Prices

September 27, 2018

HRC Curve: Roll it Away?

Written by Gaurav Chhibbar

Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this new role, he and his firm design and execute risk management strategy for clients along with providing process and analytical support.

In Gaurav’s previous role, he was a Trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. He can be reached at Gaurav@MetalEdgePartners.com for queries/comments/questions.

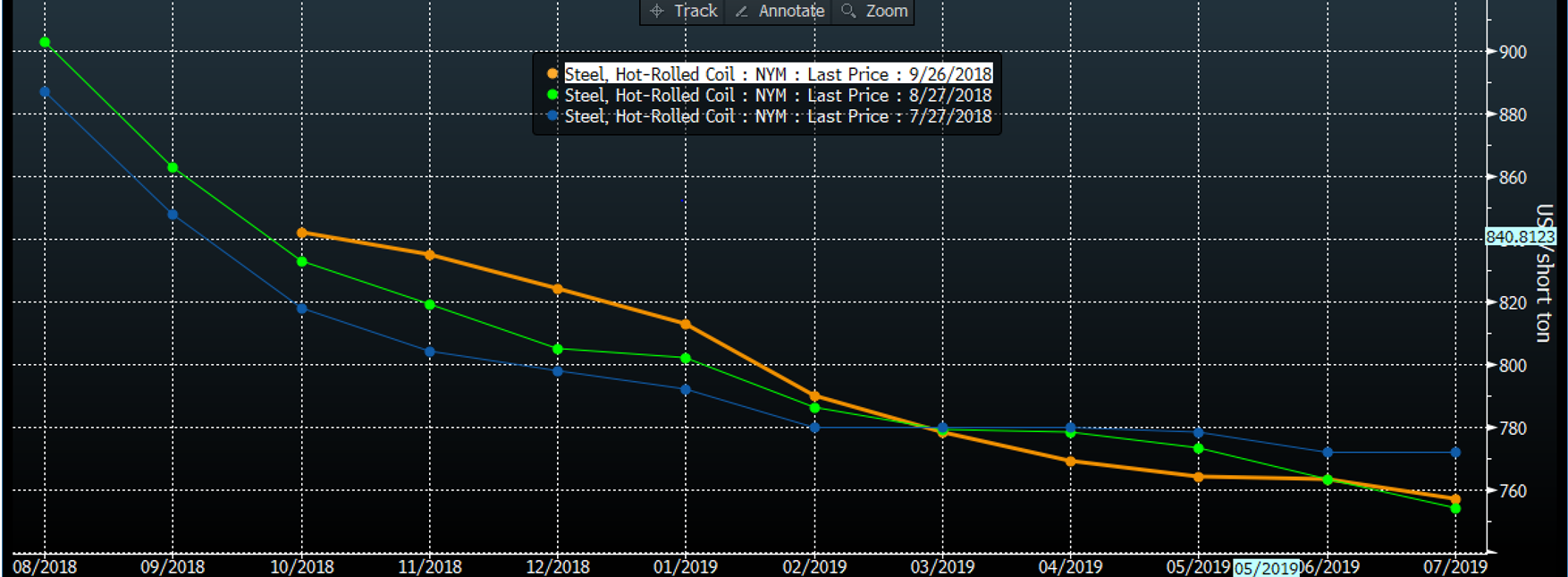

The Hot Rolled Steel price indices have moved lower in the past few weeks. The lower trending index in the past weeks has not seen the HRC futures market react wildly. To a great extent, the futures were already pricing-in the decline in physical steel transaction prices. Month over month, the nearby month is a touch higher (the orange line vs. the green line). Interestingly, the back end of the curve (Mar ’19 onwards) has seen the contracts on those months trade lower. One possible explanation of this may be the market participants either getting more bearish on the market longer term, or spreaders betting that the spread between Q4 and months in Cal 19 will expand further.

In addition, the steep backwardation in the market doesn’t allow much room for importers to hedge their inbound steel, leaving the curve looking rather attractive for those interested to buy.

