Prices

September 25, 2018

Service Center Spot Pricing: Is Capitulation Close?

Written by John Packard

The percentage of manufacturing companies and service centers reporting distributor spot prices as weakening is nearing the SMU level of capitulation. Capitulation is the point at which steel distributors are panicking and dumping what is perceived as high-priced steel into the spot market at ever lower prices. The process feeds on itself and the distributors begin to hope for a change in market direction, which usually comes in the form of a domestic mill price increase. In the past, Steel Market Update has identified the point of capitulation to be when approximately 75 percent of the distributors report declining spot prices in our SMU Flat Rolled and Plate Steel Market Trends Analysis. We conducted our most recent analysis last week.

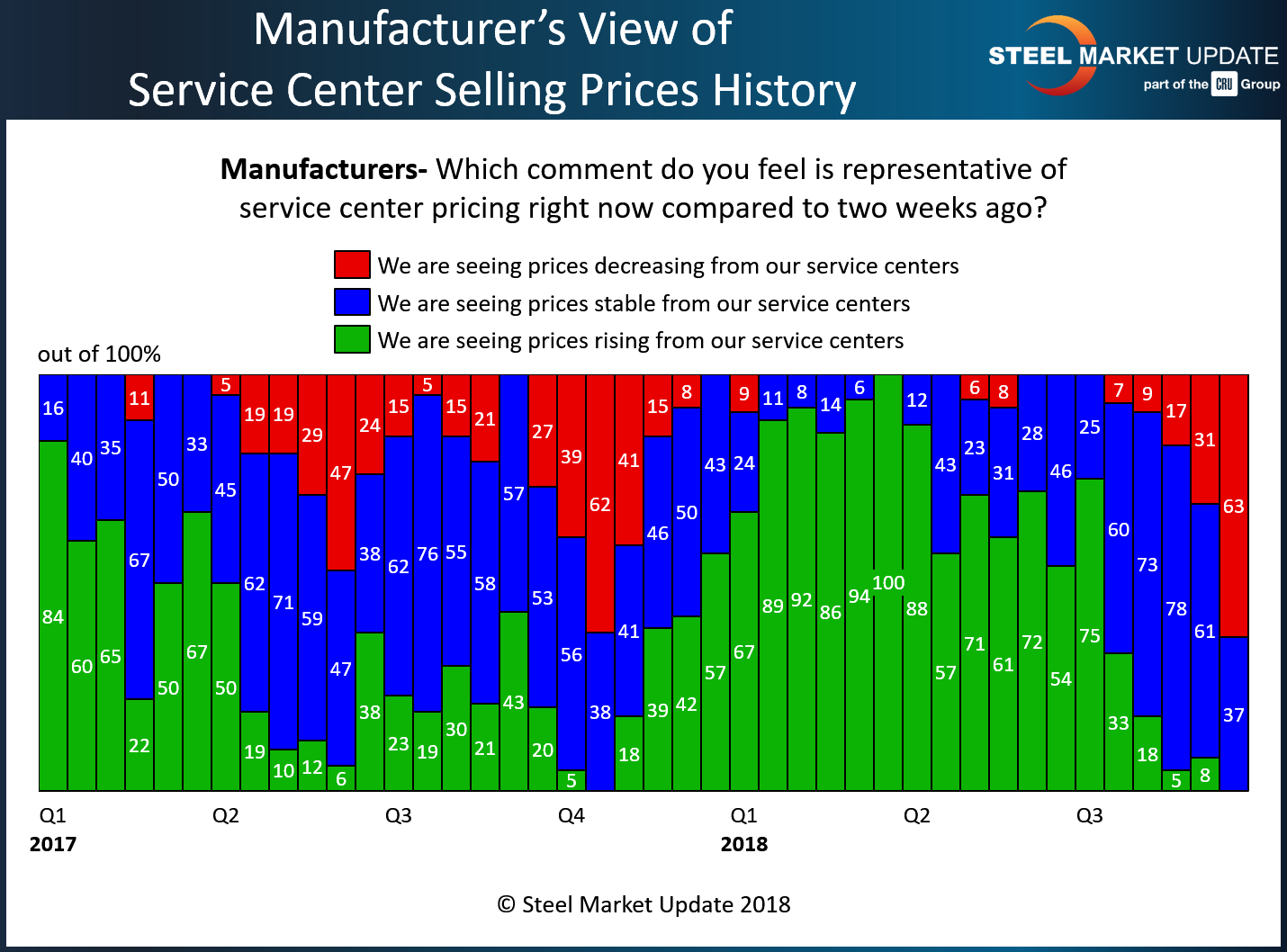

Sixty-three percent of the manufacturing respondents reported service center spot prices as declining. This is twice the percentage SMU collected at the beginning of September. The change in spot price direction has been quick and sharp as seen in the graphic below. At the beginning of July 2018, 75 percent of the manufacturing companies responding to our survey reported distributor spot prices as rising, not falling.

