Product

September 21, 2018

SMU Market Trends: Demand, Prices, Inventories All Down

Written by Tim Triplett

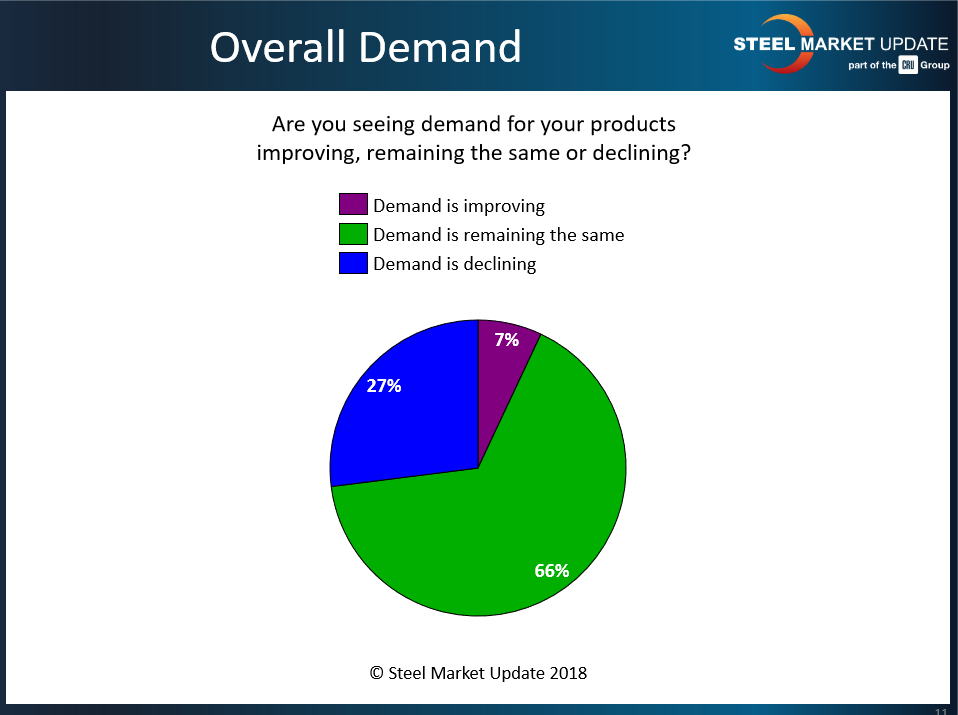

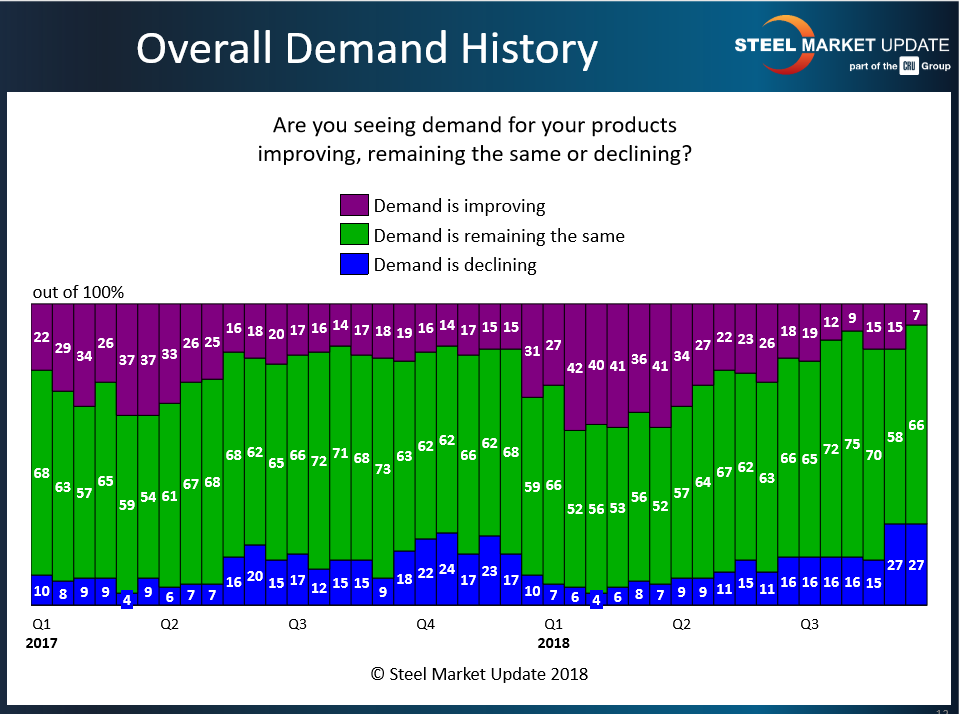

Steel demand appears to be softening. Last week’s Steel Market Update’s Flat Rolled Market Trends questionnaire shows that far more buyers see declining than improving demand. While two out of three respondents report that demand is remaining steady, a significant and growing percentage (27 percent) say demand is declining. Only 7 percent report improving steel demand.

