Prices

September 11, 2018

Analysis of New Coating Extras

Written by John Packard

Over the past few weeks, a number of domestic steel mills have announced new zinc coating extras for galvanized steel. The reason behind the adjustment has been due to the price of zinc moving lower on the LME spot market.

Steel buyers should not assume that all of the steel mills are using the same extras. That would be a big and potentially costly mistake. When taking an item such as .018 G90, the extras run from a low of $9.80/cwt (California Steel and UPI) to $12.85/cwt (NLMK and SDI). In the table below, SMU does a quick comparison of the differences between a number of mills that have made adjustments to their extras.

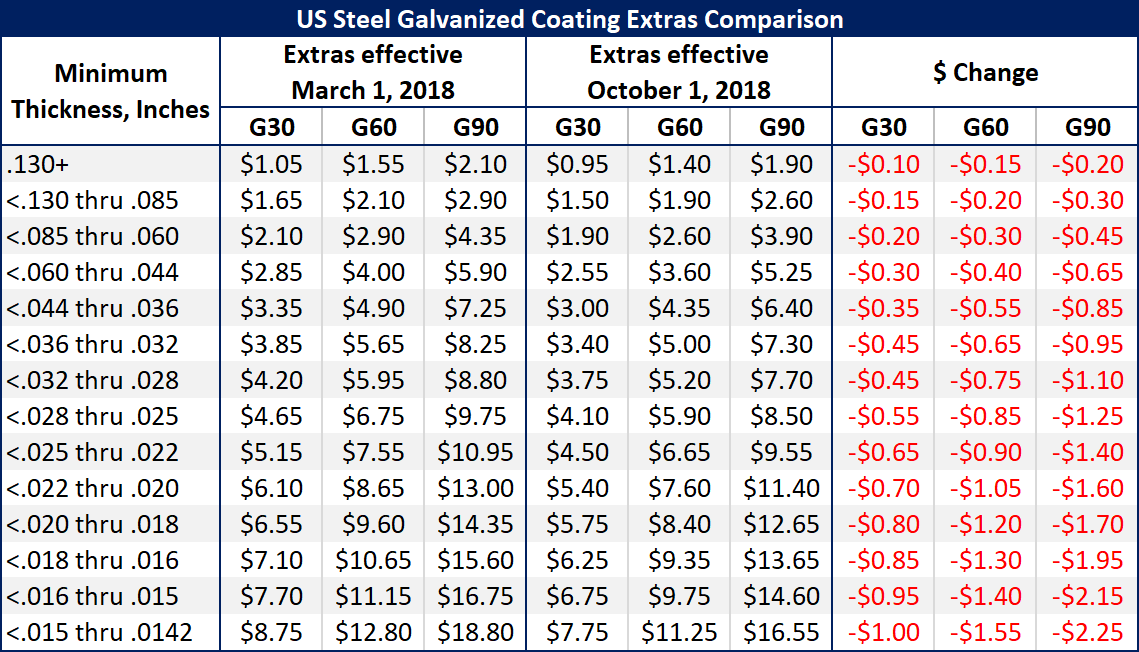

All but one mill have reverted back to the extras being used prior to Jan. 1, 2018. In the table below, we show the difference between the extras being used earlier this year versus the next extras, using U.S. Steel as an example: