Market Data

September 5, 2018

Global Steel Production Surges as China Increases its Share

Written by Peter Wright

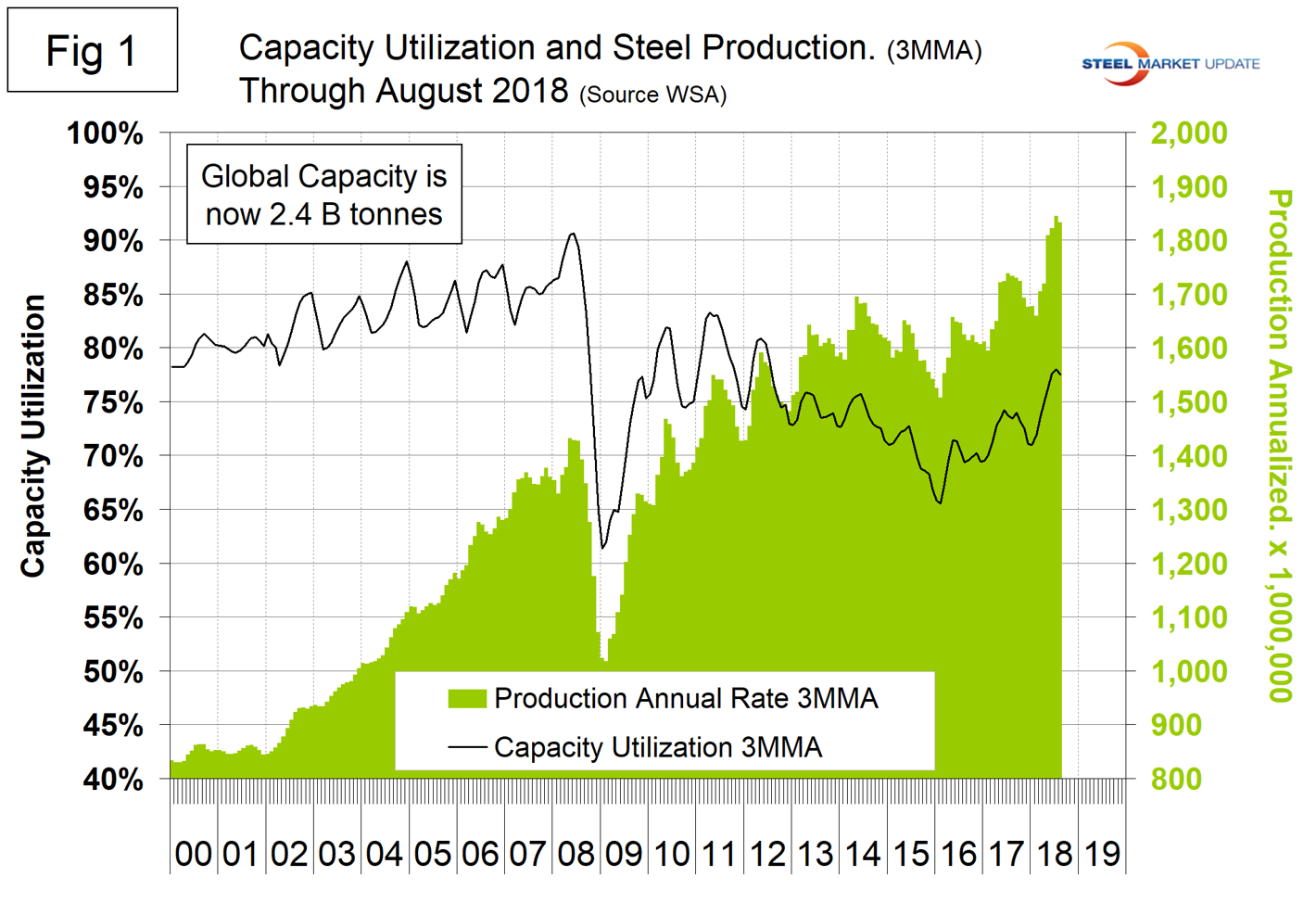

Global steel production in August achieved an annual rate of 1.821 billion metric tons. Capacity is calculated to be 2.4 billion metric tons; therefore, capacity utilization was 76 percent, according to the latest Steel Market Update analysis of World Steel Association data.