Following are some respondents’ comments:

• “Demand is sketchy.”

• “September is starting off slower than expected.”

• “The bottom hasn’t dropped out by any means, but the HVAC market is slowing.”

• “As prices decline, people are less inclined to buy forward, as they do not know how low the domestic price can fall.”

• “Normal cool-weather slowdowns, coupled with customers waiting to see lower prices, are leading to reduced shipping volumes.”

• “Inquiries are less now as customers are pulling back on ordering futures.”

• “October will be good, November less so, and December is always slower.”

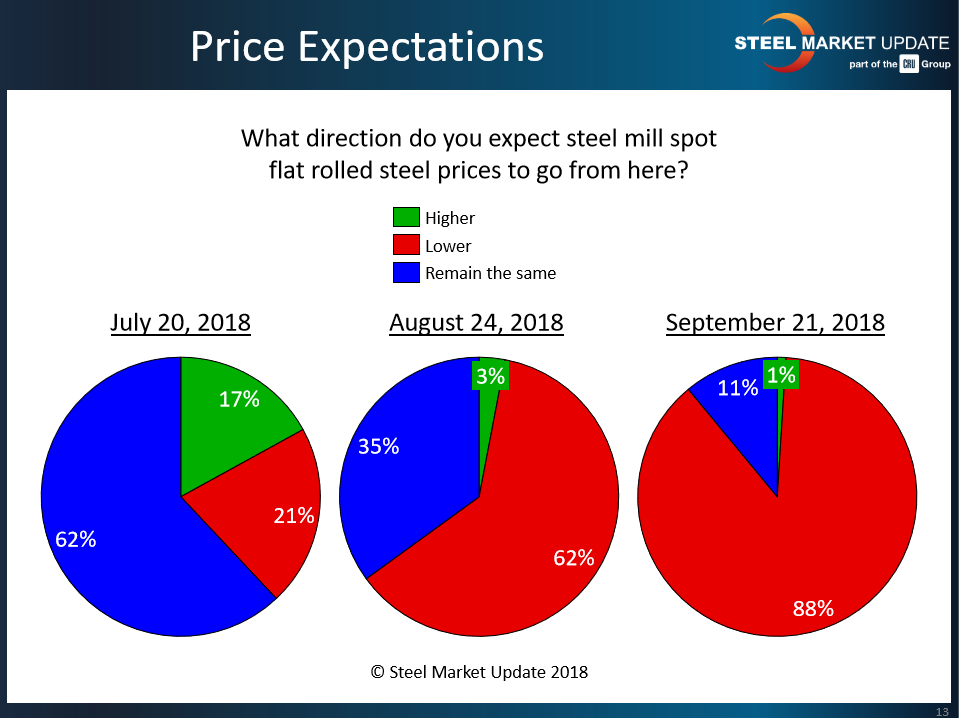

Steel Prices to Keep Falling?

Steel prices have been on the decline and are widely expected to continue falling, at least for the short term. About 88 percent of respondents to last week’s Steel Market Update flat rolled market questionnaire expect spot steel prices to move lower, while virtually all the rest expect prices to remain the same. Almost no one expects prices to rise under current market conditions.

“Prices are moving lower but will bottom out later this year,” commented one respondent. “Prices will be lower in last quarter of ’18, higher in first quarter of ’19,” said a second. “Another month down, then slowly rising again to the $865 per ton area,” predicted a third.

Of course, no one can be certain of the steel price a month from now. As another respondent observed: “Always subject to multiple caveats; a strike at U.S. Steel would be a game changer if it happens.”