On the international front, the markets have been more active. Recent news around Chinese government tackling shadow banking structures sent rebar (white line in the chart below) lower as market players questioned the ability of real estate markets to operate in conventional and mainstream borrowing space. Despite the correction, rebar prices remain at elevated levels and within 300 rmb of 12-month highs.

Jury is out on what the ore prices into China will do over the next few days. Although traders seemed satified post clarifications on ‘Clear Skies’ policy not being weaker year over year, the latest question marks over borrowing practices may deflate some of the positive sentiment that was building around high-grade ore.

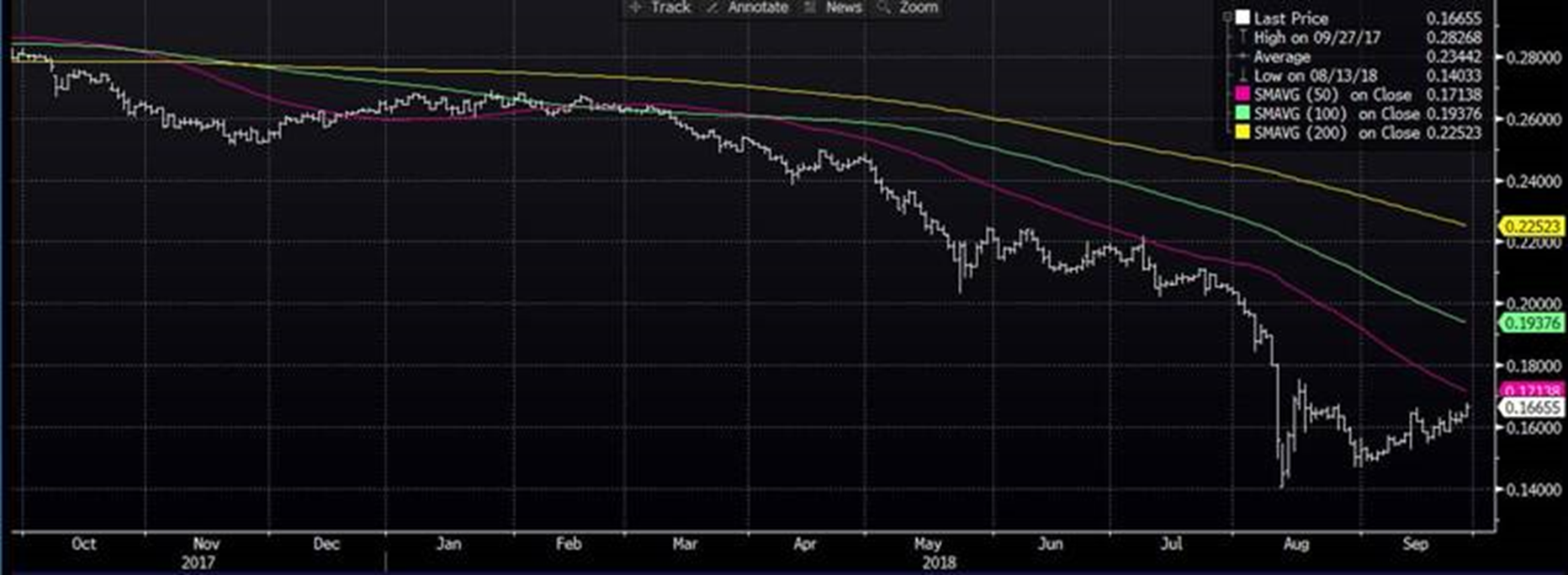

The Chinese mills, having seen margins (white line below) come under pressure in the past few days due to the stubbornness of ore will likely see more pain as rebar retreats. The key to watch out for U.S.-based businesses is how, if at all, Chinese market movements end up impacting demand for steel products in China. A weaker domestic market in China may incentivize exports and lower global prices, which may further widen the gap between U.S. and global steel prices.

On the currency front, the TRY USD pair is an interesting one to watch. The pair has found some support with a push from the Turkish government to jack up interest rates. The support to the Turkish lira has been a sigh of relief to the importers such as those buying scrap to bring them back in the market and try to secure deep sea parcels from U.S. East Coast.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should it be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.