Market Data

September 7, 2018

SMU Market Trends: Demand, Prices, Inventory

Written by Tim Triplett

Steel demand and prices are seeing some softening, but perhaps not enough to trigger a big inventory correction yet, report respondents to Steel Market Update’s flat rolled market trends questionnaire this past week.

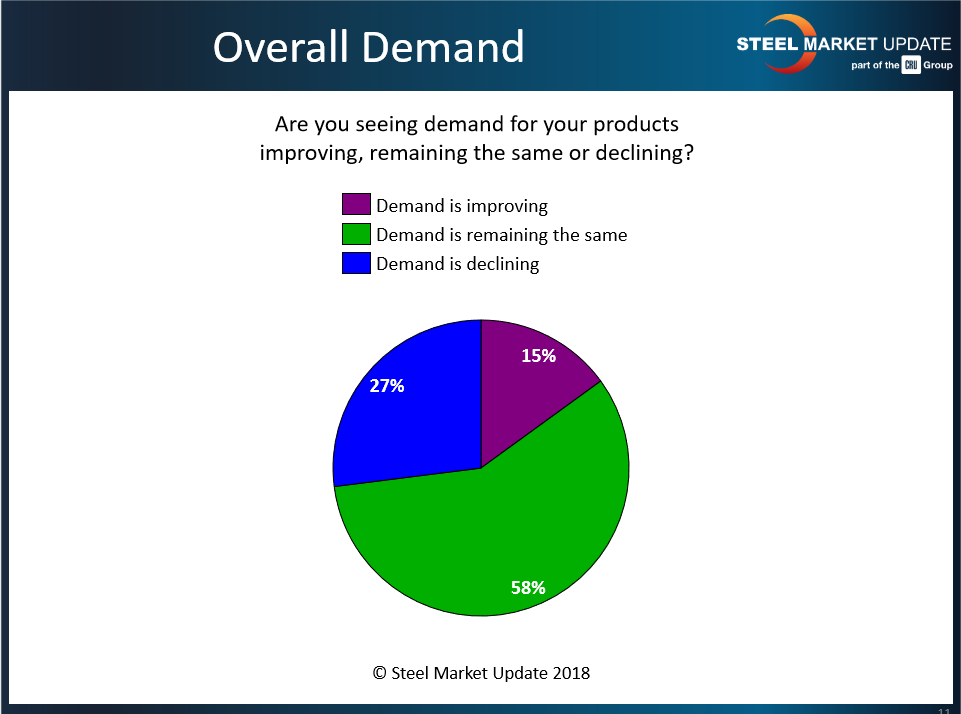

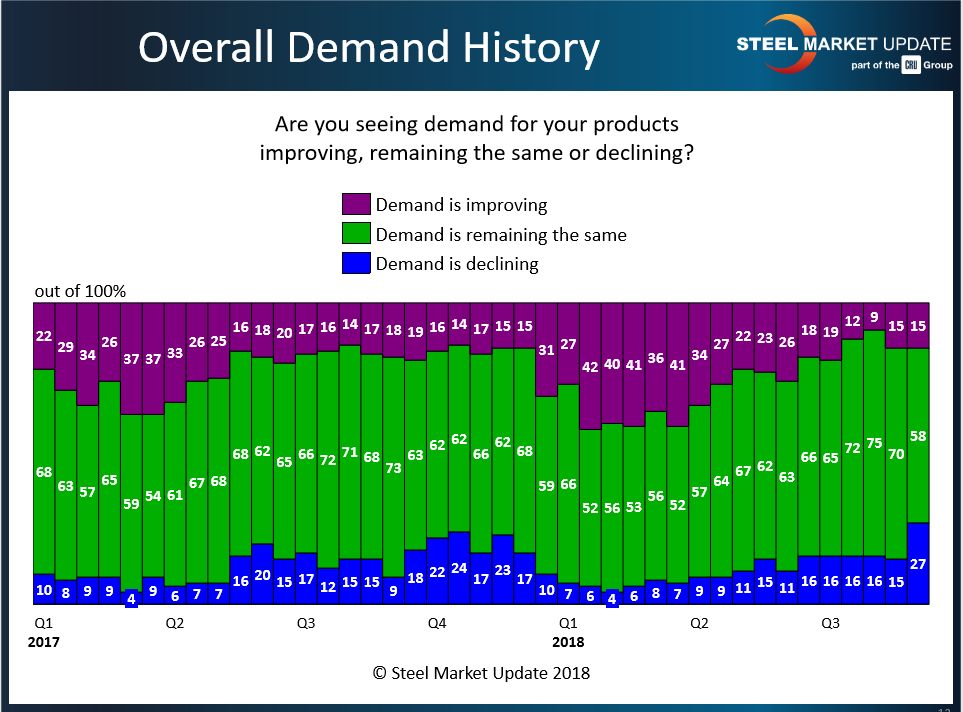

About 27 percent of the steel buyers who responded believe demand for their products is declining. However, the majority, 58 percent, report that demand from their customers is unchanged. A few, 15 percent, even see improving demand.

“Demand is slightly down, but not declining overall,” said one steel executive. “This is the first time all year we have seen a falloff,” said another buyer. “It’s softening a little as customers wait to see where the market is going,” agreed a third. “Business has pulled back a little. I think people got too heavy on inventory over the summer,” observed another respondent. “As long as U.S. purchasers at OEMs have global supply alternatives, demand will continue to shift offshore,” noted yet another.