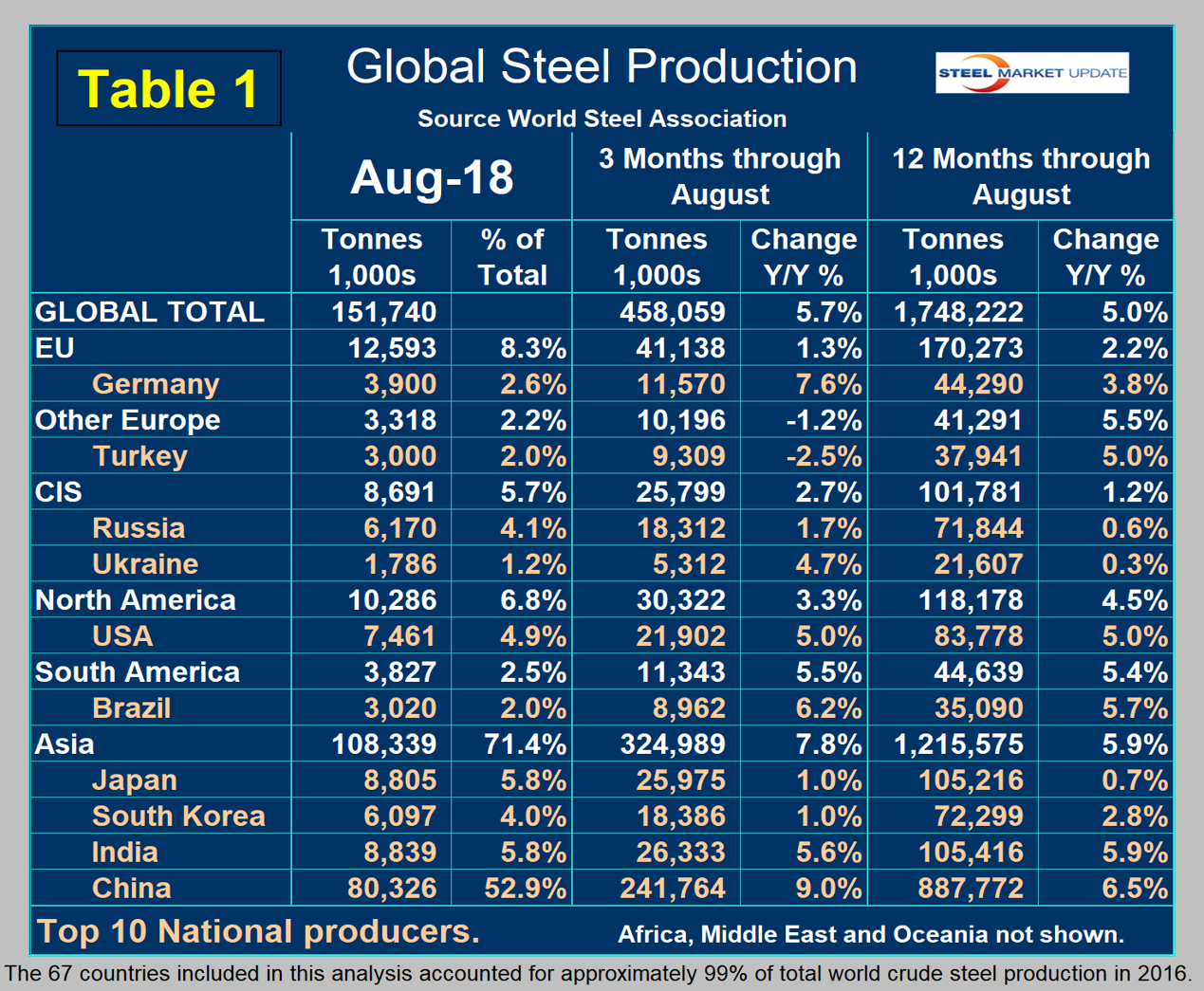

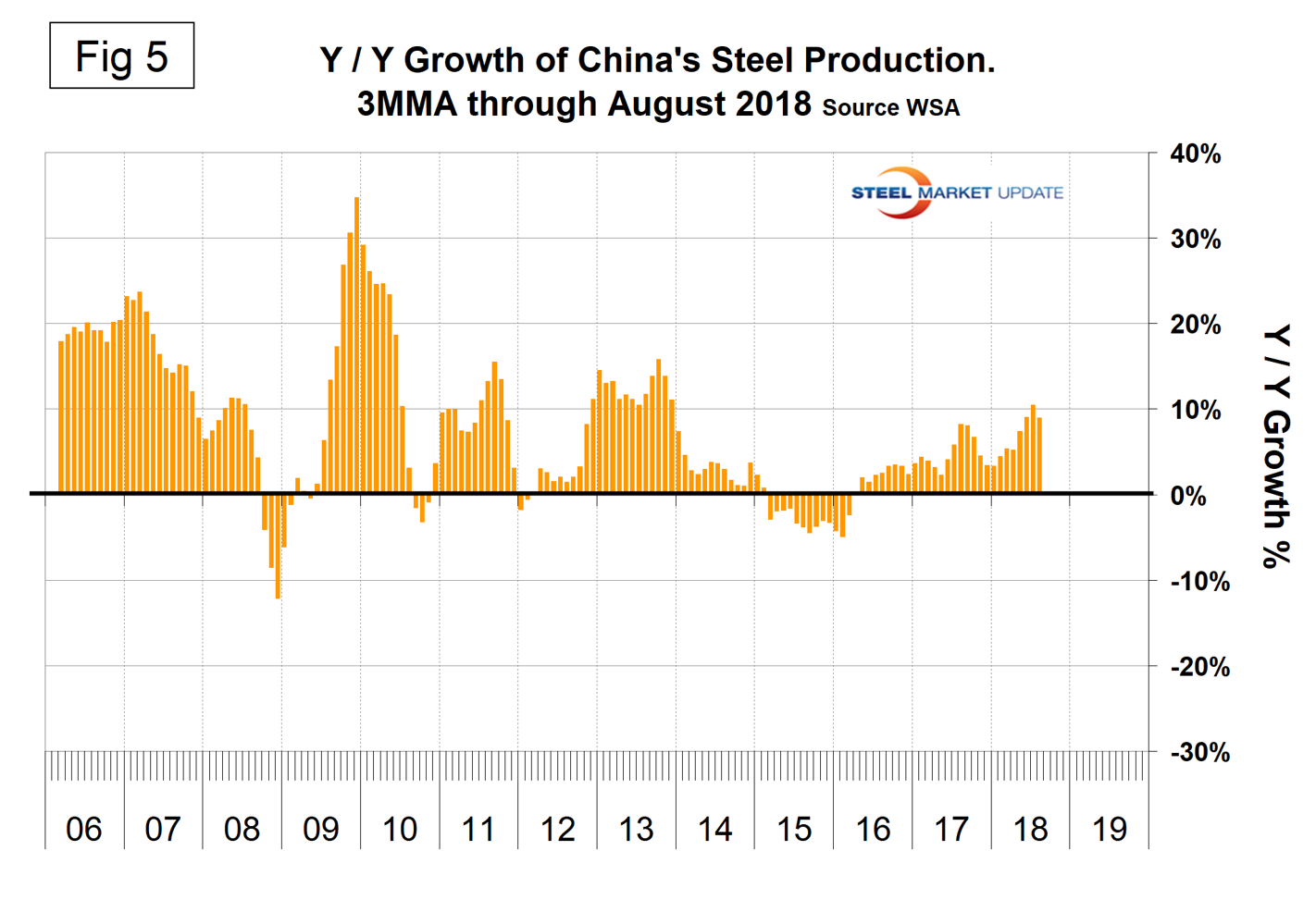

In three months through August, China’s steel production grew by 9.0 percent year over year as the rest of the world grew by 2.2 percent. China continues to increase its share of global steel production, which in August hit an all-time high of 52.9 percent.

Figure 1 shows annualized monthly production on a three-month moving average (3MMA) basis and capacity utilization since January 2000. May, June, July and August were the first months for the annualized production rate to exceed 1.8 billion metric tons. On a tons-per-day basis, production in August was 4.895 million metric tons (mmt) with a 3MMA of 4.980 million metric tons.

In September 2018, the OECD Steel Committee wrote: “Even though the global steel industry is currently facing significant excess capacity, gross capacity additions are taking place in various regions of the world. Information on announced investment projects suggests that nearly 52 mmt of gross capacity additions are currently underway and could come on stream during the three-year period of 2018-20, while an additional 39 mmt of capacity additions are currently in the planning stages for possible start-up during the same time period.”

