Market Data

September 4, 2018

End of the Month: August 2018

Written by John Packard

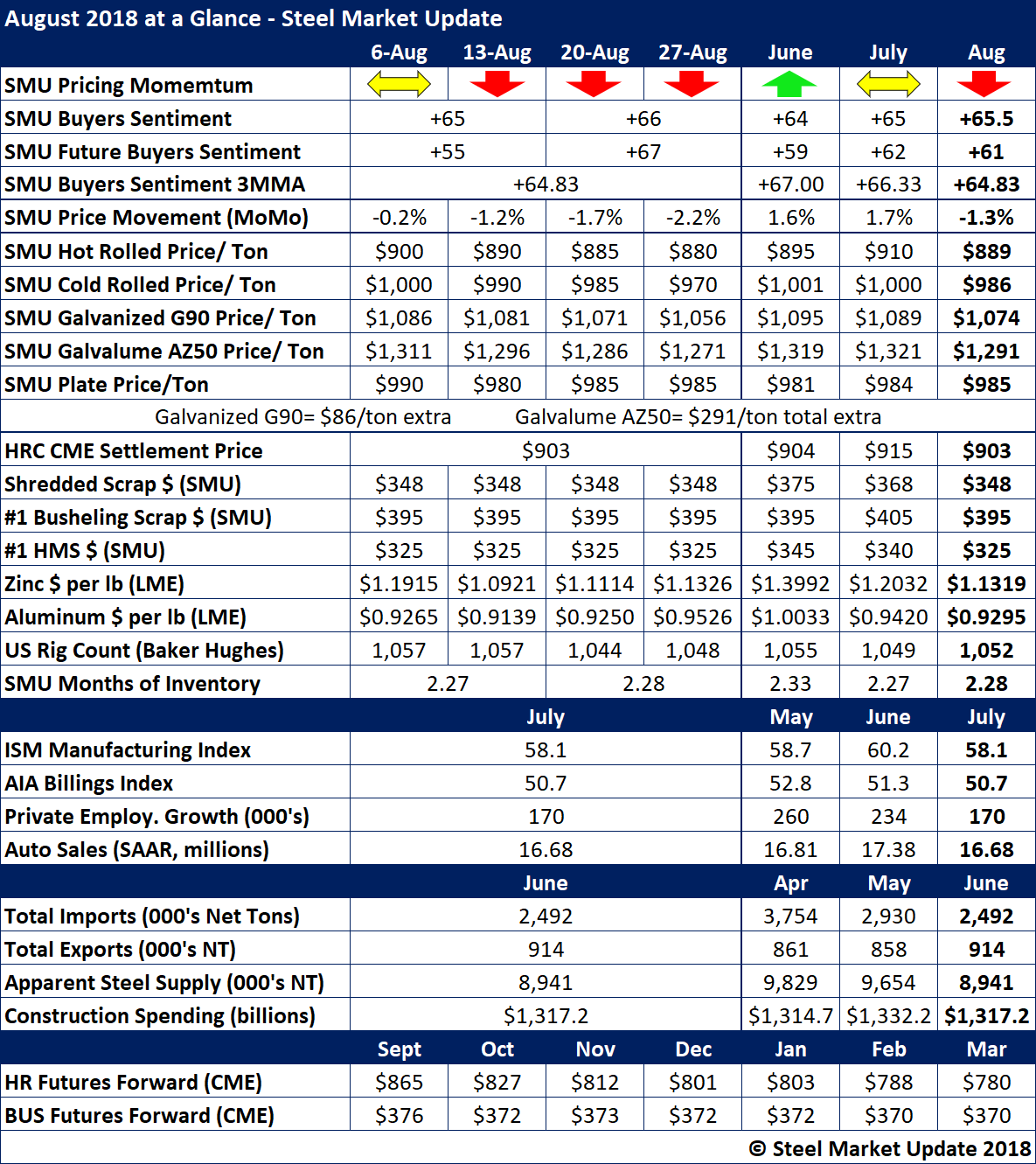

August saw our SMU Price Momentum Indicator move from Neutral to Lower indicating our expectation that we will see prices drop over the next 30-60 days. The last couple of weeks of August and into early September has seen prices dropping and the trend does not appear ready to abate quite yet.

Our Sentiment Index has been moving lower as buyers and sellers of steel fret about steel prices, Section 232, Section 301 and the political environment. This is something we need to pay attention to as Sentiment is a leading indicator.

As mentioned about, steel prices on all but plate have slipped.

Scrap prices have also moved lower and are forecast to move lower again in September.

Zinc prices have been steadily moving lower forcing the steel mills to adjust their coating extras as the month came to a close (and into September with SDI making their announcement earlier today).

Please review some of the main items we watch on a monthly basis.