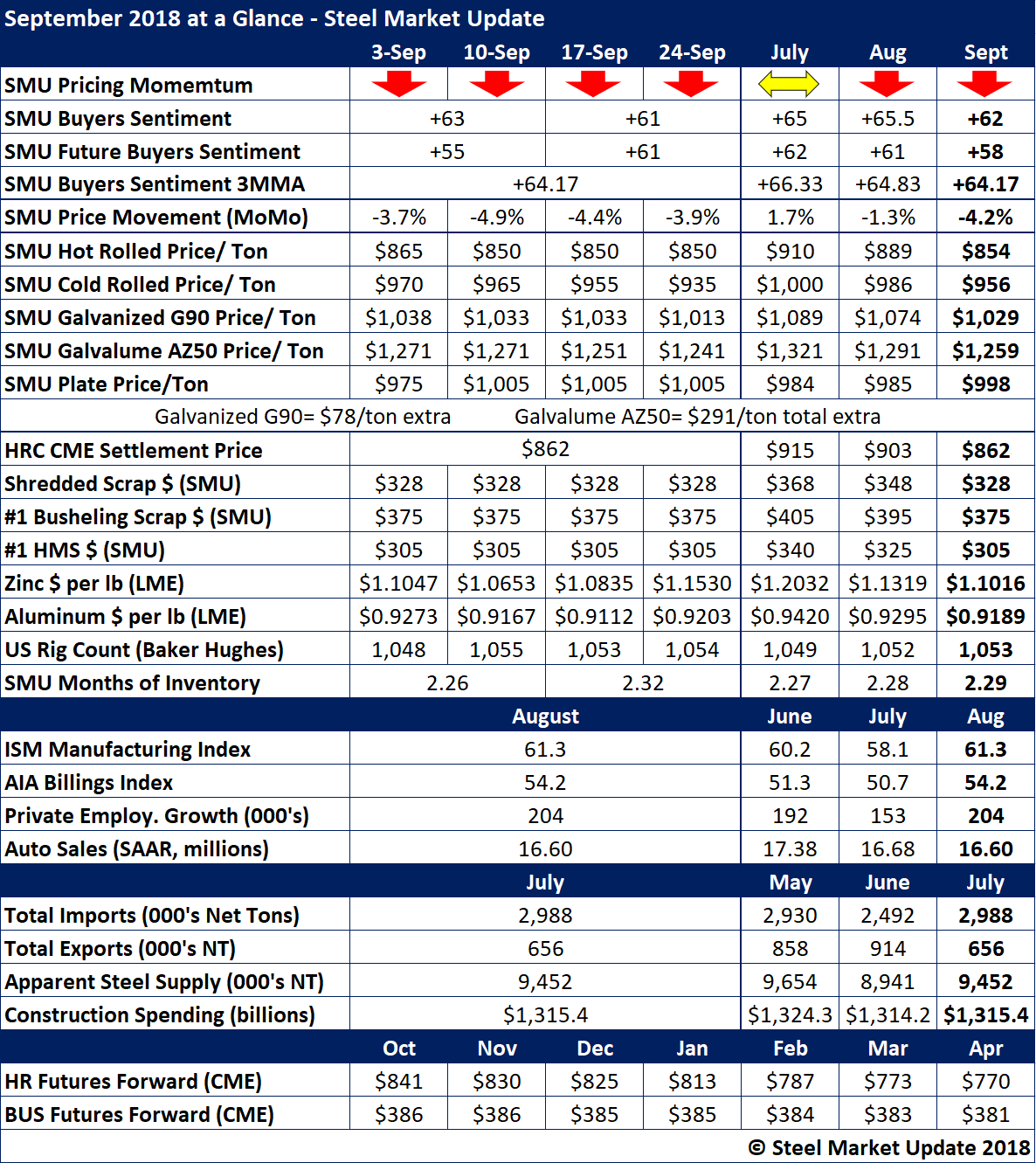

September at a Glance

Written by John Packard

The month of September saw steel prices continue a steady decline that began in August. Steel Market Update data in the table below shows the benchmark hot rolled price slid from more than $900 per ton in the summer to the current price around $854. The same for cold rolled, which went from $1,000 a ton to about $956. The price of zinc has declined to $1.10 per pound, prompting the mills to lower their coating extras and the price of galvanized products. Ferrous scrap prices also have declined by about $40 per ton over the past three months, adding downward pressure on finished steel prices. SMU’s Price Momentum Indicator remains at Lower, meaning prices are expected to continue dropping for the next 30 days.

SMU’s Buyers Sentiment Index remains at optimistic levels, though Future Sentiment has shown a slight erosion as contentious trade negotiations between the United States and its foreign trading partners make the future uncertain.

The table also offers a snapshot of economic conditions in the U.S. In the energy sector, oil and gas prices have risen and the rig count continues to inch up, bringing with it demand for oil country tubular goods and line pipe. ISM’s Manufacturing Index, a survey of corporate purchasing managers, has been near or above 60 for the past few months, well above the 50 percent level that indicates growth in the U.S. economy. Healthy spending and architectural billings point to favorable conditions in the construction sector. Auto sales have declined from more than 17 million to around 16.6 million vehicles on an annualized basis, but continue at historically high levels.