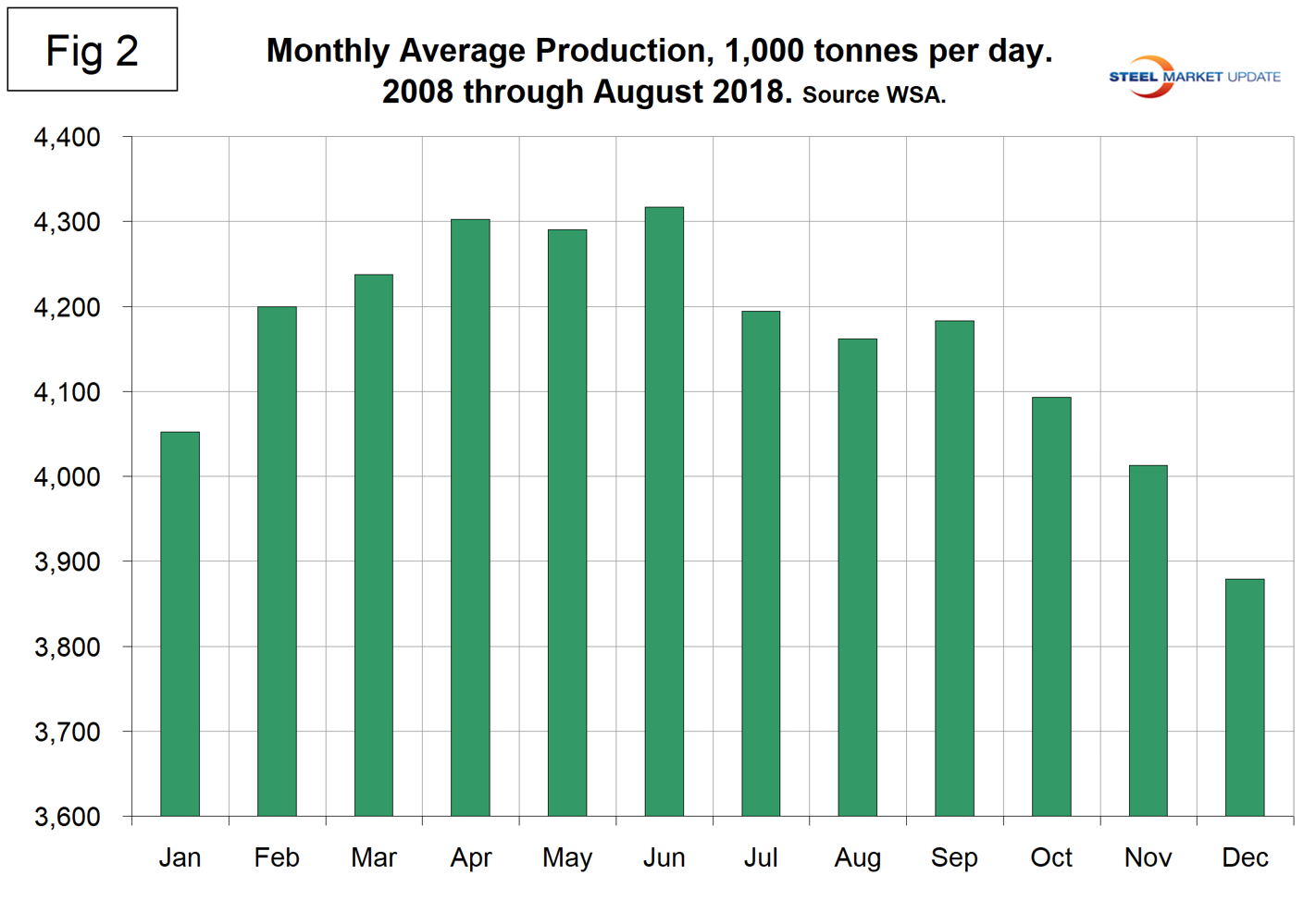

Digging deeper, we start with seasonality. On average, global production on a tons-per-day basis peaked in the early summer in the years 2010 through 2016, but last year the second half downtrend was delayed until November and in 2018 there is still no sign of a slowdown. Figure 2 shows the average tons per day of production for each month since 2008.