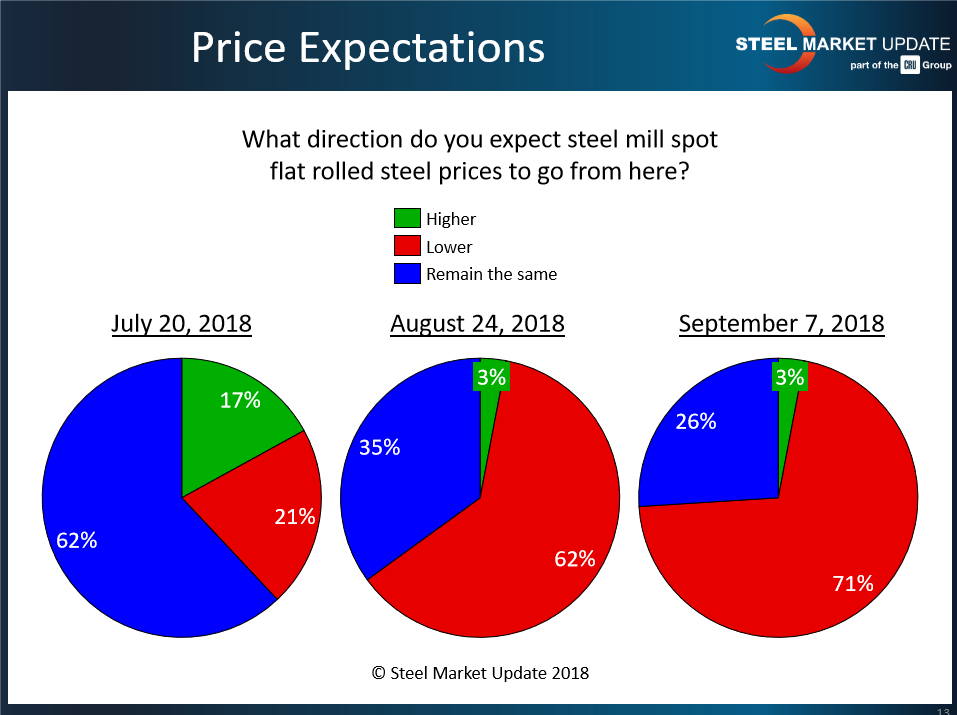

More than 70 percent of those responding to SMU’s query expect flat rolled steel prices to decline further. Nearly all of the rest believe prices have bottomed and will stay about the same.

“I see prices down $40-50 within a month, then plateauing,” said one exec. “Prices are heading lower, but some possible future tightness in supply could cause them to rebound,” commented another. “There has been a modest drop—perhaps affording us some buying opportunities,” observed one respondent. “Prices should be about the same, unless trade wars scare customers into irrational buys” said another. “Down then up then down and up. It’s a roller coaster,” another buyer commented.

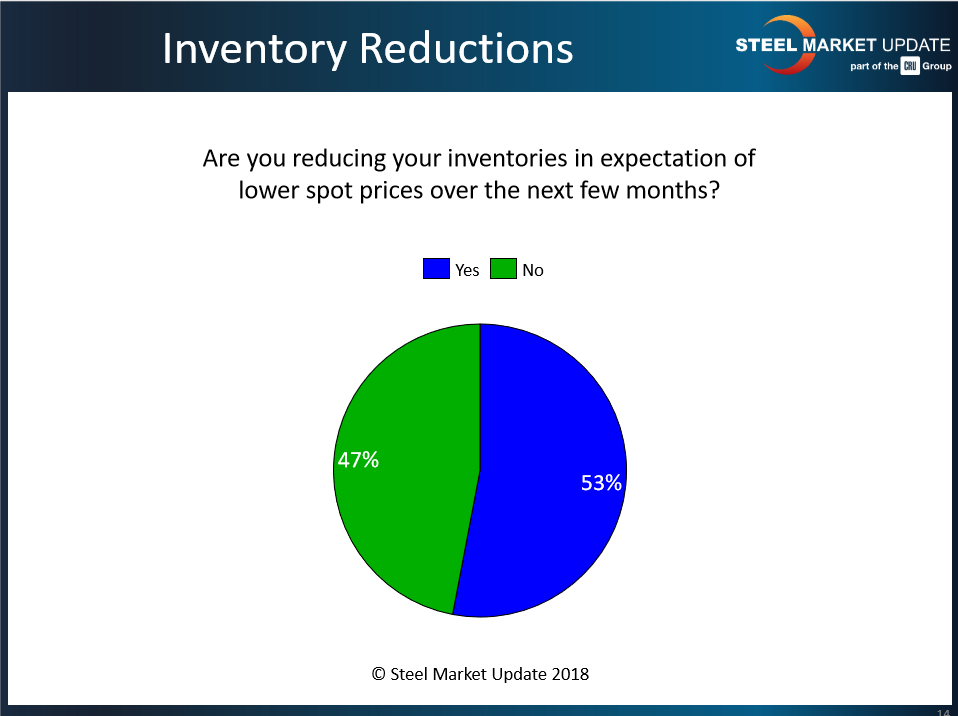

Despite changes in pricing and demand, the market is almost evenly split on what to do with inventories. Fifty-three percent say they are reducing inventories in anticipation of lower prices over the next few months, while 47 percent say they are staying the course. Following are some of their comments:

• “Our inventory is already lean.”

• “The mills are running behind, so I need to have ‘buffer stock.’”

• “We’re only buying minimums. Customers are delaying all commitments as long as possible.”

• “End user customers are still buying, but they are cutting the amount to just what they need and not over committing. The same for distribution, but only for set projects.”

• “We’re reducing inventory, and so is the rest of the service center industry, which gives the impression the market has fallen further than it really has.”

• “There will be plate shortages in two months, so why lower your inventory waiting for lower prices that likely will not happen.”

• “Price is not the reason that we are reducing inventory.”

• “It’s no fire sale, but I feel less may be best.”