Market Data

September 26, 2018

Durable Goods Soar on Aircraft/Defense Orders in August

Written by Sandy Williams

Aircraft and defense drove a 4.5 percent increase in new orders for durable goods in August, exceeding economists’ expectations. Aircraft orders jumped 69.1 percent and defense orders surged 44.4 percent last month. Orders for autos and parts, however, fell 1.0 percent. When removing transportation from the mix, orders rose a much softer 0.1 percent.

Core capital goods, manufactured goods excluding defense and aircraft, fell 0.5 percent from July. Due to high business confidence supported by recent tax cuts, the dip in core capital goods is expected to be temporary. So far, the trade war with China has had little impact on the economy, but further escalation could affect confidence and spending by both consumers and businesses, said economists.

The August advance report on manufacturers’ shipments, inventories and orders follows:

New Orders

New orders for manufactured durable goods in August increased $11.1 billion or 4.5 percent to $259.6 billion, the U.S. Census Bureau announced. This increase, up two of the last three months, followed a 1.2 percent July decrease. Excluding transportation, new orders increased 0.1 percent. Excluding defense, new orders increased 2.6 percent. Transportation equipment, also up two of the last three months, led the increase by $10.9 billion or 13.0 percent to $95.3 billion.

Shipments

Shipments of manufactured durable goods in August, up three of the last four months, increased $1.9 billion or 0.8 percent to $253.1 billion. This followed a 0.1 percent July decrease. Transportation equipment, up two of the last three months, led the increase by $1.6 billion or 1.9 percent to $86.0 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in August, up nine of the last 10 months, increased by $10.4 billion or 0.9 percent to $1,176.5 billion. This followed a 0.1 percent July increase. Transportation equipment, up six of the last seven months, led the increase by $9.3 billion or 1.2 percent to $811.0 billion.

Inventories

Inventories of manufactured durable goods in August, down following 19 consecutive monthly increases, decreased $1.4 billion or 0.4 percent to $407.0 billion. This followed a 1.2 percent July increase. Transportation equipment, down two of the last three months, drove the decrease by $1.8 billion or 1.4 percent to $129.3 billion.

Capital Goods

Nondefense new orders for capital goods in August increased $5.7 billion or 7.6 percent to $81.3 billion. Shipments increased $2.2 billion or 3.0 percent to $77.3 billion. Unfilled orders increased $3.9 billion or 0.5 percent to $718.6 billion. Inventories decreased $1.3 billion or 0.8 percent to $177.4 billion. Defense new orders for capital goods in August increased $4.9 billion or 44.4 percent to $16.0 billion. Shipments increased $0.1 billion or 1.2 percent to $11.6 billion. Unfilled orders increased $4.4 billion or 3.0 percent to $151.5 billion. Inventories decreased $0.2 billion or 0.8 percent to $22.6 billion.

Revised July Data

Revised seasonally adjusted July figures for all manufacturing industries were: new orders, $499.1 billion (revised from $497.8 billion); shipments, $501.8 billion (revised from $501.7 billion); unfilled orders, $1,166.1 billion (revised from $1,164.9 billion) and total inventories, $675.7 billion (revised from $675.8 billion).

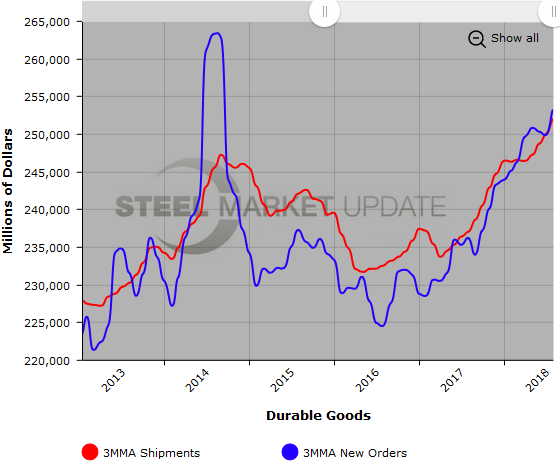

Below is a graph showing the history of durable goods shipments and new orders. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.