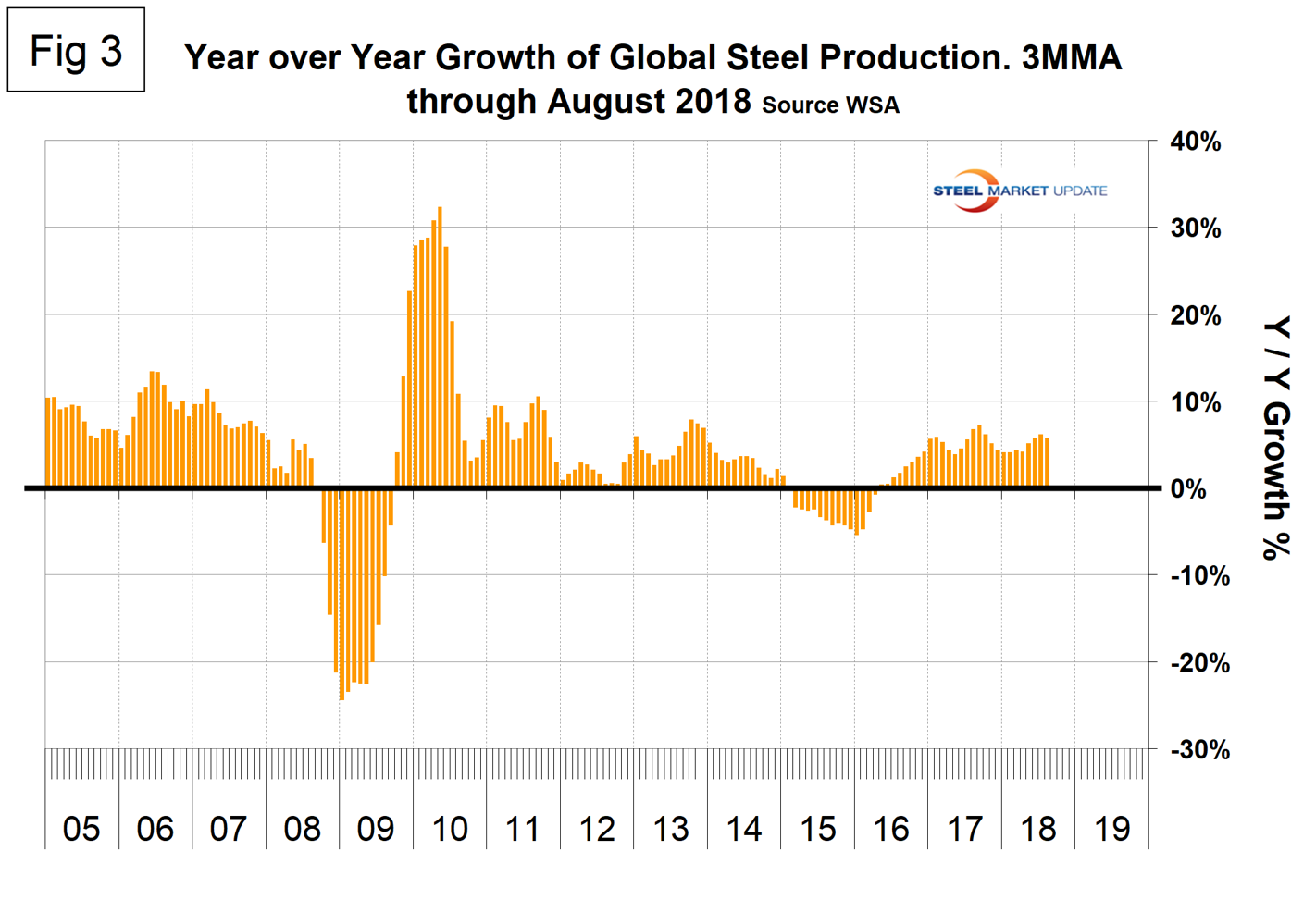

Figure 3 shows the monthly year-over-year growth rate of global production on a 3MMA basis since January 2005. Growth in May, June, July and August was 5.1 percent, 5.7 percent. 6.1 percent and 5.7 percent, respectively.

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of August, and their share of the global total. It also shows the latest three months and 12 months of production through August with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige.

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of August, and their share of the global total. It also shows the latest three months and 12 months of production through August with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige.

The world overall had positive growth of 5.7 percent in three months and 5.0 percent in 12 months through August. When the three-month growth rate exceeds the 12-month growth rate, as it did in June, July and August, we interpret this to be a sign of positive momentum. These were the first months of positive momentum since October last year. On the same basis, China grew by 9.0 percent and 6.5 percent. All regions except other Europe, which was dragged down by Turkey, had positive growth in the three months through August. Table 1 shows that North America was up by 3.3 percent in three months. Within North America, the U.S. was up by 5.0 percent, Canada was down by 8.0 percent and Mexico was up by 3.5 percent.

