Market Data

August 23, 2018

Steel Mill Negotiations: Talks Loosen

Written by Tim Triplett

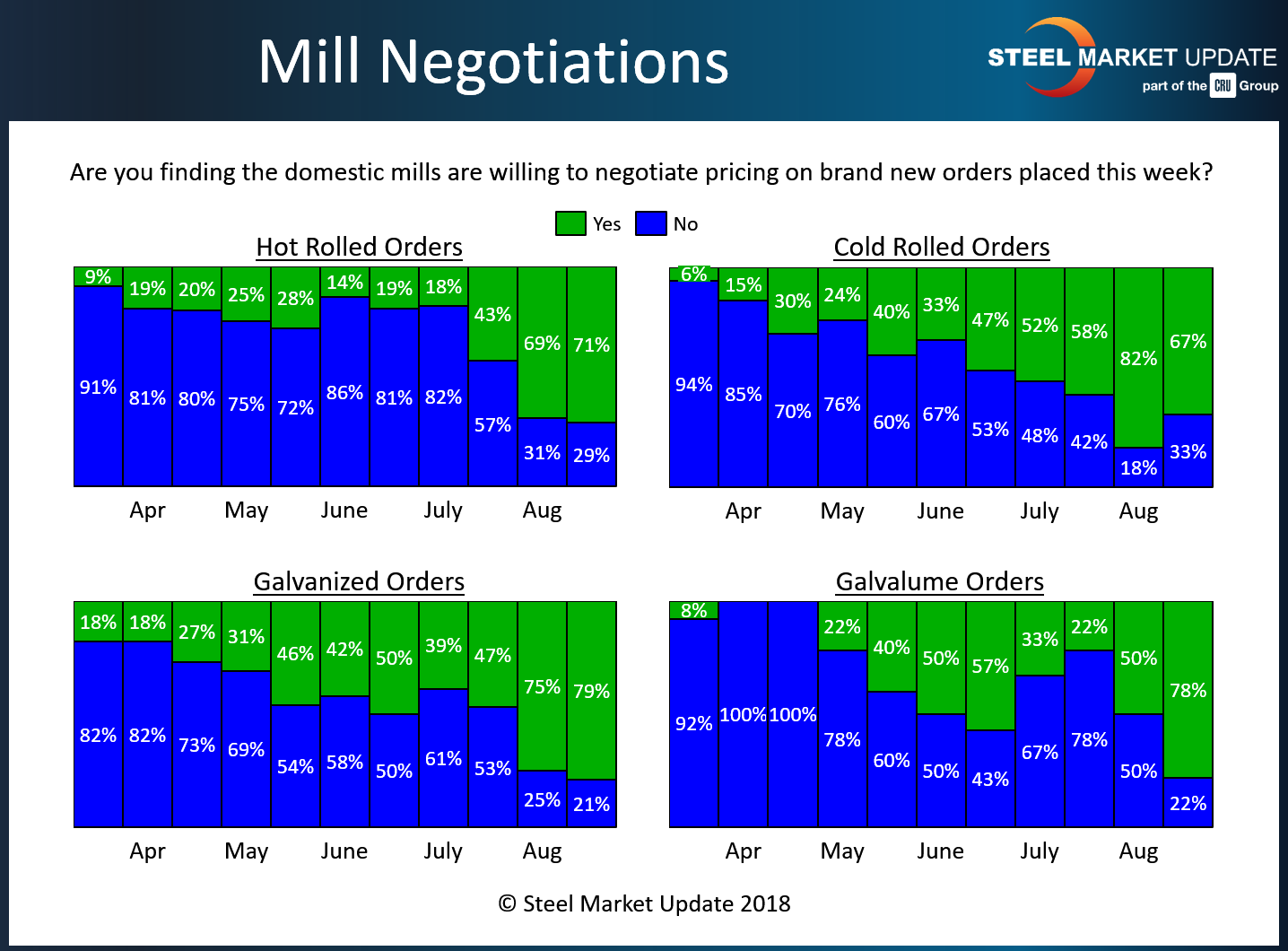

Mills appear more willing to negotiate spot prices on most flat rolled steel products than at any other point this year. Twice per month, in a proprietary poll, Steel Market Update tracks how buyers and sellers of flat rolled steel represent the mill negotiation position. According to respondents to this week’s market trends questionnaire, 71 percent of hot rolled buyers said they have found mills willing to negotiate, up from 43 percent a month ago. Just 29 percent said mills remain firm on price.

In the cold rolled segment, 67 percent said they have found some mills willing to talk price, up from 58 percent in mid-July. About 33 percent of respondents reported current mill prices on cold rolled as non-negotiable.

Likewise, prices on coated products appear to be flexible. In the galvanized sector, 79 percent said the mills were open to price discussions, compared with 47 percent last month. In Galvalume, 78 percent have found mills willing to negotiate, up from just 22 percent one month ago.

While talks have loosened in recent weeks, comments from a few buyers indicate that negotiations still tend to be limited in scope, and usually only based on tonnage.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.