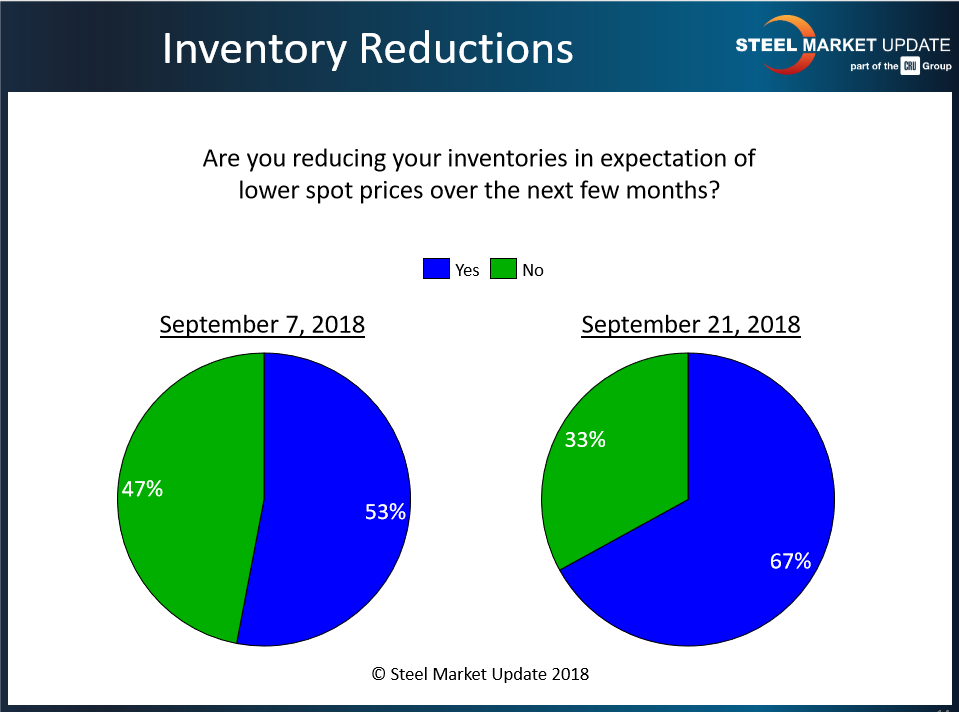

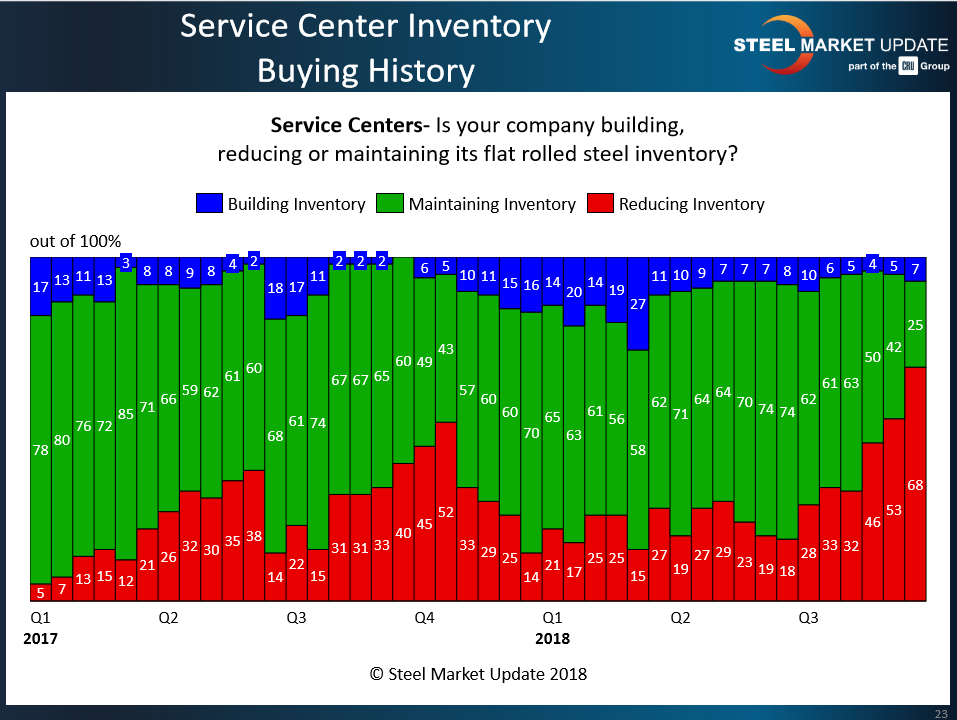

Service Centers Tightening Inventories

With steel prices on the decline, a growing number of service centers are working down their stock levels. Two out of three respondents to Steel Market Update’s flat rolled market trends questionnaire said they are reducing inventories in expectation of lower spot prices in the next few months.

“We are reducing inventories due to slowing tonnage sales and year-end personal property tax in Texas,” said one respondent. “We are about as low as we can go,” commented another. “I think the bottom is here and now might be the time to start to build inventory, at least a little,” added a third.