In the 12 months of 2017, 115.3 million metric tons of steel were produced in NAFTA of which 70.8 percent, 11.9 percent and 17.3 percent were produced in the U.S., Canada and Mexico, respectively.

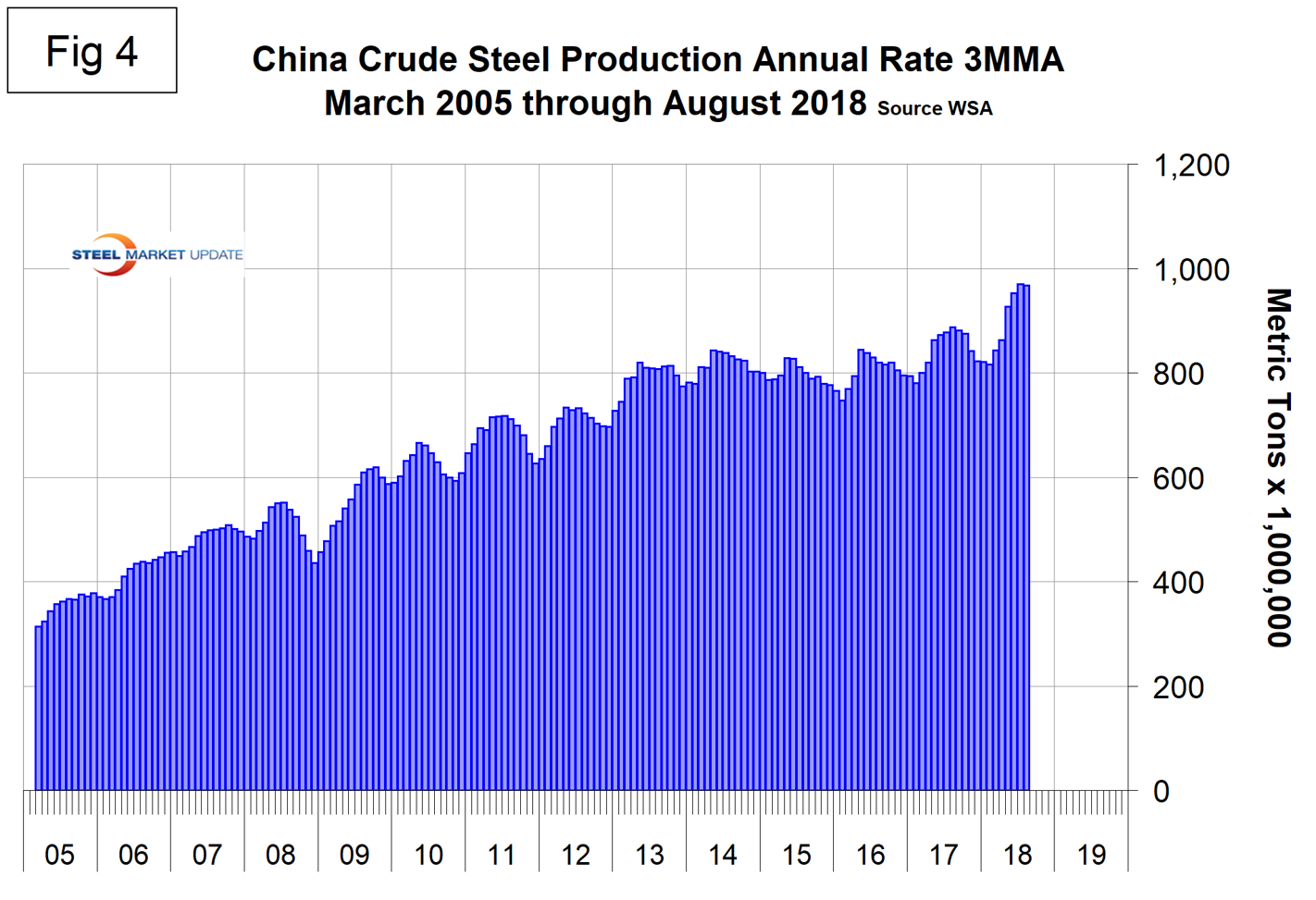

Figure 4 shows China’s production since 2005 and Figure 5 shows the year-over-year growth. China is increasingly dominating the global steel market and is approaching an annual rate of one billion tons of crude production. According to the OECD Steel Committee’s September report, there are some new capacity investment projects in China. Shandong Iron & Steel is building an 8.5 mmt plant in Rizhao, Shandong province. In the context of Shougang Jingtang’s investment project in Caofeidian port, Hebei province, the company has started a second phase that entails an additional 5 mmt of steelmaking capacity. These new mills are designed to produce high value-added products to meet demand for flat products in the automotive and home appliance industries in China.

