Market Data

September 29, 2018

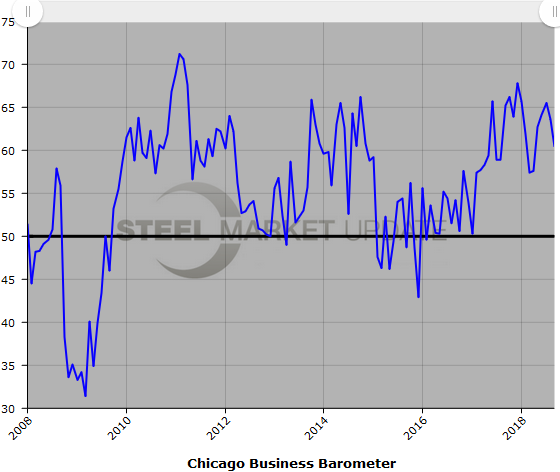

Chicago Business Barometer Drops in September

Written by Sandy Williams

The Chicago Business Barometer dropped to a five-month low in September, sliding down 3.2 points to 60.4.

Production and new orders continued solid growth in September, but softened to a six-month low for production and a five-month low for orders. Output and weaker demand was noted by some firms, although many continue to outperform their own forecasts, said MNI Indicators.

Backlogs rose again as firms struggled to keep up with demand. Allocation issues and employment shortages exacerbated the problem.

“There was evidence that Hurricane Florence impacted operations, specifically trucking routes, while the wider effects of import tariffs and material shortages continued to rumble on in the background,” said MNI Indicators.

Inventories grew as companies stockpiled input materials to hedge against shortages and future demand. Employment opportunities were available, but workers were hard to find.

Input prices were at a 20-year high on both a monthly and calendar quarter basis, said the report. Tariffs combined with material shortages pushed prices higher for firms.

“Supply-side frustrations continue to hamper firms’ production lines and the majority of firms expect delivery times to lengthen further, anticipating ongoing trade disruptions to continue weighing on their suppliers” said Jamie Satchi, economist at MNI Indicators.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.