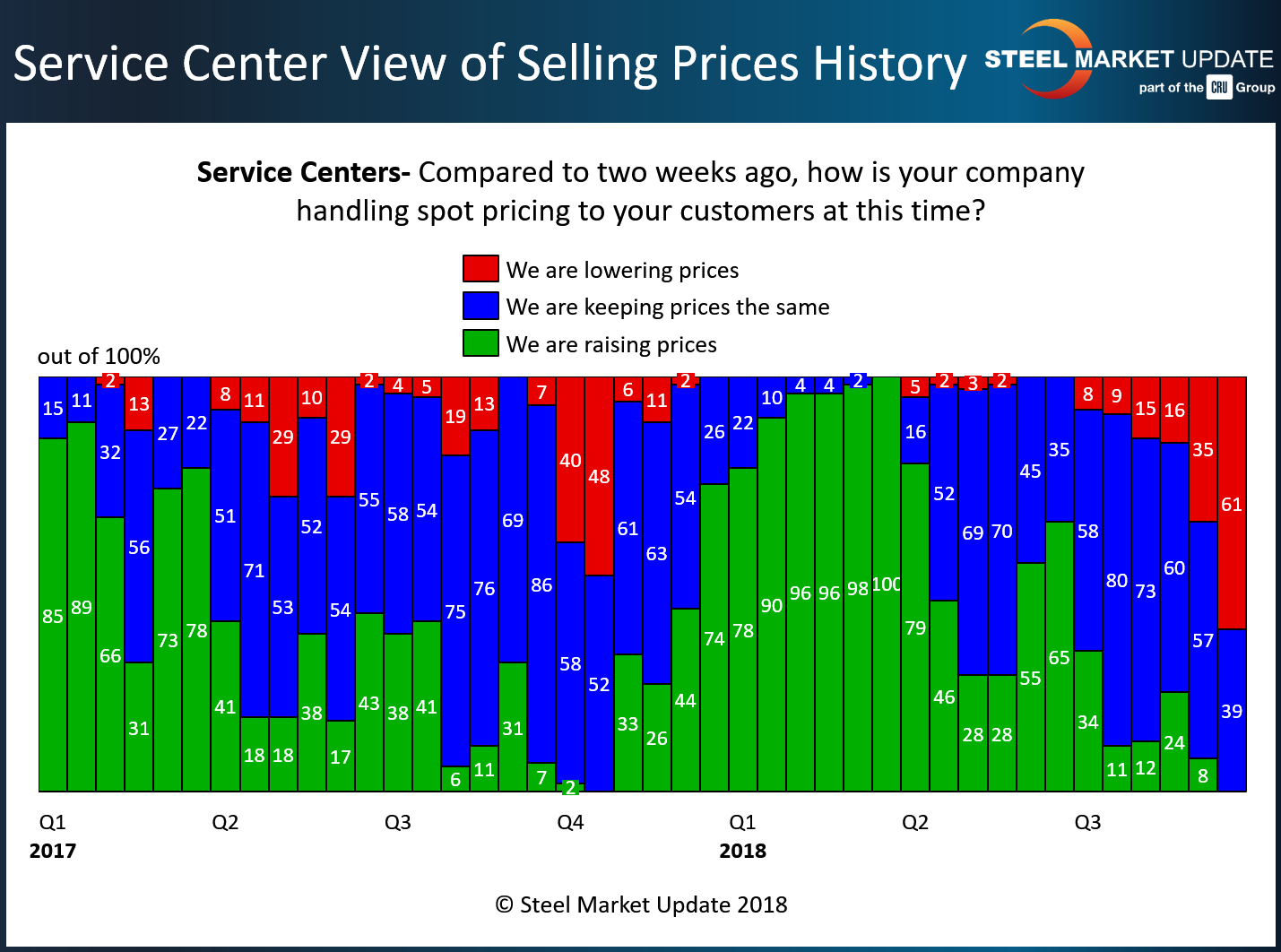

Service centers are in agreement with their manufacturing customers with 61 percent of the responding distributors reporting their company as dropping spot prices. At the beginning of September, only 35 percent of the steel distributors were reporting spot prices as dropping, while at the beginning of July 65 percent of the distributors reported spot prices as rising.

With Section 232 in place, SMU is not quite sure whether our view on capitulation will hold and that we will see mill price increases potentially in the very near future as we approach that critical point.

Benchmark hot rolled steel prices have come down almost $100 per ton since their peak. Lead times continue to be modest, and our survey is reporting steel mills as being willing to negotiate spot prices on all flat rolled products (not yet on plate).

What we have seen in the recent past is for the plate mills to lead the way since they continue to be on controlled order entry. Plate mills have not seen the same erosion in pricing as has been happening on the flat rolled front. The plate mills may be content to ride the wave they are on and leave good enough alone.

On the flat rolled side, as lead times start to move through December and into January, that is when we would expect the mills to make a move. Most likely the first move could come from an automotive mill that doesn’t carry much spot business (like an AK Steel).

The question the mills have to ask themselves is how wide a spread do they want between their prices and that of foreign? Second, are they able to make a suitable return with hot rolled above $750 per ton?