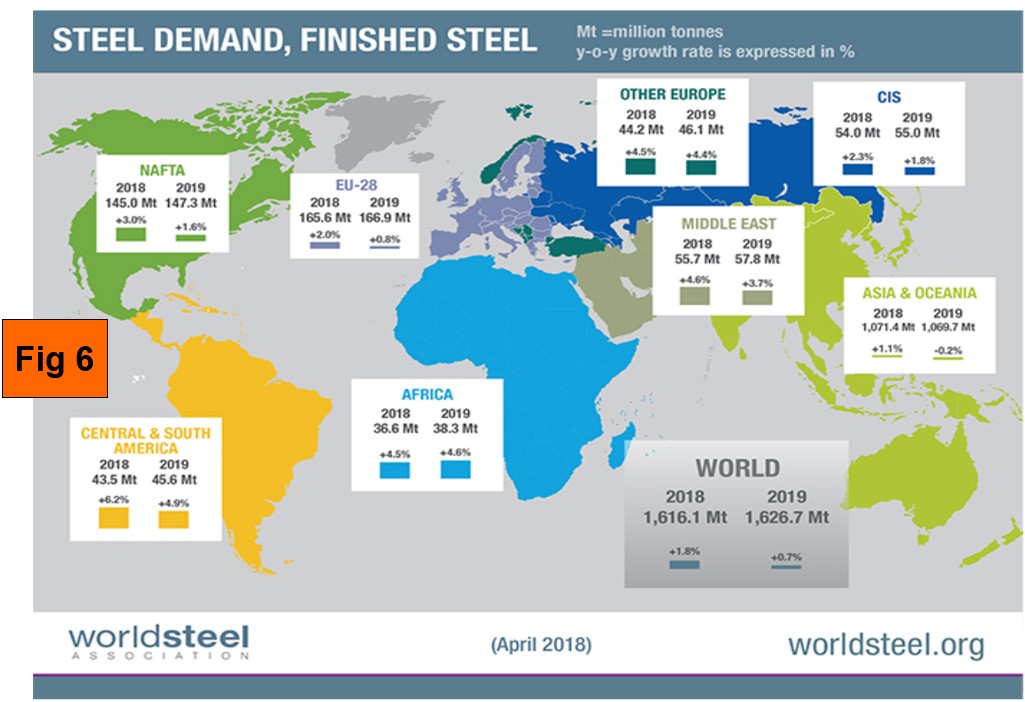

The April WSA Short Range Outlook (SRO) for apparent steel consumption in 2018 and 2019 is shown by region in Figure 6. WSA forecasts global steel demand will reach 1,616.1 million tons in 2018, an increase of 1.8 percent over 2017. In 2019, it forecasts that global steel demand will grow by 0.7 percent to reach 1,626.7 million tons. A revised forecast will be released in October.

The April WSA Short Range Outlook (SRO) for apparent steel consumption in 2018 and 2019 is shown by region in Figure 6. WSA forecasts global steel demand will reach 1,616.1 million tons in 2018, an increase of 1.8 percent over 2017. In 2019, it forecasts that global steel demand will grow by 0.7 percent to reach 1,626.7 million tons. A revised forecast will be released in October.

Commenting on the outlook, the chairman of the WSA economics committee said, “the outlook for steel demand in the U.S. remains robust on the back of the strong economic fundamentals.”

SMU Comment: Trends have been consistent in recent months and the growth of China’s steel production continues to outpace the rest of the world. New plants are coming on stream and almost all of these are BOF-based, according to the September report by the OECD Steel Committee. The IMF will release its autumn projection for global growth in 2018 and 2019 in the next few days.

This analysis is based on data made public monthly by the World Steel Association. The WSA is one of the largest industry associations in the world. Members represent approximately 85 percent of the world’s steel production, including over 160 steel producers, national and regional steel industry associations and steel research institutes.