Market Data

September 20, 2018

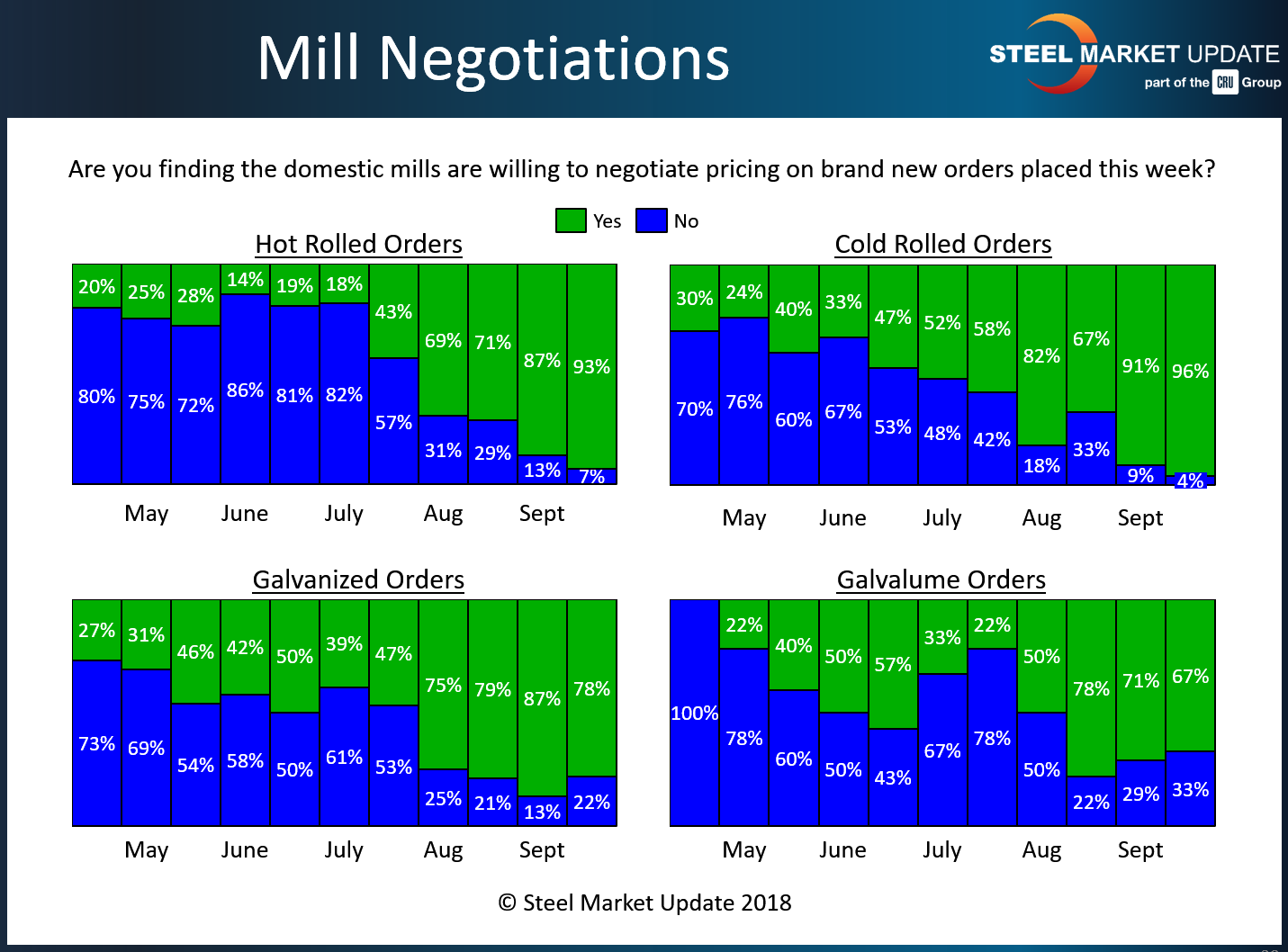

Steel Mill Negotiations: Buyers Gain the Advantage

Written by Tim Triplett

The pendulum has definitely swung back in buyers’ favor when it comes to negotiating steel prices with the mills.

Steel Market Update tracks how buyers and sellers of flat rolled steel represent the mill negotiation position. More than nine out of 10 buyers report that mills are willing to negotiate spot prices on hot rolled and cold rolled steel, and the majority say mills are flexible on coated products, as well.

According to respondents to this week’s market trends questionnaire, 93 percent of hot rolled buyers said they have found mills willing to talk price, double the 43 percent two months ago. The current dynamic is a complete flipflop from March, when more than 90 percent said the mills considered HR prices non-negotiable.

In the cold rolled segment, 96 percent said they have found mills willing to negotiate, up from 67 percent one month ago. Only 4 percent of respondents reported current mill prices on cold rolled as firm.

The mills have been holding the line somewhat on coated product prices in recent weeks. In the galvanized sector, 78 percent said the mills were open to price discussions, about the same percentage as a month ago. In Galvalume, 67 percent have found mills willing to negotiate, down from 78 percent last month.

The loosening of talks between the mills and steel buyers is a clear sign that steel demand is not as strong as earlier in the year.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.