Market Data

September 16, 2018

Service Centers Reducing Flat Rolled Inventories

Written by John Packard

The following analysis is from the SMU Service Center Inventories Index. This index is a proprietary product produced through data collection and interaction with a large number of flat rolled and plate service centers across the United States. This index is normally shared only with data providers and our Premium level members. If you would like to know more about how to become a confidential data provider or a Premium member, please contact us at info@SteelMarketUpdate.com

Forty-one percent of the responding service centers reported their inventories as being lower at the end of August than the previous month. Our diffusion index is 39.7. Any reading under 50.0 indicates service centers are reducing inventories.

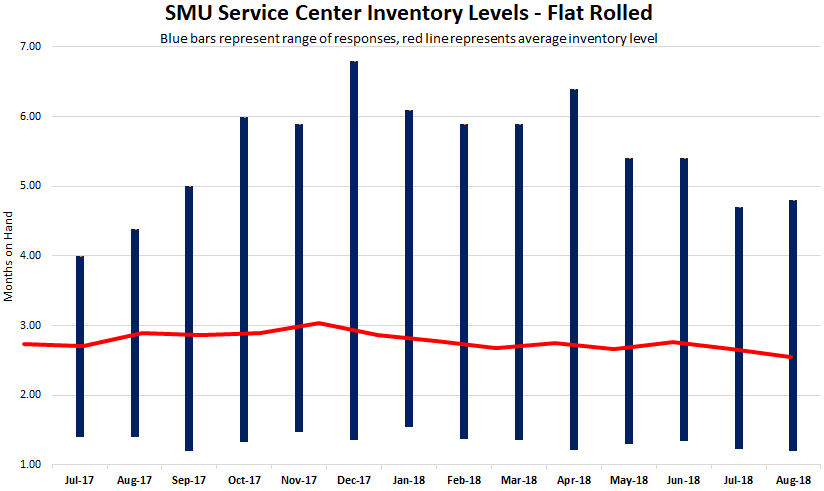

Flat rolled steel distributors’ number of months of supply dropped to 2.60 months at the end of August. SMU reported flat rolled inventories as being 2.7 months at the end of July. This is the third consecutive reduction in inventories, and at 2.6 months of supply this is the lowest level we have seen since we began this analysis in July 2017.

As you can see by the graphic below, the spread between the lowest and highest amounts being reported has been shrinking since the peak of December 2017.

Plate Inventories Stuck at 2.0 Months of Supply

With the domestic plate suppliers on allocation and controlling order entry, the domestic plate service centers have been unable to build inventories and remain at 2.0 months of supply, which is the same as at the end of July 2018.

No service centers reported their inventories as being higher. There was an even split between those reporting inventories as being the same and those reporting inventories as being lower.

What Our Respondents Had to Say

The following is a sampling of the responses provided to SMU during the data collection process:

First Respondent: “Spot HR demand slowed in August as buyers pulled back on talk/expectation of lower prices. Contract demand for other products remains steady to strong. See no change to either in September. Plate supply to remain very tight. Underlying demand is solid, but our shipments were off in August as we look to hold up margins. No use chasing cheaper prices if we have supply restrictions. Expect more of same in September.

“Note: September is only a 19-day month followed by October at 23 days. Key KPI to watch is tons/day, which we expect to actually be modestly higher vs. July/Aug as buyers realize the price situation probably is not as weak as being reported/predicted. Regardless, we will keep inventory VERY lean due to perceived downside risk.”

Second Respondent: “It’s going to be a great shipping month in September. Bookings in August were a high for the year.”

Third Respondent: “August was slower than normal for us. We are hoping for a sales recovery in September, but there is a rush by many to liquidate inventory and further stall the market.”

Fourth Respondent: “We continue to move to reduce our inventory as we head into the fall due to the high cost of steel and inventory carrying costs. With interest rates rising, the borrowing cost of capital forces us to continue to move toward being leaner. We are getting close to healthy inventory levels and positioned for buying opportunities as we head into the fourth quarter. We also are continuing to participate in futures, further taking advantage of longer-term pricing stability for our customers. We are expecting a strong shipment month in September as we continue to reduce prices to move higher-priced inventory as more low-cost steel starts arriving.”

Fifth Respondent: “It’s business as usual for us. Like everyone else, we are starting to be a little more cautious on opportunistic purchases.”

Sixth Respondent: “The trend [lower inventories] would have continued its downward trajectory, but we did receive a large import purchase at the end of August.”

Seventh Respondent: “We are currently buying less than we are shipping. We also had a great ship month in August. We are expecting that to continue in September, although with less billing days.”

Eighth Respondent: “Business is expected to be strong in September and October. The typical seasonal slowdown in July and August did not happen.”

Ninth Respondent: “Customers slightly slowing down. I believe with prices falling, they are hesitant to buy, waiting for the new bottom.”

Tenth Respondent: “Major factor was fear of the unknown (political announcement, supply side questions, etc.) creating a softening in the market, so we tried to back off buying.”

Eleventh Respondent: “We lost a few thousand tons [of supply] from Turkey. [September] should be solid. Same per-day volumes as August.”

Twelfth Respondent: “Shipping rates expected to be very strong in September/October, which have the highest projected build rates for our end-use customers in 2018.”

Thirteenth Respondent: “Deliveries and not having too much material at elevated prices [were major factors affecting inventories].”

Fourteenth Respondent: “Shipments remained steady, but our spot buying has decreased some in light of weakening mill-offer prices. We have slowed spot buys a little, resulting in slightly lower inventory compared to recent months.”

Fifteenth Respondent: “Our August shipments increased by 8 percent over July, which was 6 percent below the average through June. The largest impact on inventory for August was mill over shipments, which was the first time this year that they across-the-board over shipped. Our September order book is just average; few opportunities for ‘new business.’”